How Big of An Emergency Fund Do Homeowners Need?

This post is brought to you by The Huntington National Bank and The Motherhood. All opinions are my own.

Everyone should have emergency savings but an emergency fund for homeowners is crucial. I bought a house a little over a year ago and when we were in the process of preparing for homeownership, I definitely focused more on saving for a down payment and closing costs.

I knew I needed an emergency fund, but it wasn’t top priority for some reason. This turned out to be a big mistake because although my first year as a homeowner was pretty peaceful, recent months have left me clinging to my emergency fund for dear life.

Within a few weeks, I had my car break down ($400 to fix), realized we needed to buy a new stove ($630), and had some semi-urgent plumbing issues to take care of ($1,200).

As you can see, these everyday issues cost around $2,230 and it all happened in a matter of a few weeks. Life is like that sometimes. So as a homeowner, it’s especially important to prepare and build a large emergency fund.

Table of Contents

Common and Unexpected Expenses For Homeowners

If you own a home or are looking to buy a house, it’s important to understand all the expenses you will be responsible when it comes to maintenance and repairs.

I knew that homeowners paid for all costs associated with the home, but there were plenty of expenses that I didn’t even think about or wasn’t prepared for. Some costs include:

- Annual maintenance services (for things like your furnace, HVAC, plumbing etc.)

- Contractor service fees (it often costs money just for someone to come out to look at your home and assess a problem)

- Roofing, siding, and windows

- Foundation work

- Weatherproofing basement or crawl space

- Lawn care (weeding, mowing, landscape design)

- Tree trimming and removal

- Insulation (attic, garage, etc.)

Not to mention, there may be cosmetic things that you wish to do to update your home. When we first moved in, I immediately had new flooring installed. While my dad helped with this, it still cost us around $700 or so.

We also updated our half bath, painted and removed some trees. I was literally shocked that is would cost us around $300 to remove some trees last summer. We still have a ton of work to do on our yard.

So How Big of an Emergency Fund Do Homeowners Need?

After hearing about all my unexpected expenses so far and seeing what you could potentially be paying for homeowner you may be wondering how much should really be in your emergency fund.

My short answer is: as much as possible.

I try to stay away from telling people how much to save or buy but when you have a home, you do want to set aside at least 6-8 months of basic expenses. It may sound like a lot but trust me, it’s worth it.

Another thing you want to do is pay off as much debt as possible before buying a home. This will help free up more money for you to build your emergency fund quicker. Before buying a house, my husband and I paid off his credit card debt, my student loans, and both of our car loans. This knocked out at least $700 in monthly minimum payments allowing us to save more for our home.

Tools to Help You Save

Saving money is a habit and you can do it easily when you use the right tools. For starters, you want to make sure your bank allows you to set up automatic recurring savings transfers.

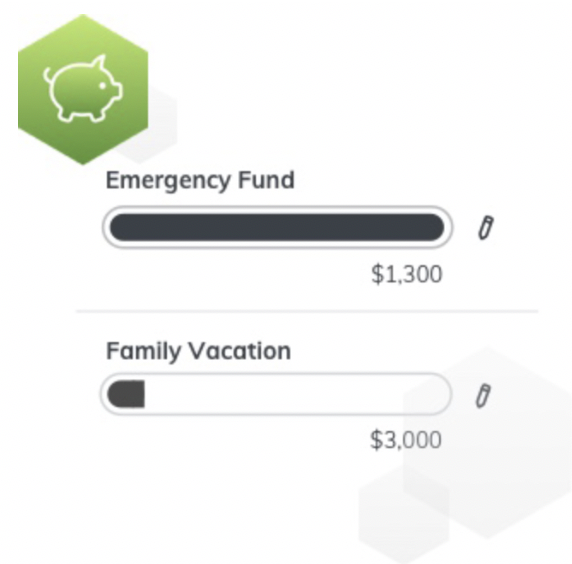

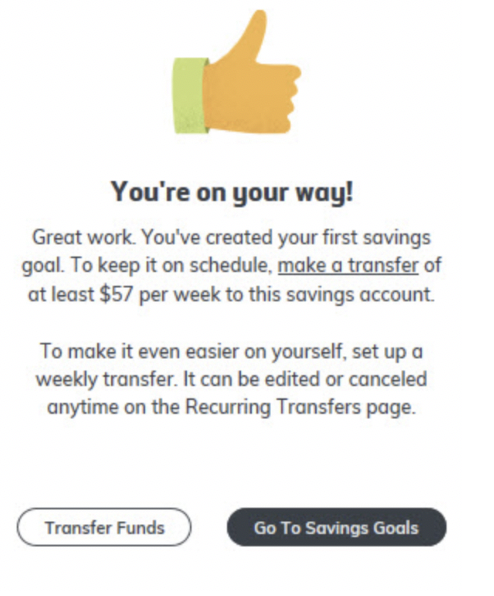

That way, you can set money aside regularly without even thinking about it. Huntington Bank offers the Savings Goal GetterSM tool on The Hub for their savings and money market accounts. You can set up two types of savings goals: Emergency Fund and Savings Goals. With the Savings Goals option, get specific and narrow down up to 10 specific savings goals that you have, large or small.

Huntington Mobile App Savings Goal Getter View

If you wish to build an emergency fund as well with this feature, the emergency fund will be prioritized first before you can add to the savings goal. Then, your funds will be directed toward your other savings goals after you hit your ideal emergency fund balance.

Huntington Savings Goal Getter

I like having the option to save for multiple goals because we have a few sinking funds as well and all of our savings don’t go straight to the emergency fund account.

Also, set a deadline for meeting your emergency fund goal to motivate yourself. Savings Goal Getter also serves as a guide by showing you how much you need to save per week to stay on track.

What To Do In the Meantime

The toughest time can be when emergencies arise and you haven’t fully funded your emergency fund. Not to mention, as a homeowner you may be constantly replenishing your fund.

I saw one source recommend that homeowners save around 20% of the purchase price in an emergency fund. If you were thinking about putting 20% down, that’s like a double down payment – a ton of money! Whether you’re thinking of saving that much or not, these tips will help you get ahead and prepare for the unexpected.

Continue to Live on Less Than You Earn

If you’ve been reading my blog for a while you know I live by this. Living below your means allows you to avoid debt and often have money left over after you get paid. There’s just so much peace of mind that comes with keeping your living expenses low.

This is the main reason why we bought a house that was below our means and also had extra room if we want to rent some space out. This allows us to save more and cash flow some home repairs and maintenance costs when they come up.

Cut Some Bills

I am always looking for ways to cut bills and expenses. We shop around for auto insurance every few months and we recently lowered our health costs since we hadn’t been to the doctor in a while.

For the car repairs and new oven I mentioned earlier, we actually were able to lower our expenses and earn extra money to cover them as opposed to going into our emergency fund.

By the time the plumbing issue came up, our finances were already tight so we did actually draw from our emergency fund. Still, it was so relieving to know we could fall back on that money.

Feed Your Account With Windfalls

We all get windfalls whether it’s a refund check from a utility bill company, a bonus at work, or a tax refund.

Put this money directly toward your emergency fund and act like you never had it to spend in the first place…because you didn’t.

Make Some Extra Money

Making extra money is always an option to help you cover planned and unplanned expenses. It can also help increase your emergency fund. Learn more here on Huntington.com

My husband drives for ride-sharing companies sometimes and I take on freelance writing and virtual assistant jobs. We also do focus groups sometimes and earn cash back from shopping rewards sites.

Final Thoughts

Building an emergency fund for homeowners should be top priority. If you’re looking to buy, make sure you have a large emergency fund (6-8 months of expenses or more) saved up before you start the process.

Even if you can only put 5% or 10% down on a home and not the recommended 20%, it’s still best to hold onto your large emergency fund balance because you will need it.

Consider using banking tools like Huntington’s Savings Goal Getter tool to help you track your savings and make steady progress. If you are ever feeling overwhelmed, especially after encountering an unexpected expense, Huntington has many resources to help guide you in the right direction.

It all comes down to being disciplined and making sure that you’re hitting your weekly or monthly savings goal no matter what. Lowering your expenses and earning more money can help you in the meantime until you hit your ideal balance.

To help even further, I’ve put together a 4 part masterclass called ‘Build A Full Emergency Fund…FAST’ and it’s dedicated to all things emergency fund! We’ll dive into all the areas needed to get your emergency fund to where you want it to be fast.

We’ll discuss things such as your personal ‘why’ for building a full emergency fund, what you should and shouldn’t use emergency savings for, how many months of expenses you should set aside for your own personal situation and SO much more. I am also including great bonuses that will help you beyond the masterclass. Join the masterclass here!