July Budget Review

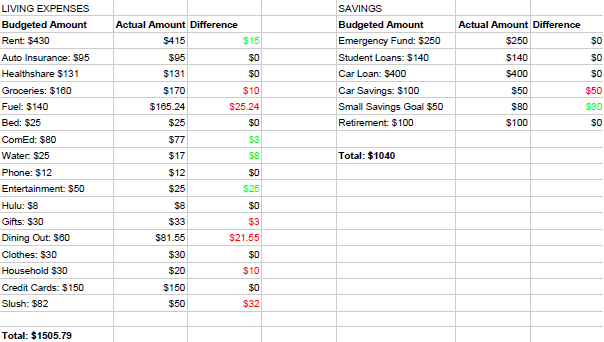

Another busy month is over and like everyone else, I’m trying to soak up the last few weeks of summer. Last month I introduced my goal of living on only about 50% of my income and using the rest to save and pay off debt. July was my first month of working toward that goal and while I definitely see room for improvement, I think I’m off to a decent start.

My Highs

My Lows

Onto the Budget

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.