Creating a Student Loan Debt Plan of Attack

It’s been a little while since I shared an update on my student loan situation. Luckily, I’ve still been paying making progress and paying off my loans aggressively even though I’m freelancing full time.

Long time readers know I started this blog to document my debt repayment journey and be accountable. I really want to be debt-free. But I know it’s a process and I’m trying to make the best of it.

My debt has held me back from a lot of things. And it will continue to hold me back until I get rid of it for good. I know I’m not the only one saddled with student loan debt either. While the national student loan debt average hovers around $31,172, the average millennial has a student loan balance of $34,504. But let’s talk about a student loan plan of attack.

Table of Contents

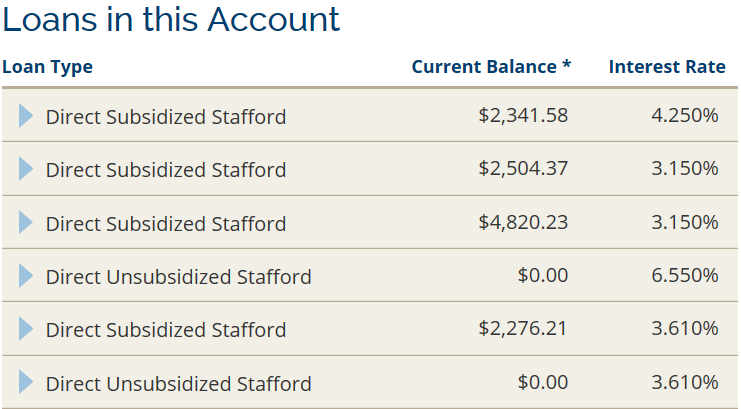

My Current Student Loan Situation

During the last update, I shared what my loan totals were and discussed the idea of considering student loan refinancing or consolidation. Below are my current numbers as of October, and I’m happy to say my loans are almost half way paid off.

(Update February 2020: I am student loan debt-free!)

Since my interest rates are pretty low and I have a federal lender, I decided against refinancing my loans. While I hope to have the whole balance paid off soon, I didn’t want to have to opt out of being able to take advantage of federal student loan relief options if I needed them.

Paying off my student loans has been an up and down process but I’m pleased with the progress I’ve made since I started taking debt payoff seriously at the end of 2014. If you are dealing with student loan debt as well and need a plan of attack, here are a few tips and strategies to keep in mind that helped me.

Find Out How Much You Owe, Who You Owe, and What Your Interest Rate Is

Your first step in your student loan plan of attack is to know your numbers. You always want to know this information so you can get a clear picture of your situation. According to Forbes, 37% of millennials don’t know what the interest rate is on their loan, while 15% don’t even know how much they owe.

While this sounds ridiculous, I can somewhat understand the confusion because student loans can be tricky to understand and sometimes life can get super busy and you just may not have had the time to look into your situation.

Back when I was in college, I probably didn’t keep a tab on how much money I borrowed in loans. However, now that you’ve graduated and have to repay that money, it’s important to get all your ducks in a row and have all these important details on hand.

Try the Avalanche Method

There are two popular strategies to use when paying off your student loan debt. It’s clear that I’m more partial to the avalanche method of debt repayment over the snowball method. With the avalanche method, you focus on paying off the loan with the highest interest rate first because it is most likely costing you more money.

The avalanche method of debt repayment is a definite way to make sure you are saving as much money as possible. By focusing on paying off my loans with the highest interest rate first, I am able to pass less interest over the life of my loans.

With that being said, sometimes it won’t matter which method of debt repayment you use since everyone’s situation is different. Maybe your loan with the lowest balance has the highest interest rate so you’ll use a hybrid strategy that involves both the debt snowball and debt avalanche methods.

Maybe paying off your loan with the highest interest rate won’t help you save that much money because there are other loans that are costing you more money each month. For example, the interest rates on my student loans are all pretty similar. I had a few high balance loans that had lower interest rates and were costing me a ton of money, while my loan with the highest interest rate wasn’t costing me nearly as much money because it was only a $1,000 loan.

This is why I say the avalanche method is great to try if you want to minimize the interest you pay on your student loans over time, but as long as you’re making process using whatever strategy works best for you, that’s all that matters. If you really want to get more bang for your buck, see which loans are costing you the most money each month and pay those off first.

Interest accrues on your student loans daily and you should be able to calculate which ones are costing you the most money each month or just ask your lender.

Try the Snowball Method

With the snowball method, you pay off the loan with the lowest balance first in order to gain momentum by paying off debt quickly.

The snowball method is great if you want to stay motivated throughout your debt repayment journey. It’s also great if you have loans that have the same interest rates, or a lot of “little” loans that you can eliminate quickly, thus focusing on the bigger loans.

Want to try out the snowball method? Check out my post on how to make it work for you!

Create A Budget For Your Loan Payments

For some of us, a clear budget can help us focus on our bills and pay off student loans faster. Sometimes, you have more money than you think you do. But you spend it before you see it, or spend it on unnecessary costs. Your first step should always be to create a budget. That way, you know what money is coming in and what’s going out.

If you create a budget and realize that you have more money going out than in, the next step is to lower your expenses to pay off debt faster. Here are just a few ways that you can cut costs:

- Lower your grocery budget

- Cut out cable and use streaming services instead

- Move to a smaller/cheaper place (if you can)

- Have a no-spend week/month

- Buy needed items secondhand

- Shop around for better insurance rates (car, home, life)

You can also use my free debt repayment checklist to help you stay accountable and pay off your debt faster.

Make Extra Payments

Making extra payments was a huge factor that contributed to paying down my loans so fast. When you first start paying back your student loans, it seems like a large amount of your minimum payment goes toward the interest each month.

I really didn’t want to be stuck paying on my loans for 10 years so as soon as I paid off my other high-interest debt, I started making extra payments on my student loans.

First I started making double payments, then triple. Now, I try to put an extra $1,000 on my student loans each month if I can. Since I established a profitable side hustle through freelance writing, an extra $1,000 monthly payment was possible.

There are plenty of you can do to earn extra money that you can throw toward your loans and I’ve covered a few options here on this site like virtual assistant work, customer service jobs, driving for Uber, becoming a tutor, becoming a product demonstrator, mystery shopping, and more.

Even if you get extra bonuses from work you can put that money toward your student loans. At my old job we used to receive a bonus each month whenever we hit a goal. And, we usually hit it regularly so it was nice extra money to put toward my student loans at the time.

Also, don’t worry about starting big. Even if you put an extra $100 toward your student loans each month, you’re cutting down your repayment term. You can even try making your minimum payment twice each month. If you have a 10-year term and do this every year, it could cut your term down to 5 years instead.

Make Strategic Payments and Check to See That They are Applied Correctly

Some people say you should make additional student loan payments on certain days. This is to maximize how much of your payment goes toward the principal balance and not interest.

I usually make my extra student loan payment a day or two after my minimum payment is made. This isy because the interest accrued on my account is lower at that time. All in all, you can’t get around paying interest. So you probably don’t need to stress too much about when you make your payments as long as you are at least making your minimum payment on time.

After you make an extra payment, log back into your account to make sure it was applied correctly. If you want your payment to go toward a certain loan you need to let your lender know. You can call or email them, or request it right on the website as you are making your payment. You must keep in mind that each lender has a different allocation process and a portion of your payment may go toward interest or another loan before your request can be met.

Even if you set up automatic recurring payments, it still doesn’t hurt to log in once a month and make sure your payments are being allocated correctly since lenders can make mistakes from time to time.

Don’t Stress Out Over Unforeseen Circumstances

While it’s important to set a ‘debt free’ date for your student loan plan of attack and try to stick to it, life is unexpected. Anything can pop up and deter you while you’re on your journey.

I originally planned to have all my student loans paid off by the end of this year. But I decided to quit my job and work for myself instead. The income I’m making now fluctuates a lot. It’s not the best situation to have for debt repayment, but I’m making the best of it.

If I can’t hit my payment goal for the month, I don’t beat myself up about it. I just make adjustments. So far so good though, as I’ve been keeping my living expenses low enough that I can cover all my basic needs, freelance taxes, and my extra student loan payment each month. I’ve also been planning ahead for expensive months. That includes events like birthdays and Christmas so I can get by without a scratch.

Summary: Student Loan Plan Of Attack

Your journey will most likely be different from mine. But it’s important to stay focused, plan ahead, make extra payments when you can. And of course, adjust accordingly whenever your situation changes.

P.S. I Need Your Help

In order for me to continue to share valuable stories and information to make this site as helpful as possible, I need feedback on the content as well as suggestions for what you’d like to see. If you could just take a few minutes to complete a brief survey, it would mean the world to me. I value your opinion and your time. This is why I made this survey short and sweet and easy to complete in under 3 minutes. You can find the survey here. Thank you so much for your support!