How I Found Money to Start Investing

Thank you DiversyFund for sponsoring this post. It’s never too early to learn about investing for your future!

Ever since I got serious about financial wellness, I’ve been interested in investing and saving for the future. However, like most Americans, I felt like I could not afford to start investing. According to a 2019 Go Banking Rates survey, over 55% of respondents said the main reason why they don’t invest is because they can’t afford it.

On the bright side, you don’t need a ton of money to start investing. Yes, investing does require some money but today it’s easier to get started without thousands of dollars or a ton of management fees.

One of those ways is by investing in real estate. If you’re not interested in buying properties to manage or becoming a landlord, no worries. Doing this can be very time-consuming but DiversyFund makes it easier to invest in real estate automatically.

For me, investing is a habit and it starts by being intentional and freeing up money from my budget in the first place. Here are 3 things I initially did to free up more money to invest and diversify my assets.

Table of Contents

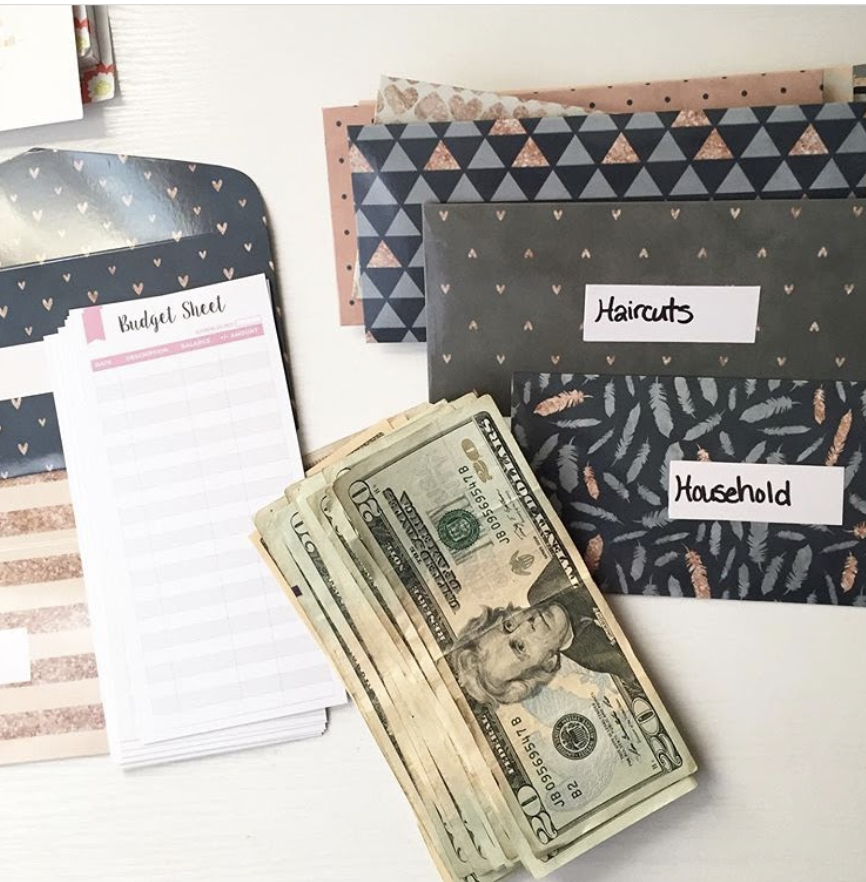

Budget For It

This is key. I sit down with my husband every week and we have a finance date where we discuss our cash flow and money goals. It’s a great time to hold each other accountable and review our budget closely. We get clear on our priorities and this often dictates what we budget for.

When I told my husband that I wanted to start investing, we immediately created a budget category for it. I love budgeting because it allows you to see a realistic view of your spending and income. There have been many times where I felt like I couldn’t afford something. Then, I actually ran the numbers to find out that with a little tweaking, the goal was actually attainable.

Watch Sneaky Impulse Spending

One of my absolute favorite memes is the one that says ‘You have food at home’. There are now several variations of this meme floating around but I’m sure it’s such a great reminder to most of us. My family doesn’t spend nearly as much as we used to on restaurant meals and takeout. My husband brings his lunch to work and we plan meals out for each week and prep on Sundays.

Doing this saves us thousands per year and we’re still able to dine out on occasion when we want to. The difference is that I’m not running to the drive-through because I’m too overwhelmed to sort through the food we have at home. Planning and preparation is key. It’s the same with other types of sneaky impulse purchases.

Whenever I’m at the store or see a sale online, I stop to ask myself if I’m thinking about making a purchase based on emotions or impulses. Using the 72-hour rule has worked wonders for me because it allows me to ‘sleep’ on the idea of making the purchase to determine whether I truly need it. Oftentimes, I don’t and end up saving the money instead.

Tip: Track your impulse spending (unplanned purchases) over the past few months by either reviewing your bank statements, finding a good budget tracking system or using a site like Mint.

Add up how much you spent over the past 3 months to see how much you could have saved by avoiding those unnecessary purchases altogether. Use that number to solidify your plan to invest $X moving forward.

Related: 50 Everyday Expenses You Need to Stop Spending Money On

Keep High-Interest Debt at Bay

One of the biggest financial moves I made in recent years was swapping out my debt payments for investment contributions. I’ve never liked how high-interest debt would eat up a ton of my disposable income. I remember putting hundreds of dollars on my credit cards each month, paying $250/month for my car note, and also covering other personal loan minimum payments.

I would often wonder how nice it would be to one day have this money added back to my budget once the debt was gone. I developed a debt repayment strategy that allowed me to chip away at my accounts one-by-one.

The fact that my husband and I both have paid off cars saved us $400+ per month easily. This is money that could be redirected toward saving.

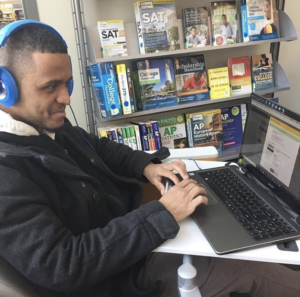

(My husband in the library making the final payment on one of our personal loans.)

Even if you’re not able to pay down all your debt balances, consider just picking one to chip away at for now. If you can free up $100+ per month to invest it’s worth it.

Related: Prioritizing Your Debt-Free Strategy

How to Pay Off High-Interest Debt

How to Start Investing (Without a Ton of Money)

Once you free up money to invest, you’ll have an array of options to consider. Diversification is everything to me. I like to invest in traditional tax-advantaged accounts, through an online broker and I’ve also been dabbling into real estate investing as well.

If you’re interested in real estate, one of the top options right now is DiversyFund. DiversyFund was founded on the belief that everyone deserves access to the same wealth-building tools that have long been used by the 1% to create and sustain generational wealth.

With DiversyFund, you’ll invest in REITs (Real Estate Investment Trust) with a pool of other investors to share the returns. Think of it this way. Maybe you’ve wanted to invest in real estate but don’t know where to start or don’t feel you can afford to buy a property outright.

Instead, you can make a smaller, $500 investment that will be added to other investors’ contributions so you can all share ownership of a residential or commercial property. You don’t have to worry about managing tenants and every dollar you put goes toward your investments due to DiversyFund‘s fee-free model.

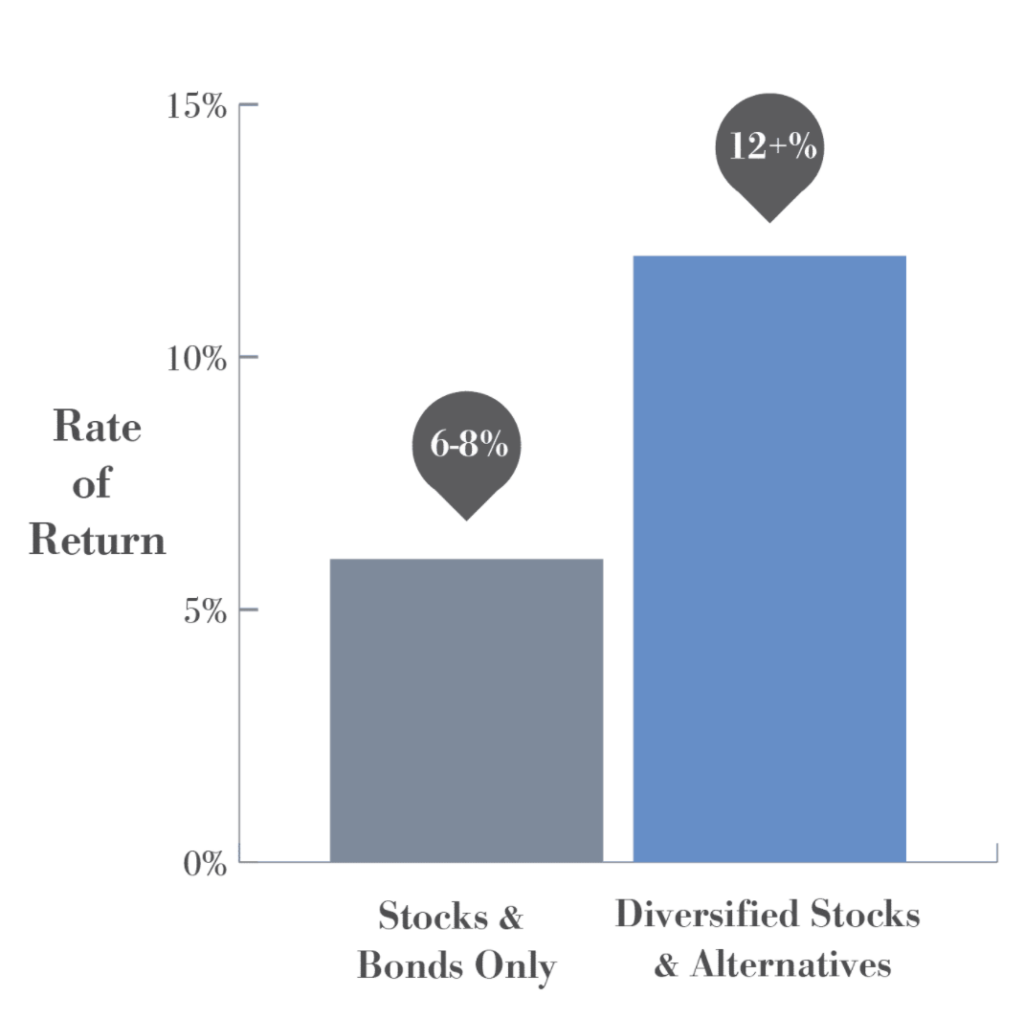

Like all investments, the rate of return can vary but so far, returns with DiversyFund‘s REITs have performed historically higher than portfolios with only stock and bond investments.

Invest For the Long Haul

I will say that investing in REITs with DiversyFund is a long-term strategy so you’re not going to see a ton of returns instantly. Building wealth, in general, is something that does not happen overnight. It requires making a consistent effort by freeing up money in your budget to invest, along with diversifying your income and assets.

I started investing about 3 years ago and honestly wish I would have started sooner. The sooner you make the decision to actively start building wealth for the future, the more time you’ll have for your investments to grow.

Good luck and be sure to let me know what your investing goals are for 2021 and beyond in the comments below!