How To Negotiate Your Bills To Save Money

Expenses and bills are a normal part of life but they can certainly surprise us each month when they are higher than normal or just constantly on the rise. Most people think that the only thing they can do is pay and hope for the best the following month or they try to negotiate but it eats up all their time and is a terrible process.

It doesn’t have to be a hopeless situation.

If you want to see just how much you can save on your bill without the hassle of negotiating yourself then you’ll want to learn more about Billshark.

In this article, you’ll learn all about what Billshark can do to help you keep more money in your pocket when bill time comes each month.

Table of Contents

What is Billshark?

Billshark is a bill negotiation service that works on your behalf to lower your monthly bills.

CEO of Billshark Steve McKean helped to found the company in 2016 with the vision of helping people live out “Smart Money” values by helping them lower their monthly bills.

The company is one of the leading options in the bill reduction services sector and for good reason.

Since the company started, they have saved their customers millions of dollars. It also has a strong A+ rating with the Better Business Bureau and an average 4.5 star rating on the BBB and 4.9 on Google Reviews. Plus Billshark garnered the attention and acclaim of Shark Tank’s Mark Cuban who now backs and advises the company.

How Does Billshark Work?

The company currently works by helping you lower your internet, cellphone, landline, home security, cable and streaming options, as well as satellite radio bills.

If you’re already in good standing with your service providers, Billshark negotiates with them in order to figure out a way to provide you with a deal that results in saving you as much money as possible.

Once you become a Billshark customer, their team of experts (referred to by the company as Sharks) utilizes proven methods to successfully negotiate your bills. They have worked on thousands of bill negotiation deals and have a 90% success rate for lowering bills.

Also, these Sharks average between $300-$500 of savings per bill negotiated for you, and the savings are automatically applied to your bill in your next billing cycle.

Billshark also offers a great customer service experience that easily notifies you of updates regarding your bill negotiation via a concierge service and SMS updates within a few days.

In addition, the company keeps track of when your savings expire and will automatically restart negotiations for you to help you keep the best rate possible.

Is Billshark Free?

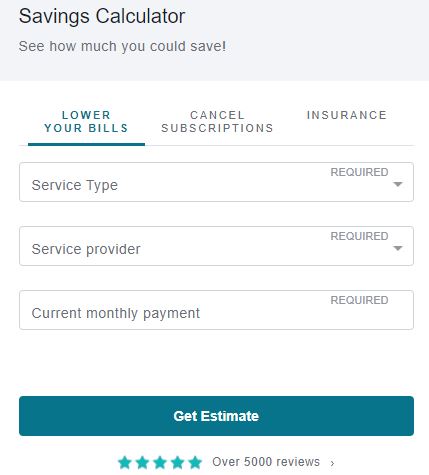

Yes and no. Billshark’s savings calculators are free to use to provide you with an estimate on what you could save.

Once you decide to work with Billshark directly, you will be charged a one-time fee of 40% of savings however if they can’t find a way to save you money then you aren’t charged anything at all.

Is It Safe to Use?

The company prides itself on using the best security measures. Billshark uses 256-bit encryption which is bank-level security, and they never store your credit card or share your information without your permission.

How Can I Get Started With Billshark?

The first step is to get started by taking advantage of their estimate savings calculator on their website to get an idea of what you could possibly save.

If you feel the estimates show potential for savings for you then you will create your account and upload a copy or photo of your internet, cellphone, landline, home security, pay-TV, and satellite radio bills.

It’s very easy to become a Billshark customer. You can go to their website and sign up or download the app and sign up.

Both methods allow you to create an account using your Facebook or Google profile or you can enter your first and last name, phone number, email address and create a password.

Does Billshark Offer Other Services?

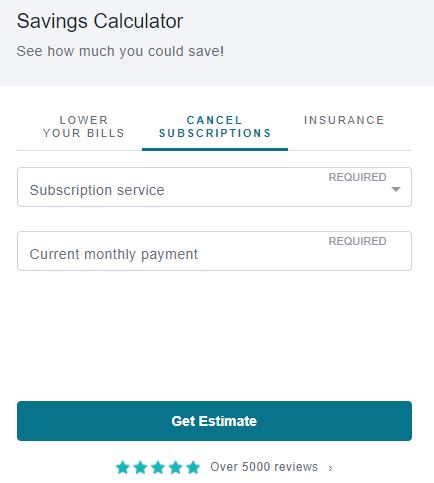

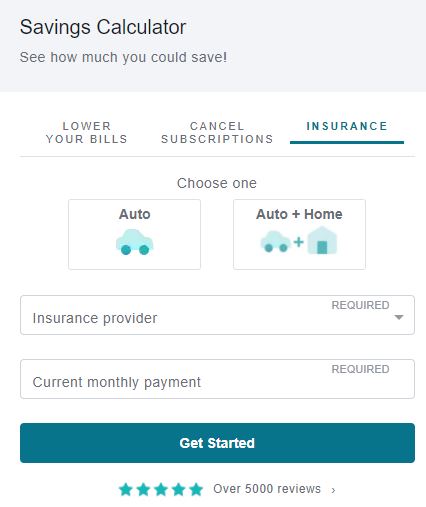

Yes, they offer other ways to help you save money such as the opportunity to cancel subscriptions and compare your car and home insurance.

The Billshark website offers a savings calculator to help you see how much you could save by canceling the subscriptions you no longer use but are still paying for.

Plus you can use a savings calculator to see how much you could save by finding a lower-cost car and home insurance quote.

For each subscription you decide to cancel with Billshark there is a $9 charge but there is no cost to use their insurance comparison savings calculator.

Are There Pros and Cons?

Like anything, there are always good and not-so-good points. For Billshark consider:

Pros

- You can get an idea of what you’ll save before committing to the process by using the savings calculator for an estimate

- It takes only a few minutes to sign up and get the process started

- They allow you to speak to a person over the phone as well as email —1-800-957-1710 Monday – Friday, 9 am – 5 pm ET or help@billshark.com

- You can save money on your current monthly service bills, cancel subscriptions as well as find lower insurance options all in one spot

- They have a reward program and a referral program

- They offer a payment plan if you can’t pay their 40% one-time fee all at once

Cons

- Estimates given from the savings calculators are not guaranteed

- 40% fee could be high depending on your particular savings situation

- Subscription cancellation costs $9 per subscription

Billshark Summary

Essentially, you could also call your bill companies to negotiate your bills on your own but negotiating on your own can be time-consuming, stressful, and a negative experience. Billshark makes it fast and easy for you by providing a service where bill negotiation experts do this for you.

With a 90% success rate and lots of positive customer reviews, Billshark is really a great risk-free option for saving money on your monthly internet, cellphone, landline, home security, cable TV, and satellite radio bills.

Ultimately, Billshark saves you time and money and is definitely worth looking into!