Digit App Review: Is It Worth It?

Looking to save more money each month? Serious question. I know that if I ask the average person if they’d want to save more, their answer would be ‘yes’, but then I’d have to follow up by asking how much they want to save and which specific action steps are they taking to get there.

Over the years, I’ve tried several different strategies to help me save money but I’ve found that my favorite solutions were options that didn’t involve too much time and effort. This is why micro-savings apps like Digit definitely deserve a second glance.

I’ve known about Digit for several years now and I can’t believe I’m just now writing a review about it. Digit is one of the best tools to help you save more automatically and I’ll be sharing exactly how it works and how I’m using it in this Digit app review.

Table of Contents

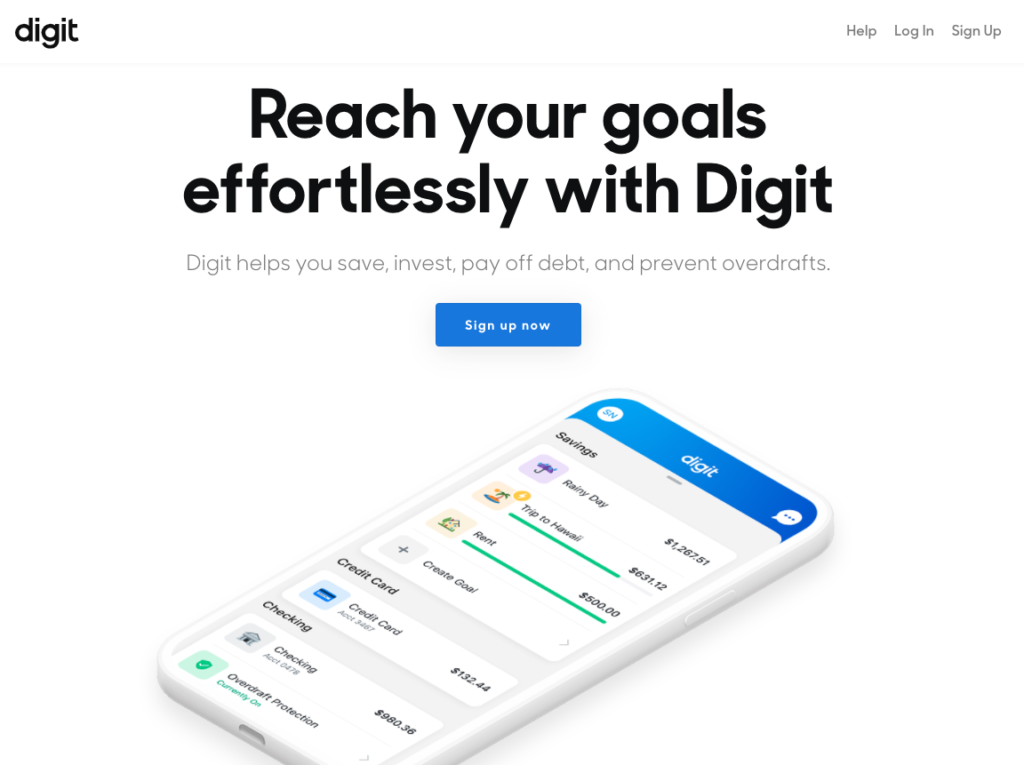

Digit App Review: What Exactly Is Digit?

Released in 2015, Digit is a robo-financial assistant and micro-savings app that allows you to save money, invest money and pay off debt. It is designed to help you achieve financial health with ease. Digit helps you small amounts of money – one day at a time – consistently to help you reach your goals whether it’s to fund a vacation, save for birthdays, or prepare a down payment for a new home.

If you’ve been wanting to save for small and large goals in the past but didn’t think you have enough to put aside, Digit helps you get started where you’re at so you don’t waste time.

Who Is Digit For?

If you have debt or are looking to boost your savings rate, Digit is for you. The average American has $90,460 in debt while the average savings account balance is $3,500. Like I said, most of us could use some extra savings for various different purchases. If you need help with creating a savings habit and/or making additional debt payments then this app is perfect for you.Even if you don’t feel that you have enough to set anything extra aside, Digit will help you save those smaller amounts of money aside that you might have used for fast food runs, coffee or other trinkets in the past.

By stashing your hard-earned money in a secure savings account, you’ll be able to put it to much better use in the future.

How Does Digit Work?

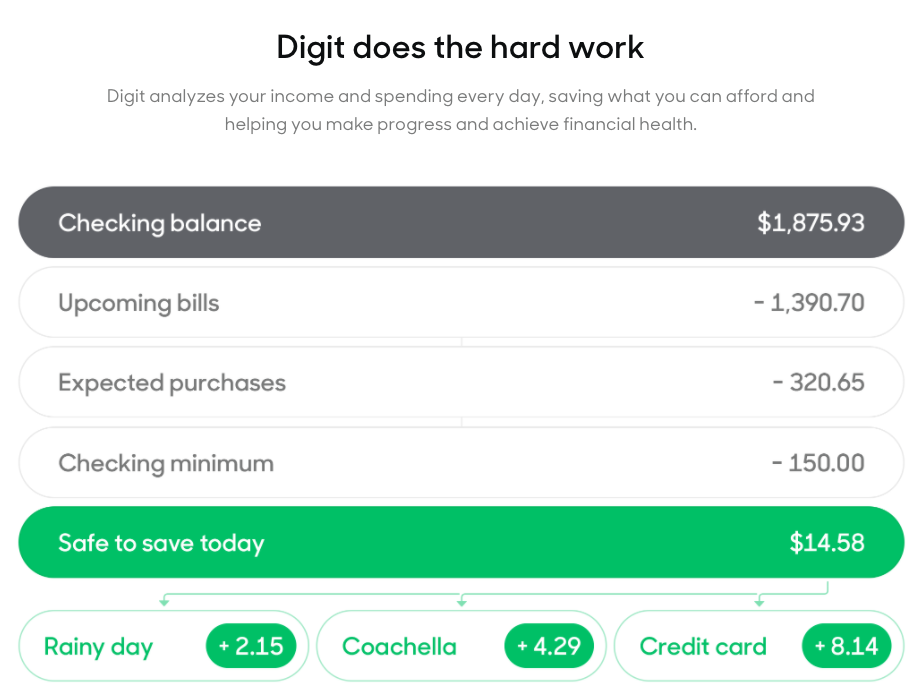

Noted as the first of its kind, Digit provides a personalized and automated savings plan that is designed around your specific spending habits, which it uncovers through its sophisticated algorithm.

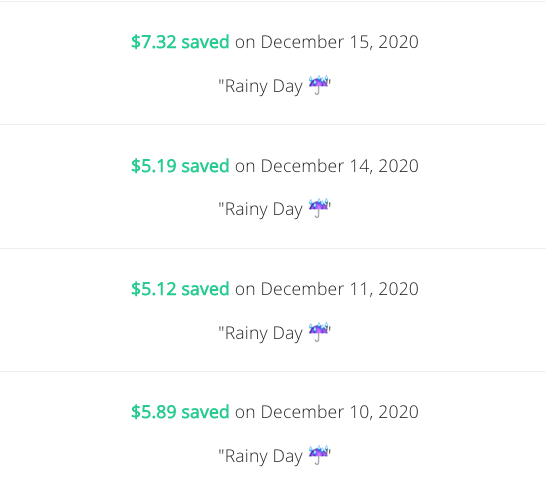

In other words, Digit keeps track of your income and spending patterns once you connect a checking account. With that data, it determines the amount of money that can be transferred from your checking account to a separate Digit savings account. The amount of money transferred over is generally small because the goal is to move over amounts that you can afford to and the transfer happens every 2 to 3 days.

The algorithm works by reviewing the amount of money in your checking account, your last or next direct deposit paycheck, your upcoming bills, and how you’ve been spending lately. It’s highly intuitive so it can determine what works for your particular lifestyle. Here’s a snapshot of what my Digit transfers look like:

The Digit Chatbot creates a financial personal assistant element to the app and allows you to text commands to have specific actions happen within the app to personalize your experience further.

Additional Digit Features

This Digit app review wouldn’t be complete without me digging into the features a little more closely. Digit has definitely simplified the way you interact with your money and these are some of their features that I find super helpful.

Save

You can save for as many things as you like because Digit offers unlimited savings goals. Transferring funds from your goals or adding funds to them with a one-time deposit from your bank account is also available.

Digit also gives you control by allowing you to manually set your savings amount and you can withdraw your savings anytime you want with no fees, charges or penalties. Plus there are no minimums for their accounts so you can hold any amount of money in them.

Although there isn’t a huge interest bonus, Digit does offer a 0.1% Savings Bonus that you receive once a year. It’s calculated based on your Digit account’s average daily balance and it’s prorated.

Overdraft Protection

Digit has a great Overdraft Protection Plan as well. You can set a minimum balance amount that you want in your checking account at all times. This means that Digit won’t take out funds if it will cause your checking account balance to go below the amount you set. My minimum balance amount is around $150, so if this is all I have left in my checking account, Digit won’t make any savings transfers until the account balance is higher.

Also, if for some reason they do take out funds that disrupt your checking account minimum balance and you get an overdraft fee, Digit will automatically reimburse you and put the reimbursed amount in your Rainy Day Fund in the app.

Debt Repayment

The Digit app acts as an additional payment option on credit card and/or student loan debts by allowing you to connect your credit card and/or student loans to a goal.

Digit will save for you and then once a month it will send your balance saved to your debt payee. This additional monthly payment to your credit card and/or student loan payment can be a huge help in reducing interest and paying them off faster!

Related: Two Easy Things I Did to Cope with a Long Debt Payoff Journey

Saving and Paying Off Debt With an Irregular Income

FAQ

Is Digit Safe?

Yes, Digit is completely safe to use. The app is partnered with a total of six FDIC-insured banks: Chase, Wells Fargo, BBVA, Luther Burbank, Bank of America, and Axos.

With the level of security utilized by Digit, you’re covered up to $250,000 if Digit or any of these banks were to go bankrupt.

I know it may sound weird to have an app or some bot peering in at your bank account to study your spending, but to use Digit you run the same risk of setting up mobile banking or partnering with any other app to make automatic transfers. Plus, Digit goes about it responsibly and uses 256-bit encryption which is the same level of security used by governments and militaries. With these safety measures in place, they have successfully moved over $5 billion for their users.

According to their privacy policy, Digit does not share your personal information with other financial companies for joint marketing purposes or any third-party companies to market to you.

Will Digit Link to My Bank?

Digit links to over 2,500 banks and credit unions in the U.S. so you’re bound to find the one you bank with. I’ve changed my bank account a few times over the past few years and I’ve always been able to link my account without an issue.

What Happens If Digit Transfers Too Much Money to Savings?

Let’s say you have some money in your account that you were planning on using for a specific purpose. While you know this, of course, Digit does not and ends up transferring some of that money to savings. It’s easy to simply transfer that money right back to your account. plus, you can set up overdraft protection which is what I do. If you don’t want Digit to transfer money once your account balance is $500 or any amount you select, you can set this rule up in just seconds.

Can I Pause Digit or Can Cancel or Stop Using Digit At Any Time?

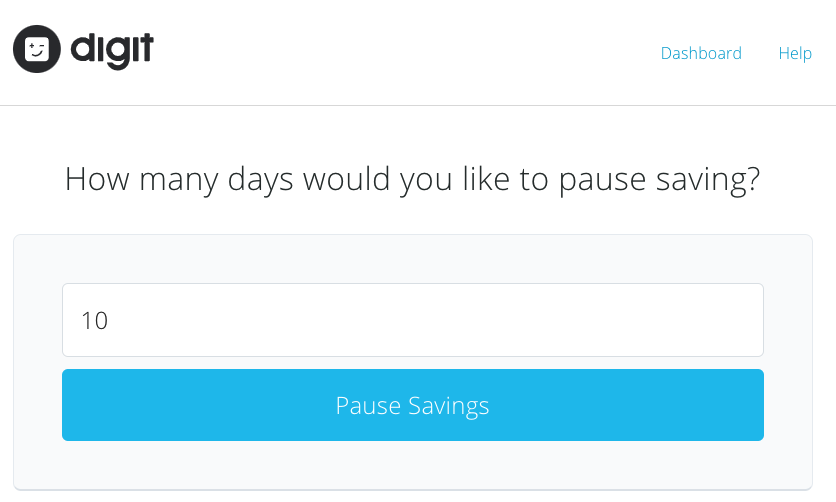

Yes, you can completely pause savings transfers throughout the month whenever you want. Choose how many days you wish to pause savings transfers for. When that time is almost up, Digit will send you a reminder that it is about to start saving again so you’ll get a heads up.

If you want to cancel Digit and close your account, you can do this from the account settings area or even text Digit at any time.

Is Digit Free to Use?

Digit does come with a small monthly fee of $5 but that’s after a 30-day free trial. This is less than a typical Starbucks order and I can think of a lot worse things to spend $5 per month on. If you’re serious about saving more money and meeting some of your financial goals, this small fee might be worth it.

Can You Refer-a-Friend

Of course! Digit actually has a refer-a-friend program that pays you $5 for each person you refer and there are no limits to how much you can earn.

Digit App Review and Ratings Online

The Digit app has an average rating of 4.5/5 in both the iPhone Store and Google Play Store. Low reviews mostly centered around Digit customer service being limited and slow however the app does have an extensive online help center to look through first.

Is It Worth It?

I hope this Digit app review helped you get a good feel for how many things this app can do and how it can help you save more money. When deciding whether Digit is worth it and worth the $5 per month, realize that you can definitely save money without paying for Digit. However, you have to be honest and ask yourself if you’re truly doing this.

Are you saving consistently and challenging yourself regularly by increasing your savings rate?

Are you meeting financial goals and do you truly feel like you have enough to spend on things like vacations, large purchases, and other needs and wants without freaking out about money deep down?

Most importantly, are you tired of looking at an empty or low-balance savings account and wondering when you’re ever going to have enough to save?

Digit can help with all of these things and eliminate all the work on your end to plan for savings. I challenge you to take a minute today to scroll through recent transactions for your checking account and see how many unplanned or unnecessary purchases you might have made this month. If they add up to more than $5, you can definitely afford to start using Digit. If you feel you would truly get value out of this service, I’d encourage you to sign up and start your month-long free trial.

Then, come back to this post and leave a comment to let me know how much more money you’ve saved over time as a result!