Self-Care: My New Not So Guilty Pleasure to Spend Money On

This post is sponsored by The Huntington National Bank and The Motherhood. All opinions are my own.

I have always been big on self-care for as long as I can remember. Back in college, I never pulled an all-nighter because I was so adamant about always getting 8 hours of sleep – so I made sure to do all my homework and studying during the day. Now, feeling like I could afford to spend money on self-care was another topic. When I started getting serious about paying off debt, my first step was to start trimming my expenses. This is something I’d recommend for anyone who has a tight budget, is looking to save more, or pay off debt.

When trimming expenses, you may find that you don’t need to pay for certain things, but it’s also important to realize that some cuts can just be temporary.

This is when getting on a realistic budget can come in handy. As you start to get a clear idea of what’s coming in and what’s going out of your account each month, you’ll know how much you have to spend on fun splurges or things that you truly value. Had I known this earlier, I would have made my debut at the spa much earlier.

My First Trip to the Spa Last Year

About a year ago, my sister and I flew to California to see our favorite childhood singer perform at a concert. We decided to make a fun girl’s trip out of it and do some other activities while exploring Los Angeles.

One thing that my sister had on the agenda was a trip to the spa. Visiting a spa never seemed like an option for me before because I always thought it would be an expensive and unnecessary luxury.

We looked at an online coupon site and found a deal where the spa was less than $30 per person. This included all the sauna rooms, common areas, rooftop access and more for the entire day.

Having this initial spa experience made me realize that I could actually budget for some self-care costs and make it affordable.

Smart Spending: Budget For Self-Care

As someone who works lots of hours (most of them being from home) and holds a lot of responsibility in my household, self-care is crucial to me. I can’t be anything to anyone if I don’t show up first for myself.

I practice self-care in so many ways including:

- Going to the spa once a month or every other month

- Getting massages every other month (or at least quarterly)

- Getting my nails done or doing them at home

- Going to the gym 3-4 times per week

- Eating healthy most of the time and drinking lots of water

- Getting at least 8 hours of sleep

- Paying for a coworking space to visit once or twice per week (great for socialization if you’re a solopreneur)

- Keeping up with my Audible subscription so I can listen to inspiring and helpful books

- Taking time off when needed (Okay, I’ll admit it, sometimes I have complete Netflix binge days)

So How Do I Afford to Spend Money on These Things?

Budgeting

Yes, budgeting plays a major role in me being able to spend on self-care. I bank with Huntington and get to use their Huntington Heads Up® tool – this tool helps me determine when I can splurge (and when to save).

Huntington Heads Up alerts are real-time insights into your spending and saving to help you make more informed decisions about your money. To use this feature, you have to be a Huntington customer who is also enrolled in Alerts so you can receive your Huntington Heads Up by email, text or push notifications to your phone and other devices (as always, message and data rates may apply).

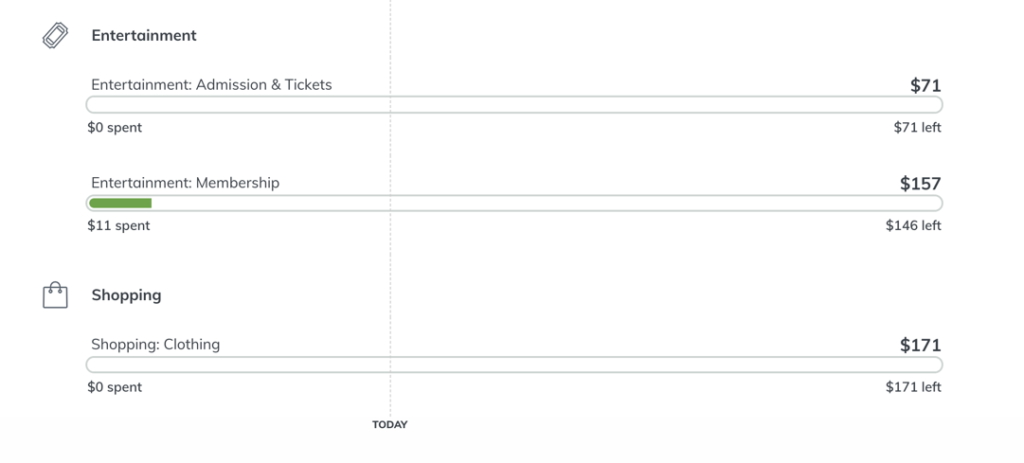

It’s actually really convenient because once you create your budget categories, Huntington will track your spending and keep up with where you’re at for the month.

As you spend money from your Huntington account, you’ll get a Huntington Heads Up alert to let you know when you’ve spent more than average when you’re close to the spending limits you set, and more. The text alerts are super helpful especially if you don’t have time to check your account or keep up with your spending for the week. It’s just one more way to hold yourself accountable so you can plan to spend smarter during the month.

At the end of the month you’ll know if you hit your goals and if you came in under budget, you can put the extra money toward savings.

Utilizing Discounts and Coupons

To help me stick to my self-care budget, I also like to take advantage of discounts and coupons. I check online coupon and deal sites often for deals on daily admission to the spa and massage offers.

For my gym membership, I could have chosen to workout anywhere but I do it at the park district so I can get a resident discount. I only pay $36/month for my gym membership and it includes unlimited access to the fitness equipment, along with unlimited access to group classes.

Mixing in the Free and Home-Friendly Options

I still soak in all the free self-care that I can whether that’s taking a nap on a Saturday afternoon, going outside for fresh air, reading a good fiction book or writing in a journal.

I also try to do some things at home since I still don’t find it necessary to pay for a spa trip each weekend. Activities like touching up my nails, taking a long bubble bath and meditating are all things that I can do at home. Doing my nails may involve getting a few supplies from the store but it’s a pretty cheap alternative overall.

What are some things you like to spend money on? Do you consider yourself to be pretty good at self-care or do you feel there could be room for improvement?