Why You Should Sign Up With CreditKarma If You Haven’t Already

CreditKarma has been around for almost 20 years, and has grown in popularity in the last decade or so. But, should you be using CreditKarma on your personal finance journey? Here’s our honest CreditKarma review.

The main feature that CreditKarma offers is its ability to provide you with free credit reports and scores. These consist of your Equifax and TransUnion reports; your Experian score is not included. You can view your credit score, upcoming bills, minimum payment due dates, and outstanding balances on the company’s app. And, the company is consistently making changes to its website, app, and what the customers want, so they’re always adding new benefits.

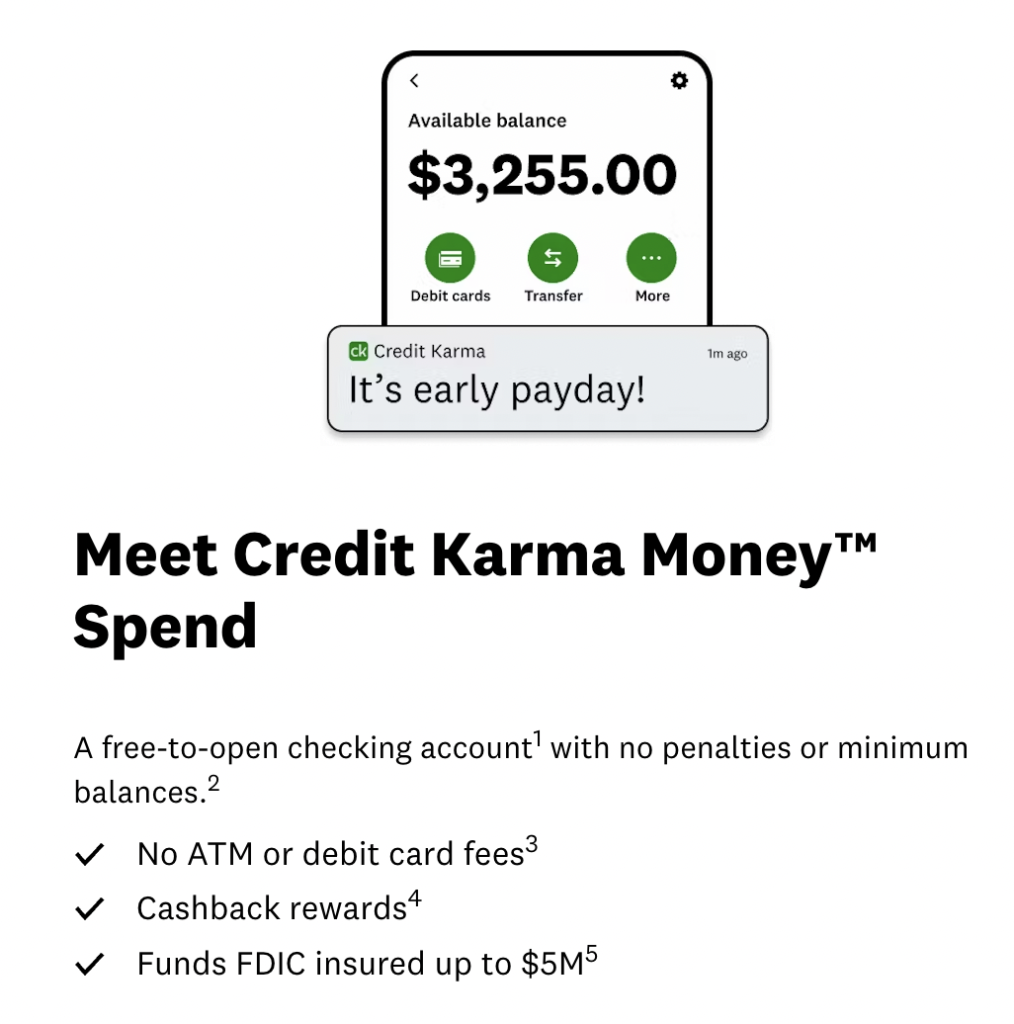

CreditKarma and Mint merged to form CreditKarma Money in 2023. The business also launched savings and checking accounts, among other services. These choices provide no-fee overdraft protection and up to five days of early access to government benefits. In addition, there are 55,000 ATMs in the US that are free to use.

Table of Contents

Overview

It’s easy to get started with CreditKarma. All you need to do is provide CreditKarma with some basic personal information in order to use it; typically, this is just your name and the last four digits of your Social Security number. CreditKarma then obtains your credit reports with your consent, creates a VantageScore, and provides it to you.

The app is completely free to use, and you can essentially check your credit score every day if you want. It’s also incredibly easy to use, with a dashboard that shows everything you need to know upfront, along with your score.

You also never have to worry about your information being compromised. Due to the sensitivity of customer information, the website takes security seriously and uses two-factor authentication in addition to standard 256-bit encryption.

Is CreditKarma Legit?

If you’ve never used CreditKarma, you may be wondering “Is CreditKarma safe?” and the simple answer is yes!

Yes, the whole “free credit score” part may make you wonder if CreditKarma is a scam, but it’s really not. The company mainly makes their money working with credit card companies and banks.

Outside of providing you with your credit score, a checking and savings account (if you want), and offering you pre-appoval for credit cards if you ask, they don’t require anything from you. You don’t even have to give them any billing info like a credit card, because most of their features are free!

CreditKarma Features

Now let’s go over some of CreditKarma’s most popular features.

Credit Monitoring

First, one of the best features of CreditKarma is its credit monitoring options, including how it makes it easy to see your credit score right when you login. You’ll also be able to see your credit report more in full, like your on-time payments and any new accounts you’ve opened recently.

Related: Best Free Ways to Check Your Credit

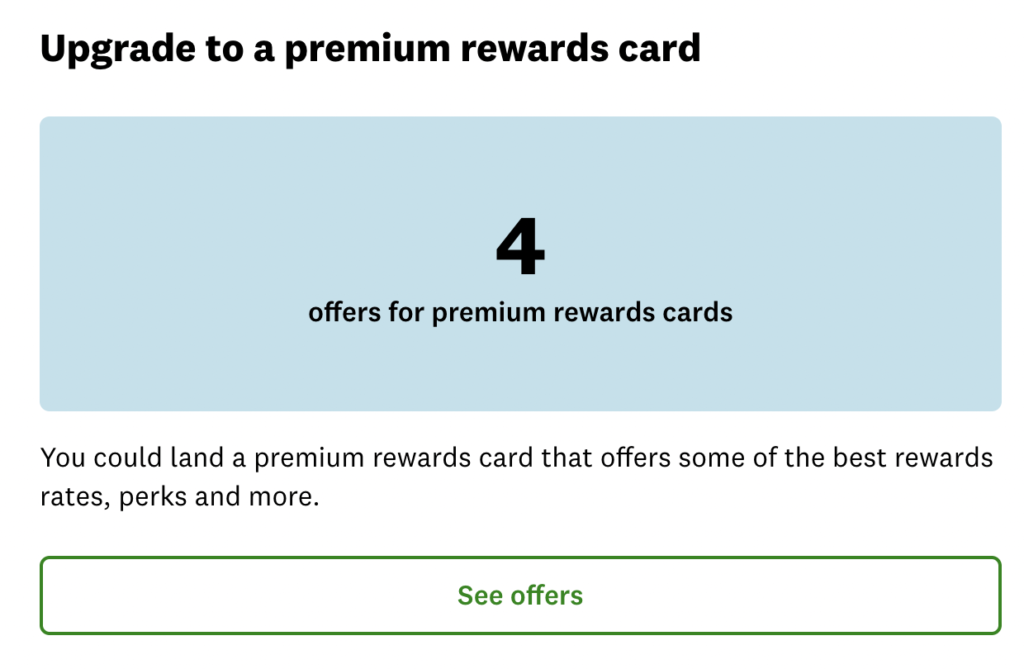

Product Recommendations

While you don’t have to use this service, CreditKarma will recommend credit cards or personal loan options to you based on your credit score and what they think you’ll most likely be approved for. This is completely free to you. CreditKarma gets paid by banks when they successfully sign up a new customer.

Mostly Free

With CreditKarma, it is completely free to check your credit score, and you can do it as much as you want!

CreditKarma Money

CreditKarma Money is a new service is now offered since Mint and CreditKarma joined together at the end of 2023. This service allows you to sign up for a checking and savings account, manage paying your bills, and even apply to financial relief if you qualify.

Pros and Cons

As with any company, CreditKarma has its pros and cons. Let’s discuss.

Pros

- Free to check your credit score. They also offer a free checking and savings account.

- You can check your credit score daily from two of the major credit bureaus.

- The company recently launched a credit builder option for those with no or poor credit!

- CreditKarma offers its features online, and via iOS and Android apps.

Cons

- To use bill tracking or credit builder features, you’ll need to open up a new checking account.

- Some reviews have noted that the recommendations that CreditKarma provides aren’t up to par with what lenders see, but it still gives you an idea of where your credit score is at.

- CreditKarma doesn’t track your Experian score. But Experian does offer a separate free credit monitoring service so you can use this if needed.

How to Make the Most of CreditKarma

Now that you know more about what CreditKarma has to offer and its pros and cons, let’s talk about how you can get the most out of it.

First, don’t just look at your credit score! CreditKarma offers so much more than just the score as a whole. Every credit account, closed and open, that has been reported to the credit bureaus in your name is included in your credit report.

A thorough summary of your payment history, balance, credit limit, account opening date, status, and type is included in every active account. Additionally, there are sections dedicated to hard inquiries, collections, and public records, including court rulings and bankruptcies. You can even dispute an account if needed!

The website also has a simulator for credit scores that displays potential changes to your score due to recent activity. This makes it easier to understand how a credit check or closing an account can affect your score.

Need a calculator? They offer a debt repayment option so you can figure out how to pay off your debt faster, and a loan calculator so you can see how much a loan will really cost.

CreditKarma also offers a “relief roadmap” if you need help with state-specific services, receiving benefits, and/or safeguarding your credit.

And, if that wasn’t enough, you can also receive real-time notifications about identity theft or data breaches, updates to your accounts or credit report, and details about your CreditKarma profile. The site has a lot to offer!

Related: Staying Motivated During Your Debt Payoff Journey

How to Pay Off High Interest Debt

Reviews on CreditKarma

Reviews on CreditKarma are fairly positive, but I do want to note that their TrustPilot rating is below two stars. This isn’t necessarily due to CreditKarma, however.

Many old Mint users seem to be upset about the change and that the two companies have merged. Others note that they hate feeling like they’re being bombarded with credit card offers, especially when they don’t qualify. But most users that simply use CreditKarma for their scores and as another bank option seem satisfied.

For example, many r/PersonalFinance users love using CreditKarma for credit monitoring and potential fraud protection. They also love how even if the score isn’t a perfect match, it’s still fairly close. So while CreditKarma has a lot of kinks to work out, it’s a legit company that can be a beneficial tool in your personal finance arsenal.

Better Late Than Never: CreditKarma Sign Up

There you have it, an updated and honest CreditKarma Review! Okay, are you ready to sign up for CreditKarma? It’s really simple.

All you need to do is go to the website, and sign up for free. The website will ask you a few simple questions to verify who you are, and you can have a new account set up in less than three minutes!

Summary

CreditKarma may have its glitches and issues since it’s merged with Mint, but the fact of the matter is that it’s been around for years and is a legit way to monitor your credit score without paying out of pocket.

Once you sign up, it’s as simple as logging in to see your daily updates and score, and you can always see what goes on behind the score too!

FAQs

Why is my credit score on CreditKarma different than what other lenders might see?

It’s fairly typical for your credit scores to vary slightly between agencies. Since CreditKarma only looks at two of the major credit bureaus vs. all three, your score may be a bit higher or lower than you see on your dashboard. However, CreditKarma’s reporting is often fairly accurate, with a difference of just a few points lower or higher than the score your lender is looking at.

Can I check CreditKarma as much as I want?

Yes, you can! While CreditKarma only updates your score about once a day, you can check your score multiple times a week, or even daily if you want!

Should you trust CreditKarma?

CreditKarma is a highly regarded and legit company. Millions of people use it on a regular basis, and are able to look at their credit score and monitor their accounts. We’d say it’s safe to trust them!