How I’m Preparing For Holiday Expenses

The holiday season will be here before you know it. I like to use that time to slow down and enjoy my time with friends and family. I like to partake in my favorite traditions like drinking hot cocoa and watching a Christmas movie, decorating the tree as a family, and looking at lights around the neighborhood.

I tend to take a week or two off work to relax, get organized for the new year and really reflect on the past 12 months. I understand this time of year can also be stressful if you’re not financially prepared.

The holiday season can be expensive and can overwhelm you if you don’t have the money to pay for gifts, parties, traditions, trips, decorations, donations, or anything else you want to do during this time. That’s why it’s best to start preparing your finances as early as possible.

In terms of having enough money to cover the added expenses this year, here are ways I’m preparing for holiday expenses and things you can do as well.

Table of Contents

Create a Holiday Spending Plan

While your goal may be to save as much as you can for the holiday season, it’s better to actually plan out what you want to spend money on and why. This way, you’ll know if you’re going overboard or are right on target.

Make a list of all the expenses you anticipate and estimate the costs. Christmas gifts make up the bulk of my holiday budget so I like to organize my list of people and potential gift ideas as early as possible.

A few months back, I created a Debt-Free Christmas Challenge workbook to help you organize your holiday budget and carefully plan out these next few weeks carefully. Use this as your guide if you’re serious about not stressing over money and enjoying the holidays to the fullest instead.

Related: How to Prepare Your Finances for the Holidays

Preparing For Holiday Expenses With a Savings Ladder

I may have mentioned this before, but it’s my favorite thing to do. I’m really bad at saving for Christmas year-round. Come January, I don’t even want to think about Christmas and I’m more interested in saving for other things.

However, come June or July I like to start saving for Christmas and I use a savings ladder to do so. I start saving a small amount at first, then I gradually increase it month by month. During November and December, I set aside a larger amount of money, but it all adds up thanks to the smaller amounts I set aside in previous months.

If you’d prefer to break your holiday budget up into 12 equal parts and set the same amount of money aside each month for a year, you could definitely do that too.

For me, a savings ladder just helps motivate me because it’s kind of like a challenge where I have to come up with more and more money to save each month.

Related: How I’m Rebuilding ALL My Sinking Funds

Leveraging Cash Back Programs

I love cashback programs because they provide an easy way to earn extra money for basically doing nothing. We all regularly spend money on something every day. Why not earn cashback for that regular spending?

I have a cash back credit card that pays me when I spend on the card and again when I pay off my purchases. I like this method because having credit cards can tempt you to overspend if you don’t have control over your spending in the first place. It’s best to only spend on purchases you planned on making in the first place and not just to get the cash-back rewards.

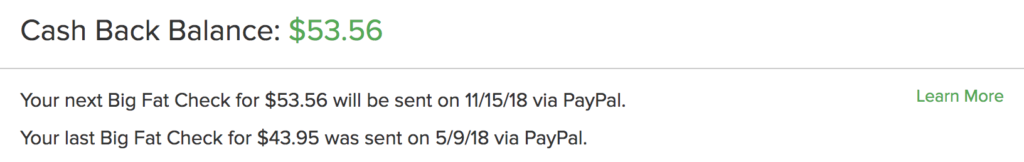

Another option if you don’t feel like using a credit card is Rakuten (formerly Ebates). Rakuten pays you cash back for regular online shopping whether you use a credit or debit card. It’s free to use and I’d recommend adding the Rakuten Google Chrome extension to your browser so you can be reminded of cash back offers whenever you visit a specific site.

Rakuten pays out quarterly and it’s one of my favorite ways to effortlessly make some extra cash for the holidays. My next payment is coming through in just a few days.

Related: Rakuten (Ebates) Review: Earn Cash Back For Everyday Shopping

Repurposing Any Gift Money

Another way you can boost your holiday savings is by repurposing any gift or unexpected cash. A few months back, I participated in a Twitter chat and won a $50 gift card.

We also received a $150 Amazon gift card as a gift at our housewarming party in the summer and still haven’t used it. We don’t really have anything to buy for the house from Amazon at this time. We mostly need to pay a few contractors for some small fixes, so we may just use the gift card for the holidays instead.

If we end up doing that, about $200 of unexpected gift money will help contribute to our holiday savings stash.

If you’ve receive any gift cards, unexpected cash, or tax refunds during the year, you can repurpose this month for holiday savings as well.

P.S., if you’re looking to sell your unused gift cards or buy discounted ones, you can check out sites like GiftCardGranny.com or CardPool.

Earn the Difference with a Side Hustle

Making extra money on the side is always an option if you need cash fast to pay as you’re preparing for holiday expenses. I’m not going to lie, I haven’t been doing a ton of side hustling lately. If you start saving for the holidays earlier in the year, you probably won’t have to side hustle as much.

Since I my income is flexible, I can work to make more money doing what I already do if I want to. Lately, I’ve been mainly focusing on growing my blog income and earning more with freelancing.

I realize that everyone doesn’t have those same circumstances, but there are still a ton of things you can do to make extra money. One thing I am doing right now is applying for focus groups through sites like FocusGroup.com or Respondent(my personal favorite). They’re easy and pay well.

You can also consider driving for Uber or DoorDash or delivering groceries with Instacart and get paid weekly. Jobs in customer service are always hiring around this time of year. You can also start doing virtual assistant work if you’d rather work remotely.

Related: 20 Ways to Make Money Today

What are some ways you’ve been preparing for holiday expenses? Are you looking to make extra money over the next few weeks? Is so, how?