It’s time to go over my budget again. August was a so-so month. Most of my time was spent getting the little one ready for school and working (blahh), but I still got to have a little fun and do some things to enjoy the last few days of summer. In August we visited the zoo, attended a festival and enjoyed a movie in the park.

It’s already getting chilly around here, but I think we may get one more heat wave because it’s supposed to be in the 90s this week. August was an interesting month financially and I received my fair share of ups and downs.

My Highs

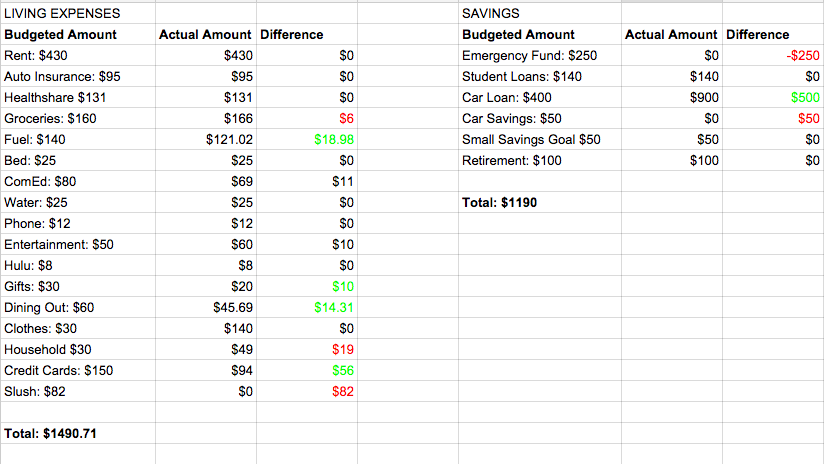

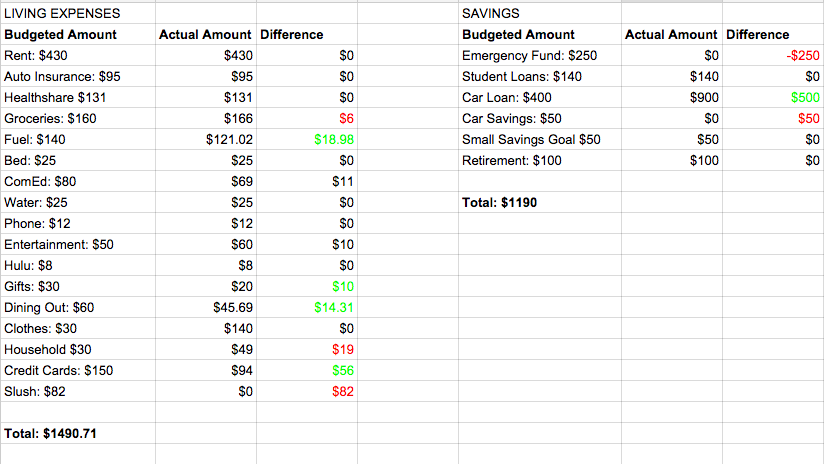

I put $1040 toward my debt in August. Whoo!! My car loan is almost under $3,000 and I can’t wait until it’s GONE. Check out my debt updates to see my progress. I’d like to keep putting this much toward my debt for the remainder of the year, but as you can see it’s at the expense of my emergency fund since I won’t be contributing to it anymore until January 2016.

School shopping for the little one was a success. I was able to get most of the items from Target and I cashed out all the money I’ve been putting aside to buy him school clothes. Since I just pulled from savings and didn’t go over budget with back to school shopping, I didn’t make the category red even though I technically spent more on clothing and such in August

My Lows

Business has been slightly slower at my day job and we didn’t get our bonus for the month of August, so that put a bit of a damper on my budget and spending. It looks like I won’t be getting my bonus in September either so I really have to cut back on some things. I know I shouldn’t depend heavily on my bonus at work because it’s based on performance and not promised but unfortunately I do. It adds about $5,000 to my annual income (after taxes) and we usually get it but that’s why I’m glad I made it a habit to spend less than I earn and establish some kind of emergency fund. It’s also nice that I have another stream of income (ie. freelance writing) so even though I won’t be able to save a ton this next month, I’ll still be comfortable as long as I control my spending.

I’m at the auto shop now getting my brakes done and apparently I need to get my tire rod fixed at my dealer soon so I will count this as a HUGE LOW for August and September. I have a coupon for $40 off, but I will report this ridiculous expense in September. I don’t even want to revisit how much money I’ve spent on my car between paying it off and doing repairs. It’s just plain ridiculous. My car is no doubt the highest expense I have and I’m not okay with that but I it’s a road block I need to plow through on my road to becoming debt free. Call me crazy, but I’ve played around with the thought of selling the darn thing. I only owe $3,000 on it now, and I can sell it for way more and pocket the profits. But then I realize that I only have a little bit left to pay and it should be all gone by December so I just need to hold on a little bit longer and then the car will be 100% mine.

Since my income has been lower in August I wasn’t able to put anything into my slush fund and I could really use it right now as a barrier to my emergency fund. I imagine work will pick up a ton over these next few months so I plan to beef it up then and just hold on tight for now.

Onto the budget:

How did your budget go in August? Anything you need to work on?