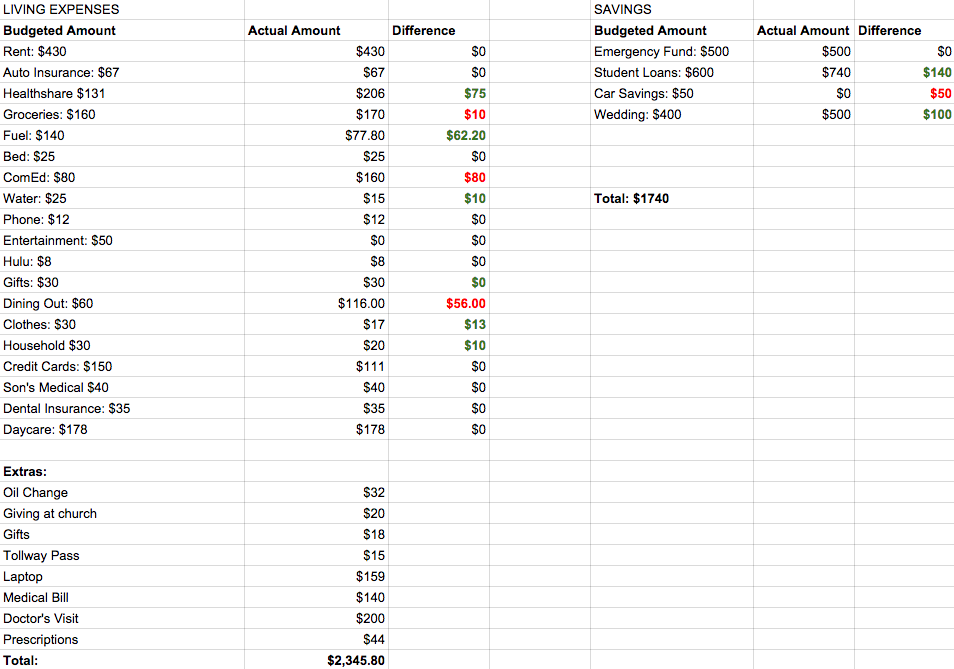

February Budget Review

The first two months of the year have flown by, and I can’t say I’m surprised or unhappy about it. February is the time when I become so over the winter and I’m in a super busy stage in my life right now so I can’t wait for future months when I can slow down.

Posting these budget reviews each month helps me be accountable for how I did throughout the month so I can acknowledge my successes and failures instead of glossing over some things.

My Highs

- I always like to acknowledge the progress made on paying off my debt each month. Every month I budget, spend, save consciously with the intent to put extra money toward my debt. This month I managed to put another $740 toward my student loans. You can check out my progress made on my debt repayment journey here. I’m excited that I’m starting to see a difference in the balance and it’s almost under $18,000. It would be great to get it down to $10k by the end of the year, but I’ve got a lot of work ahead of me.

- Even though I spent about the same amount of money on dining out and takeout as I did last month, I was happy to be able to take my mom out to eat for her birthday. It’s a rarity since we hardly ever do go out and eat together since we’re always cooking. These days I have no idea what to get my parents for birthdays anymore so I just decided to spend quality time with them instead and I feel like they appreciate that more.

- I found a nice Chromebook for my sister at the end of last month and I’ve been talking with her about helping me with some things on my blog that I don’t have time for. The one problem with growing my freelance business is that I don’t have much additional time to put into it to try out some of my strategies. I figure with her helping me, I can go after big clients and still remain within my 20-hour-per-week time constraints.

- It was unintentional, but I had another no spend entertainment month again. I think I’m starting to get the feel for this budgeting autopilot thing. Even though I wasn’t trying to cut my entertainment spending at all, somehow I guess I had a pretty unexciting month that kept me busy. One of the few benefits of staying busy often is that you don’t have much time to worry about spending money. We did do a couple of fun things though. On Valentine’s Day, we went to my friend’s daughter’s birthday party and had a great time catching up with some people from our old neighborhood while the kids played and had a blast. Minus the gift we brought, that didn’t cost anything.I also went to a comedy show with a friend last month and scored a free ticket since I knew the promoter for the show and he offered it to me as a late birthday gift (my birthday was in January). Another fun event we attended as a family, was fitness fun fair over the weekend. Admission was free and it was hosted by our park district.

My Lows

- I forgot that it was time for my annual renewal fee with Liberty HealthShare last month. I decided to stay with the health sharing ministry for another year instead of getting health insurance through the marketplace. Maybe I’ll post an update about my experience so far soon. I was a little surprised when I saw the extra money missing from my account last month, but it’s my fault for not paying attention to my renewal fees so I could be prepared for them.

- It was also big spending month for me due to a medical bill I got in the mail and decided to pay off and an unexpected trip to the clinic. Toward the middle of the month I started to have really bad back pain. On a scale of 1 to 10 it was around a 7 or 8. It was a constant pain and it was very irritating. I kept thinking I must have pulled something when exercising and that it would go away but after 4 days, I decided to go to the clinic and get it checked out to rule out anything serious. The doctor ruled out any type of infection (every time I have back pain I worry and hope it’s not kidney related) and prescribed me a muscle relaxer that seems to be working okay for now. I had to be seen as a self-pay patient though which is why the visit costs so much but I’m going to submit my receipt to Liberty in the hopes that they will reimburse me.

Onto the Budget

I try to be as accurate as possible when reviewing my budget results each year but overtime, I’m sure you’ve noticed that my spending is quite inconsistent sometimes by a few hundred dollars. This is because my income is somewhat inconsistent. My freelance income fluctuates quite a bit and since I work hourly and get paid every 15 days at my main job, most times I don’t know the exact dollar amount I’ll bring home. Sometimes the difference can be an average of $300 or so from month to month but I just try to work with what I have.