7 Smart Moves to Make With Your Tax Refund

Tax season is among us. If you get a tax refund, it can be easy to think of all the cool things you’ll be able to pay for like fancy dinners, a new T.V., Rachael Ray pots, who knows.

Receiving a lump sum or money can feel good, I know, but it’s important to resist lifestyle inflation and use that money to improve your life overall.

Here are seven smart moves you can make with your tax refund to help improve your life and get ahead financially.

Table of Contents

1. Pay Off Debt

Of course, this is a great use for a tax refund. It’s hard to stay motivated during debt payoff so when a chunk of money comes along like your tax refund, you can make put a serious dent in one of your balances.

Technically, I’m supposed to still have a car loan since I financed my car in 2014 with a 5-year loan. Instead of spending $233 each month on a car that was depreciating in value each month and paying a crap ton of interest, I decided to use my tax refund to decrease my loan balance and make extra payments to pay my car off three years early.

Now, I am loving the ‘no car loan’ life and the fact that I can keep more of my money. If you are planning to pay off some debt with your tax refund, I’d recommend that you make your payment as soon as your tax refund hits your account so you don’t accidentally use it for something else.

Related: Staying Motivated During Your Debt Payoff Journey

2. Build Up Your Savings

Having a fully funded emergency fund is so important. If your car breaks down, you lose your job or get sick, your savings can be a lifesaver. It’s important to have at least 3 months of expenses stashed away so if you don’t, using your tax refund to boost your savings is a great strategy.

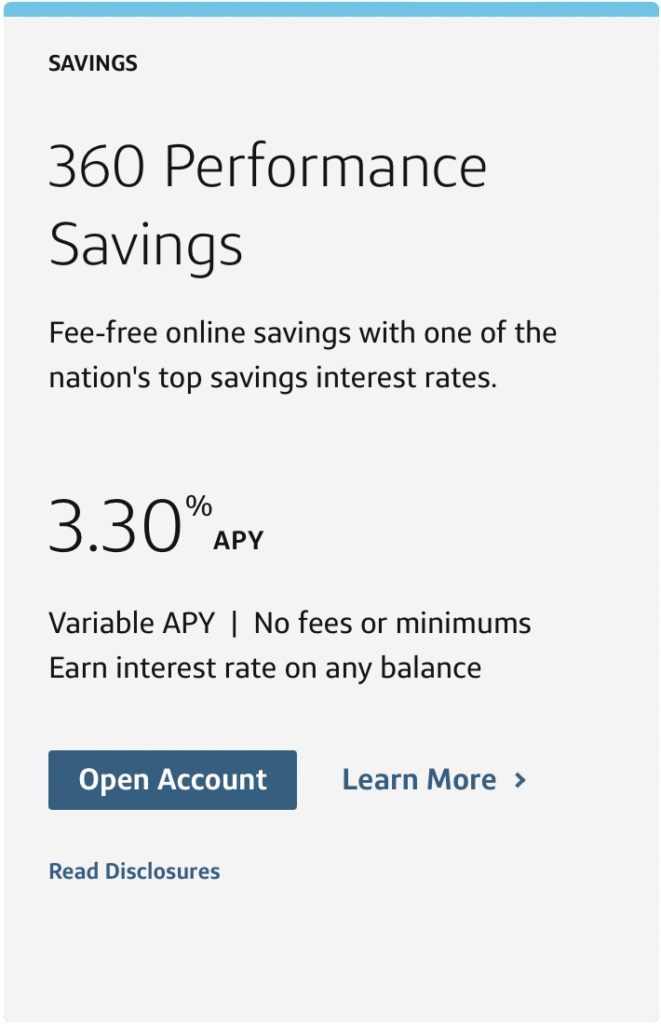

I use CapitalOne 360 to house my emergency fund. It’s a high-yield online savings account that allows my money to earn interest each month while it’s sitting there waiting for the next unexpected expense.

I’d highly recommend putting your emergency fund in an online high-yield savings account because The Performance Savings Account at CapitalOne has a 3.30% interest rate while most brick and mortar banks offer savings accounts with pathetic interest rates like .02% so your money never really earns anything as it sits in your account all year.

Related: Emergency Fund Tips: How to Grow Your Account Fast and Where to Start

3. Use It As a Down Payment on a Home

If you’re planning on buying a house, you may have to come up with a big down payment depending on the market in your area. Your tax refund can help ease that financial burden or even jumpstart your house down payment fund and motivate you to deposit more each month.

When you buy a house, it’s best to put at least 20% down in order to avoid private mortgage insurance (PMI) which can add up each year.

If you’ve been meaning to refinance your home, you can also use your tax refund to help cover the costs of the process. If refinance mortgage rates are low, this could be a great option if you’re looking to save money on your existing mortgage with a lower interest rate.

Related: Non-Traditional Housing Alternatives to Consider

4. Invest It

Ahh investing. Did you know that YOU can become a millionaire on an average salary as long as you start investing early and strategically? Don’t believe me? Plenty of people have done it.

When it comes to investing, there’s really nothing better to do if you want to build wealth and retire someday. I know retirement may seem like it’s far away, but the key with investing is to use all the time you have to let compound interest work and grow your money.

You’ll never be younger than you are today, so I’d advise you to start investing what you can now. Your future self will thank you.

If you’re interested in getting started with investing and building wealth, this post will definitely help you out. → How to Start Investing in Stocks With No Regrets

Related: Have Debt But Want to Invest? Here’s What You Need to Know

5. Home Repairs

Home repairs can be expensive and add up quickly. But upgrades and repairs can make your home a more comfortable place to live and even increase its value.

If you’ve been meaning to renovate your home or repair something that has been on your to-do list for a while, your tax refund can help so you don’t have to use your credit card or take out a loan.

Related: 10 House Projects You Can Do For $100 or Less

6. Treat Yo’Self to a Relaxing Vacation

There’s nothing wrong with doing something special for yourself every now and then. Going on a vacation doesn’t have to cost an arm and a leg but for some people, there’s often not enough time or money to go on vacation.

If you’ve already established your emergency fund and paid off some of your debt, using some of your tax refund to fund a little getaway wouldn’t be a horrible idea.

Vacationing is great for your mental health and can make you feel refreshed and ready to tackle the rest of your goals upon your return. To save money on travel, you can go on a weekend trip or stick to a domestic location.

Related: 10 Ways to Afford a $1,000 Vacation

7. Invest in Yourself

Investing doesn’t always have to relate to the stock market. You should always prioritize investing in yourself first because it can pay off big time. There might be a course or training program you’d like to sign up for if you’re looking to learn a new skill.

You may need new equipment or tools for your job or side hustle which would put your tax refund to good use. Whatever your goals are, be sure to invest in yourself from time to time so you can take your progress to the next level and become successful.

There are a number of smart ways to use your tax refund if you usually receive one this year.

At the end of the day, you just need to focus on using it to improve certain aspects of your life as opposed to blowing it on materials things you won’t even remember next year.

However, you shouldn’t get into the habit of spending the money before you receive it (since it could vary) and you should always focus on using the income you already have to boost your finances.

Establish a realistic budget, automate your savings, pay off debt, and commit to spending less than you earn. That way, your tax refund will just be considered extra and not a necessity to get by.

Will you be getting a tax refund this year? If so, how so do you plan to use it?