Achieving Financial Freedom with the Debt Snowball Method

The average American household has $96,371 in consumer debt according to Experian. This includes around $5,221 in credit card debt and $20,987 in auto loan debt.

Several years ago when I first started my debt payoff journey, I was all about saving the most money in interest and tackling the big balances first (ie. using the avalanche method).

More recently though, I’ve experienced the benefits of using the debt snowball method to pay down some of my credit card debt from last year. The debt snowball method is a popular debt repayment strategy that’s based around providing you with continued motivation.

I actually believe the debt snowball method can help you get rid of your debt for good and achieve financial freedom.

Are you looking for a way to pay down your debt faster? Let’s learn more about how to use the debt snowball method strategically to help you reach your goals.

Table of Contents

What is the Debt Snowball Method?

The debt snowball method involves paying off debts in order of smallest balance to largest balance. You start by first focusing on paying off the smallest balance first while making minimum payments on all other debts.

Once the smallest balance is paid off, you then move on to the next smallest balance and so on until all debts are paid off. This method makes it easier for you to stay motivated and keep track of your progress. As each debt is paid off, your total amount owed decreases significantly.

By utilizing this method, you can accelerate the process of paying off your debt and reach financial freedom sooner than you’d think.

How Does It Work?

The idea behind this technique is that by focusing on one small goal at a time, it will be much easier for you to stay motivated and feel like you’re making progress toward becoming financially free.

Since it’s easier to stay focused when you’re working toward smaller goals, this method helps speed up your repayment process. With the debt snowball method, you’re able to pay more each month and more quickly than if you were trying to tackle all of your debts at once.

Then, as each debt gets paid off, you’ll have more money available which can be used towards paying down larger balances faster.

By using this strategy, not only will it help speed up your repayment process, but it will also help boost your credit score by showing lenders that you can manage multiple debts responsibly over time.

Why Does the Debt Snowball Method Work?

I believe the debt snowball method words because it helps you focus on one thing at a time. Having debt can make you feel overwhelmed and you may not know where to start when it comes to tackling it.

Instead of just paying on different accounts at random times, the debt snowball method helps you narrow down a core focus.

Another reason why this works is it motivates you early on by seeing success right away. Sure, a small $200 debt for example isn’t much. But when you pay it off, you’ll instantly boost your motivation and be more likely to keep going.

Finally, this method works because your payment grows over time. Once you pay off one balance, you just roll that payment amount onto the next debt. Once you get to the last few debt accounts, you won’t have nearly as many minimum payments. This frees up more of your income to make progress on your debt.

Related: Prioritizing Your Debt-Free Strategy

How to Get Started With the Debt Snowball Method

Real Life Example of the Debt Snowball Method

So, now that we know what the debt snowball method is and how it works, let’s see this play out in action. Below is an example of how you can use this method to pay off your credit card debt.

- Synchrony Car Card: $128.85

- Best Buy: $144.98

- IHG Rewards: $151.43

- Southwest: $307.43

- Chase Slate: $620.13

- Amazon: $680.27

- Citi: $1,103.24

As you can see, I listed the balances from smallest to largest. The interest rate or minimum payment amount doesn’t matter. Only the balance amount is important.

Now, let’s say that each of these cards had a minimum payment of $35. Once we get to the last card, we already have more cash flow since we’re not paying $210 in minimum payments on the other cards.

You can use the debt snowball method for other types of debt too whether you have personal loans, a car loan, or student loans. Just list everything out and start tackling the debt with smallest balance first.

Don’t forget to continue to pay the minimum on all the other debts so you can avoid any late fees.

Pros and Cons of the Debt Snowball Method

Pros:

- Easy to start using ASAP (only focus on one thing – your balance amount!)

- Offers a quick psychological boost when you see your debt disappearing

- Helps you get organized and focus on one debt balance at a time

Cons:

- Could make it harder to get a handle on high-interest debt

- Since you’re only focusing on balance amount, your costliest debt may get paid off last

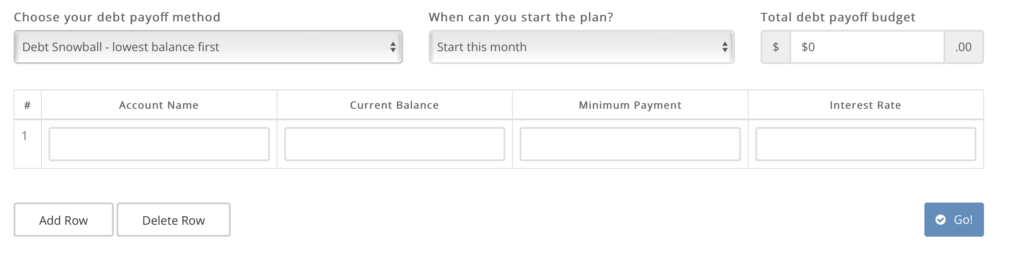

Get Started With a Debt Snowball Calculator

As I said earlier, the debt snowball method may not save you the most money in interest payments, but it will help you pay off debt regardless. To determine whether this debt payoff method would be best for you, I highly recommend using a debt snowball calculator.

Undebt.it has a great debt snowball calculator that you can use to plug in your own numbers. You’ll also see what progress you can make with other methods such as the avalanche method for debt payoff.

Just enter the name of your account, the current balance, minimum payment amount, and interest rate (if you know it).

Reduce Expenses While Paying Off Debt

While you use the debt snowball method, accelerate your progress by reducing expenses as well. It’s important to revise your budget so you can make room for minimum and extra debt payments.

Calculate how much you’re spending and see if there’s room to cut costs anywhere. Reviewing all your transactions (even just for the week) can seem daunting so I highly recommend using a budgeting app to help such as Simplifi.

Simplifi gathers all your transactions automatically and helps categorize them so you can build a realistic budget quickly. Another thing I like about Simplifi is that it helps you plan for upcoming bills, track subscriptions and even watch specific retailers and purchases in areas where you’re overspending.

Some other practical ways to reduce your spending include:

- Using a meal plan and cooking more meals at home.

- Shopping around for cheaper car insurance. My husband likes to call our current insurer first to see if they’ll give us any discounts.

- Switching to a more affordable phone plan. We have Total Wireless but Republic Wireless, Mint Mobile, and Tello are all excellent options.

Summary

The debt snowball method offers an effective way for consumers to pay down their debts faster and reach financial freedom sooner.

With this method, you can easily keep track of your progress and stay motivated throughout the repayment process.

Additionally, as each debt gets paid off, more money becomes available which can be used toward larger balances so that consumers can accelerate their repayment even further.

If done correctly, this strategy has the potential to help you achieve their financial goals much sooner. I’d love to hear your thoughts about the debt snowball method and if you’re ever tried it in the comments below.

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.