2018 Goals

Hey, all! Life has been cray cray so far this year and I feel like I haven’t shared any goals or updates with those of you who are interested in following my financial journey.

I’ve spent the last few months relishing in the fact that I no longer have to make a student loan payment and I’ve been thinking a lot about what I want and need to do moving forward.

Anyone who knows me knows that I am a huge planner and goal setter. I enjoy having goals and eventually reaching them because it helps me stay focused, grounded, and organized.

I’m excited to share all my 2018 goals with you and broke them up by category. Be sure to let me know what you think!

Table of Contents

Financial

Buy a house

This is my biggest goal of the year since my husband and I decided we wanted to buy a house last year. I’m su[er excited! Honestly, I don’t think we can over-save so we are working hard to stash away as much money as we can before our lease ends in June.

Right now, it looks like mortgage interest rates are going up and the market is not so good in our area. It seems like a seller’s market so I’m hoping things improve by the late spring/early summer when we will be moving.

Boost emergency fund to $10,000

This is financial priority #2 this year since I know becoming a homeowner can be costly. I can’t help but cringe at the horror stories people tell about spending $10k just on windows in their home and I know we will need a pretty large emergency fund.

Currently, our emergency savings sits at $5,000 so my plan is to double it by December and have a decent checking account buffer. I will set up an automatic transfer to meet the goal.

Related: Why You Need a Full Emergency Fund

Save $3,000 to open a Vanguard account

Another goal I have is financial independence around the time I’m 45 or sooner if possible. To do this, I know I need to get more serious about investing which is why I plan on opening a Vanguard account after reading the book, the Simple Path to Wealth by JL Collins last year.

I recommend anyone who dreams of early retirement or just retiring one day a millionaire read this book. It’s super easy to follow and very informative. In order to open a Vanguard Total Stock Market Index (VTSMX) account, I need to have $3,000 so I’m setting up automatic transfers of $250 each month. By December, I’ll have enough to open the account.

Start Saving For a New Car

Finally, one of my low priority financial goals this year is to start saving up for a new car. My current car is driving fine, but it’s been almost 2 years since I paid the loan off and you guys know how I feel about car loans. I hate them.

I’d much rather pay for my next car in cash which is why my husband and I are planning to drive both of our cars into the ground. Whenever one of them dies, we will share the remaining one then hopefully buy a new car in cash once the second one is done for.

I can only afford to put small amounts of money toward this goal right now so if I’m lucky, I’ll have about $600 – $1,000 saved by the end of the year.

Business

Launch a signature course

I have way too many business goals this year so I just listed a few of the most important ones in an effort to prioritize better. One of my goals is to launch my first signature course. I’m passionate about helping people improve their financial situation and this course will help with that.

In December, I started a Facebook group and interviewed some of my email subscribers to learn about their biggest money issues and what was holding them back from financial success. I’m planning to create a course to help people manage money better to eliminate those issues and reach their goals quicker. My goal is to launch the course this spring as the signature course for my blog. If I have time this year, I may complete some other products as well but this one is a MUST.

Increase income by 45%

Last year, I grossed about $70,000 with my online business during the first year which was awesome. This year, I’m hoping to earn at least 6 figures so that will require at least a 45% income increase. What’s nice about being self-employed is that you can give yourself a 45% raise if you really want it.

I have to be more focused and strategic in order to meet this goal but I’m confident I can do it.

Establish and grow speaking business

One of my other big business goals this year is to establish and grow my speaking business. Last year I mentioned how I wanted to get more involved with public speaking and I find that I really enjoy it. I’m currently taking a course to help me develop my own speaking business/brand so I’m excited to see where this goes and hope it will contribute to my income increase goal.

Start a YouTube channel

If I can meet all the business goals above, I want to work on launching a YouTube video in my spare time (yes, there’s always downtime). I’m somewhat nervous about dabbling into video but I also want to offer my audience another form of content to digest.

I’m also not too happy to hear about YouTube’s new monetization rules but ultimately, monetization would not be my primary goal. If I start doing videos, it will be to build my brand and provide my audience with quality content.

Personal

Work out 4 times per week (minimum)

My ultimate goal is to lose 30 pounds this year. I’ve been struggling at this and have gained a lot of weight in recent years. After I had my son, I weighed 135 lbs but that was 8 years ago. This time last year, I weighed around 190 pounds but I lost about 30 pounds by mid-2017.

I decided to adopt a more vegan diet last September and actually gained 10 pounds and ended back at 170 :(. I decided to go back to the diet I had that helped me lose the 25-30 pounds last year so I could do it again and get to my goal weight of 140.

I still want to be vegan but don’t feel like now is the best time. I need to do more research and learn how to prepare meals that aren’t going to be too carb heavy or calorie dense just to fill myself up.

I hired my friend to train me in the gym 2 days a week and I’ll be on my own for the other days but I’m looking forward to getting back into the habit of exercising regularly.

Read 7 books

I started reading again last year and loved it. The average millionaire reads daily and I want to read more fiction, non-fiction, self-development books, you name it. I already read 1 book this year so I have 6 more to go.

Have any book ideas you think I should add to my list? Let me know in the comments!

Start playing an instrument

Another thing I want to do this year is start playing an instrument I used to play when I was younger. Can you guess what is it???? I think it’s reaching but I would also like to learn to play an additional instrument this year.

I don’t think I’ll take formal lessons, but I may just buy instruction books and use YouTube videos to practice.

Take a class at my church/ Get more involved

Faith is very important to me so I really want to step outside my comfort zone and get more involved in my church this year whether that means volunteering or even playing my new instrument during the worship.

My church also hosts several classes during the year and I want to take one they have called The Benefits of Our Faith.

Relationships

Go on a family vacation

This is already in the works as I’m planning a 7-day trip for my family in August. We’ve been setting aside money for a while and I can use credit card reward points to pay for our flights.

More Girl’s Nights

I know it sounds super “college life”, but I also want to have more girls’ night with friends this year. During my aggressive debt repayment journey, I neglected a lot of my relationships with friends and just getting outside of the house and it had a negative effect on my mental health.

Since I work from home and my husband works all day while my son is in school, I already tend to feel isolated enough and need to get out and enjoy myself every now and then. I’m going to leave it up to myself to determine what outings will fit into my budget and not deter me from any of my other goals.

Go on 1 date night per month

This is more of a fun goal but my husband and I have decided to have at least 1 date night per month outside of the home. Our marriage in 2016 started out with both of us eager to pay off his credit card debt. We reigned in our spending, lived on one income, and paid off $4,000 in just 3 months.

During that time, we never did anything together. “Date night” consisted of both of us watching Netflix for a few minutes, then me passing out on the couch and him on the living room floor amidst a sea of unwashed dishes in the sink.

Over the past year, I’ve noticed that we’ve done a great job financially, but have put our own relationship on the back burner as a result. It’s been all about the hustle and less about spending time together and I don’t want to just feel like roommates who split bills and share a casual conversation every now and then.

After a talk, we both agreed that we need to take a step back and get into dating mode again. This involves going on actual dates. We will alternate picking the activity each month and keep it pretty frugal so Groupons, discount bowling nights, and free comedy shows will be on the radar.

How I Stay on Track

With all the goals I tend to set each year, it’s safe to say I have consistently held a 90% success rate. How? I’m a very Type A person which means I love organization and planning. I thrive on it, and careful planning is what you need in order to reach your goals.

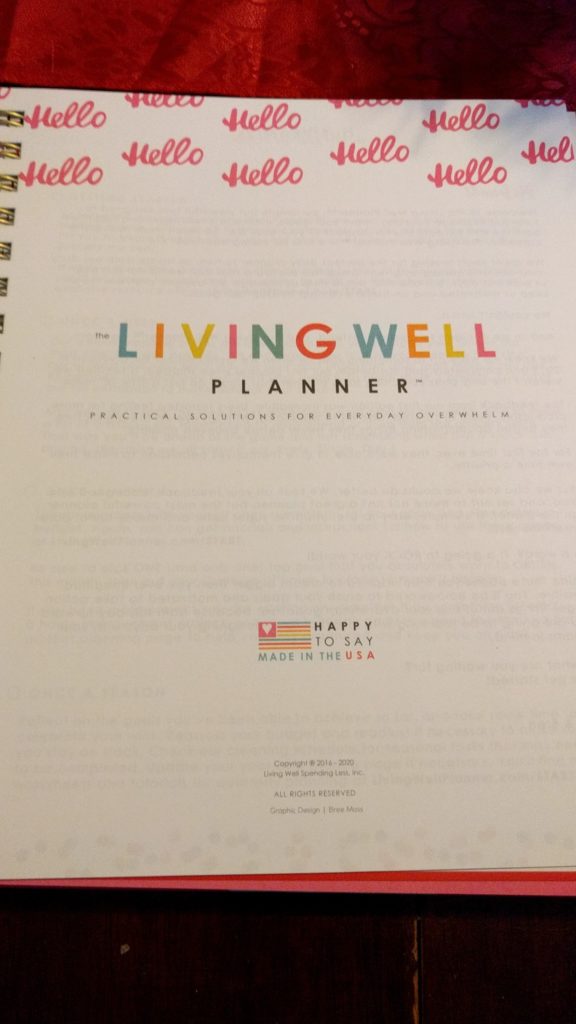

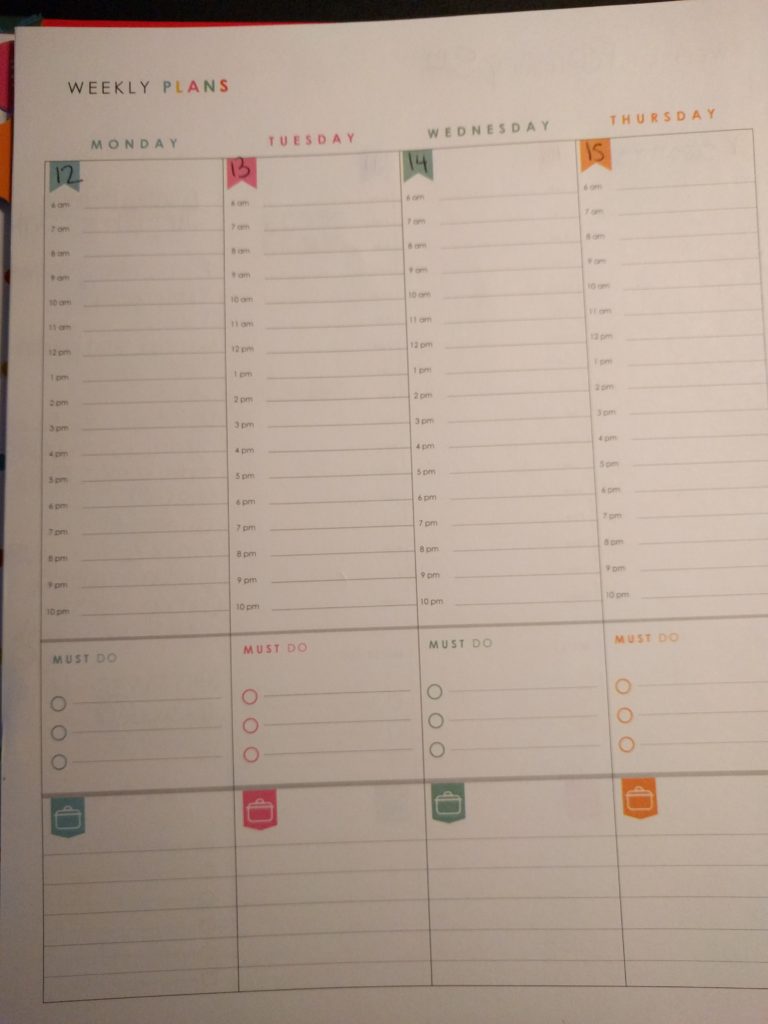

Instead of cramming everything into my phone and responding to weird buzzing noises from my devices each day, I use the Living Well Planner which has been AMAZING!

I splurged a little bit and got myself this planner as an early Christmas present but it was well worth it. Ruth Soukup, founder of the Living Well Spending Less blog and Elite Blog Academy.

This planner was created with productivity and goal setting in mind. There’s space to plan out your annual and monthly goals, brainstorm for projects, enter your budget and track your spending, plan out meals for the day and more.

I like how the weekly planner section is broken down by the house since I tend to tackle tasks in time chunks then take a brief break to refuel.

Using this format to plan my daily and weekly schedule ensures that I use my time wisely and strategically. I’ve also noticed a better work-life balance as a result. I’m not perfect when it comes to productivity and time management and I often get distracted by the silliest things often – *cough* Facebook and YouTube videos *cough*.

In order to stay focused, hit all my goals, and still make time for family and friends, I need to have a streamlined process and outline my days in advance. The Living Well Planner helps with all that any more.

Now that I’ve shared my goals along with my secret to getting ish done, I want to hear from you!

What do your goals for 2018 look like?