Want to learn how to make a budget or get better at budgeting? You’re in the right place.

It’s no secret that you NEED a budget if you want to improve and effectively manage your finances. Despite what other people will tell you, there’s really no way to get around budgeting.

You may be budgeting even if you don’t realize it. The biggest misconception about budgets is that they don’t have to be painful and make you feel super deprived.

Most people think that having a budget must mean that you’re “broke” or “struggling”. When you start earning more money and improve your situation, you no longer need to budget right? Wrong!

In this guide, I’ll show you how to set yourself up for budgeting success so you can stop worrying about money once and for all.

What is a budget?

Before we get started, it’s important to have a clear understanding of what a budget actually is. Growing up, my mom would always tell my sister and I that we were on a budget when we went to the grocery store.

To us, that often meant that we couldn’t get the “good” food that we wanted because it was too expensive. Now, I realize that my mom was using the word ‘budget’ incorrectly.

A budget is just a spending plan that you create to determine how much money goes where. That’s it. A budget is a tool to help you control your spending and meet your financial goals. These goals can help enhance your lifestyle and lower your stress levels surrounding money.

I feel we all budget in some way (whether we know it or not), but some of us are more successful at it than others. Why is this?

Why It’s Hard to Stick To One:

I’m not going to lie, sometimes it’s hard to stick to a budget. One of the biggest reasons why people can’t stick to a budget is due to that fact that they don’t fully commit to the process. If you don’t commit to anything really, you’ll have a hard time being successful with it.

When you start budgeting, you should be very intentional and avoid the mistake of just setting it and forgetting it. It’s important to take the time to set your budget up the right way and commit to the process which includes maintaining it long-term.

It’s unfortunate that some people give up on budgeting too soon due to a lack of commitment.

Another reason why it may be hard to stick to is budget is because their budget isn’t realistic in the first place.

Secret: Your budget shouldn’t be painful to follow through with.

It’s important to be honest about what your true expenses are and the lifestyle preferences you have. If you try to be too strict or too lenient, you won’t get the results you want and therefore, won’t stick to your budget.

Related: 4 Common Budgeting Mistakes You Need to Stop Making

Myths You May Have Told Yourself About Budgeting

Has budgeting been difficult for you in the past or have you avoided it at all costs? Below are some myths you may have told yourself about budgeting.

MYTH #1: Budgeting is outdated.

Just know that the day budgeting becomes outdated, money will become outdated as well. While there’s nothing wrong with following the trends, budgeting is here to stay. That’s because it’s not a trend, is a money management method.

We all need to manage our money and for this sole reason, you will always need a budget of some sort.

MYTH #2: Budgeting is only for people who are bad with money.

Having a budget is not some protocol you need to take when you’re bad with money or have a spending problem. Regardless of what your financial situation looks like a budget, will help you gain a clear understanding of your finances.

Even if your situation isn’t dire and you’re not struggling financially, you can still benefit from sticking to a budget because it helps you know where your money is going.

MYTH #3: Budgeting takes too much time.

I’m not trying to call anyone out, but I’m sure there’s a handful of other tasks that eat up way more of your time then budgeting does. In fact, you likely waste more money and time when you don’t budget.

If I don’t budget for a month, it would take me hours to go through my spending and find out how much I have left to cover various different expenses.

MYTH #4: Having a budget means I can’t spend money on anything fun.

This couldn’t be further from the truth. A good budget is a realistic spending plan that you create based on your needs and preferences. There’s nothing wrong with budgeting for fun and entertainment and I actually recommend doing so if you want to stick with your long-term spending plan.

MYTH #5: I don’t need a budget. I just need to make more money.

I think Biggie got it right when he said more money, more problems. If money solved everything, rich celebrities wouldn’t be filing for bankruptcy is they can just ‘buy whatever they want’ and not create a budget.

How to Make a Budget: Step-By-Step Guide

Now that I’ve debunked some common myths surrounding budgeting, let’s go over a basic step-by-step process on how to create a budget.

Before you start budgeting, download my monthly budget worksheet template for Google Drive and join my email list to gain access to more budgeting resources.

Step 1: Set a Clear Goal

Before you create a budget, you need to narrow down why you want to have one in the first place. What purpose will it serve for you? How will it help improve your finances and your life?

A common reason to budget is to maintain control over your finances and your spending. This is a great long-term lifestyle goal/benefit that can come as a result of a solid budget. You can also use your budget as a tool to meet other financial goals like paying off debt and saving more money.

One of my main goals for having a budget has been to use it to help me pay off my debt faster and remain debt-free. I’m low-key obsessed with living a debt-free lifestyle.

In the past, I hated being broke and never having any money. I realized that my lifestyle and debt payments made it very hard for me to get ahead.

I’m choosing debt freedom for myself and my family. I want to leave a legacy for him and possibly even help him avoid some of the financial hardships I had to endure as a young adult. Having a realistic budget is helping me meet that goal.

Related: 3 Life-Changing Benefits of Making Money Goals Visual

Step 2: Calculate Your Income

After you’re clear on your goals, you’ll want to calculate your income for the month and/or year so you know how much you’re bringing in. So many people miss this step so this is important!

You can’t have a successful budgeting experience if you don’t know how much you have to work with in the first place. Add up your take-home pay for the past 30 days including what you make at your current employer along with any additional income streams.

For example, if you rent out a room on Airbnb or drive for Uber, you’ll want to factor that income in as well. If some of your income sources are fluctuating or not really reliable, you can keep them separate from your main take-home pay but still account for them in the budget you’ll create.

For example, if you bring home $3,500 per month but make an average of $500 in side hustle income, you can budget for your regular living expenses with your guaranteed income and add in whatever side hustle money you make once it hits your account.

That way, you’re still giving all your income a purpose.

Step 3: Calculate Your Expenses

Next, you need to calculate all your expenses. Start with your fixed necessity expenses like your rent or mortgage, utility bills, , insurance etc. If the expense is the same every month and never changes, add it to your list first.

Don’t forget about minimum debt payments either.

Then, you can add up your variable expenses and discretionary spending categories for things like groceries, fuel, dining out, subscriptions, etc.

Doing this will help you create spending categories for your budget. Be sure to spend enough time on this step so you don’t miss an expense. You should also track your spending over the last 30-60 days to make sure you have a clear understanding of which expenses you have and how much they cost.

I can’t tell you how many times I’ve worked with coaching students who thought they spent a certain amount on an expense only to find out that wasn’t the case. If you believe you spent $350 on groceries per month when you actually spend $500, that can really mess up your spending plan and you could even wind up short on money by the end of the month.

This is why it’s crucial that you track your expenses and be honest about how much you spend in particular areas when developing your budget.

Related: 50 Everyday Expenses You Need to Stop Spending Money On

Step 4: Subtract Your Expenses From Your Income

Now it’s time for the moment of truth. You need to subtract your expenses from your income to make sure your budget works. If you do this and you have extra money left over, that’s great! That means you’re likely to spend less than you earn which can ensure you have enough to cover all your expenses and then some.

If you have nothing left when you subtract expenses from income, that means you’re breaking even and don’t have any margin should you ever have to overspend. This isn’t necessarily a bad thing and some people actually prefer to budget this way. It’s called zero-sum budgeting and it allows you to give every dollar a purpose. Sure, there’s nothing left over but you’re optimizing your income which is important if you have specific goals to reach.

You can turn a surplus into a zero-sum budget by taking any extra income you have after subtracting expenses and putting it toward extra debt payments or savings.

If you have a negative number when you subtract expenses from your income, that means you’re likely to spend more than you have. This could put you in a tight financial situation and lead to debt.

You want to avoid being negative at all costs so you should work on recalculating some of your expenses and decreasing the numbers where you see. Your goal is to either break even or come out positive.

Step 5: Make Tweaks and Maintain

This next step is crucial because it will help determine your success rate with budgeting. Your budget will probably never be set in stone and it’s more than okay to make tweaks and changes when they come up.

If you’re trying to work toward a comfortable monthly spending amount, you may need to focus on lowering your expenses an/or increasing your income.

Related: 15 Side Income Ideas You Can Start (With No Special Skills)

Finding the Right Side Hustle For You

5 Ways to Save Money When You’re Broke

Emergency Fund Tips: How to Grow Your Account Fast and Where to Start

Realize that your household budget will change as your lifestyle changes so it’s best to be flexible. Once you finally lock in your ideal numbers, you can start to do some pretty amazing things.

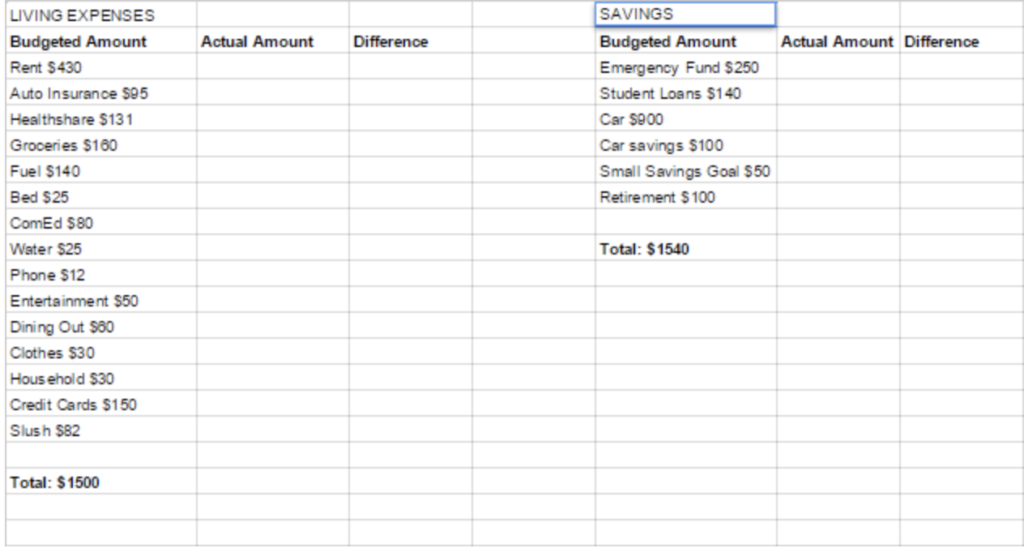

Below is a screenshot of my budget a few years back when I finally got serious about managing my spending. As you can see, I was able to decrease my spending categories quite a bit but still kept it at a reasonable amount and included categories for fun, dining out, and entertainment so I didn’t feel deprived.

Related: My New Save Half Budget

By doing this, I was actually able to live on only 50% of my income and use the other 50% to make extra debt payments and reach savings goals. This strategy is exactly how I was able to pay off $11,000 of debt during my first year of getting serious with budgeting.

To maintain your budget, you want to make sure it’s realistic and an honest reflection of your spending. Then, schedule a few minutes a day to check in on your spending to hold yourself accountable.

If you have a partner, you may want to host a weekly budget meeting so you can both stay on the same page and succeed.

Related: How To Get Your Spouse On Board With Budgeting

Budget Resources

Budgeting may seem like a challenge at first, but by following these steps you can simplify and streamline the process. That said, this guide is definitely a basic summary of the budgeting process. If you find you need more help or advanced instruction, I’d recommend checking out my Love Your Budget course.

Love Your Budget is a course that I designed to not only show you how to create a willing budget but to actually enjoy the process and all its benefits.

There are very few people I know (if any) who openly admit that they enjoy budgeting. My hope is that this course will change that. This course teaches you how to lay a solid foundation and improve your mindset surrounding money.

Like money itself, your budget is just a tool to help you. In the video course, students learn:

- How to change your mindset to embrace budgeting and abundance

- How to set financial goals

- 6 different types of budgeting methods you can try

- Secrets to creating a successful budget (through a bonus interview series with real people)

- Tips for managing periodic and unexpected expenses

- Step-by-step tutorial/guide showing you how to make a budget that best suits your needs

- How to spend less and earn more to even out the numbers

- Options for budgeting for fun while still meeting your goals

- Ways to stick to your budget and cut out impulse spending without feeling deprived

- How to maintain your budget over time – the key to long-term success!

- My proven strategies for paying off debt aggressively and increasing your savings rate with a budget

- And more!

Students get lifetime access to all this material including any updates or additional bonuses I add over time. If this sounds like something you’d be interested in, click here to learn more.

*P.S. – Don’t forget to download my free budget spreadsheet (by filling out the form below) and gain access to other freebies that will help you along your financial journey.