How to Start Investing in Stocks With No Regrets

Now, more than ever, increasing your financial awareness and multiplying your sources of income is important for your financial health.

One way to do this is through investing in the stock market. However, many people feel overwhelmed and confused just by the thought of investing. It’s different, I know. I grew up not learning much about how to manage money, let alone how to invest and save for the future.

Once I learned how the stock market worked, it blew my mind. I realized that instead of working hard my whole life and having little to show for it, I could actually put my money to work for me and grow it over time. Another thing that hit home for me was learning the fact that if you start early and invest consistently, you can reach a $1 million net worth (or higher) by the time you retire.

The great news is investing doesn’t have to be complicated or daunting. If you’re interested in learning how to start investing in stocks, you’ll want to keep reading this. No matter your budget or level of investing know-how, investing in stocks is definitely within your reach.

Table of Contents

How To Start Investing In Stocks

Investing is not something that’s only reserved for rich or well-off people. Anyone can do it but you need to understand how it works. Let’s start with the basics by defining a stock.

At its core, a stock represents a piece of a company’s value that can be traded among other stockholders. If you’ve ever heard of the term ‘shareholders’, it refers to people who own a share of a company’s stock. For example, if you buy a share of Amazon, you’ll become a shareholder, or in other words, you own a piece of that company. Right now, a single share of Amazon is just under $140.

If you don’t have that amount on hand, you can still buy a piece of the company by investing in what’s called fractional shares. A fractional share is a piece or fraction of that share. It allows you to start buying stocks without a ton of money. While you may not own a full single share of higher-value stocks just yet, you’ll own a fraction of a share which is a good starting point.

Keep in mind that buying stocks doesn’t mean that you have to invest in big-name companies only. Many other lesser-known companies are also great choices. And when you own various stocks with quality companies, as a shareholder, you have a share in those companies’ profits.

The Benefits of Investing

During your journey to start investing in the stock market, you’ll encounter several myths that deserve to be busted because they prevent too many people from starting their investing journey.

It can’t be said enough – investing in stocks is one of the best ways to expand your financial wealth so don’t let these wrong ideas get in the way.

The beauty of investing in the stock market is the financial benefits.

- One in particular, the power of compounding, creates the opportunity to make more than other investments and really grow your money beyond what you thought possible. Again, you want your money to work for you.

- With debt, your money works against you by causing you to pay interest and extra money to someone else. When you invest in the stock market, it flips things around so you are earning interest on your money instead.

- Plus, investing provides many different tax advantages to help you save money now and in the future. Yes, there is some risk involved, but we take dozens of risks each day, and investing is definitely well worth it.

What About Index Funds, Mutual Funds and Bonds?

Have you heard of any of these terms before? They sound fancy but aren’t intimidating at all.

At its core, investing in the market means buying stocks, but handpicking stocks one-by-one can be time-consuming, especially if you’d rather be more of a passive investor and save on autopilot.

Mutual Funds

Luckily, there are mutual funds that allow you to pool your money with other investors and invest in groups so you can invest in stocks, bonds, and other securities. Mutual funds are operated by professional money managers who allocate your funds to invest in certain assets depending on your goals and desired risk level.

In other words, investing in mutual funds can be seen as a quicker way to invest in more than one thing at a time and have your portfolio professionally managed.

Index Funds

Now, index funds are my personal favorite, and they are a type of mutual funds that are designed to follow certain preset rules so that the fund can track a specific group of investments.

I like investing in index funds because it’s easy, and there’s not much to think about on my end. The most popular index fund is the S&P 500 which includes stocks from the top 500 companies in the U.S. market.

If I choose to invest in an index fund that is tracking the S&P 500, I’m diversifying my portfolio pretty extensively and also getting to share a piece of each of those companies I invested in.

Spreading my investment across an index fund like this is less risky than choosing just one company to invest in. If the market dips and that one company loses money, you could lose a ton having all your eggs in one basket.

Other index funds are designed to track popular indexes like the Dow Jones Industrial Average and Nasdaq. You’ll need to open a brokerage account to start investing in index funds. I use Vanguard, but there are many others to choose from.

Bonds

Finally, there are bonds which are pretty much the opposite of a stock but still a notable investment. Bonds are basically money that is loaned out to other companies and they pay it over time with interest (Whereas stocks represent a company’s value and growth). Bonds are less risky than stocks but tend to have a lower rate of return.

Experts recommend investors choose a healthy mix of stocks and bonds to balance their portfolios. If you are willing to take more risk, your portfolio should include more stocks and vice versa if you are wanting to keep risks low.

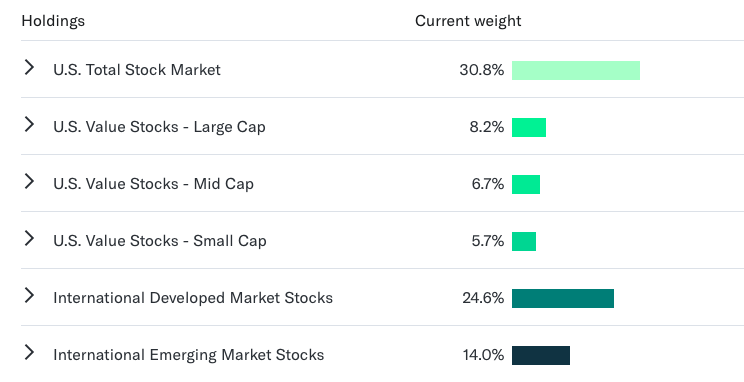

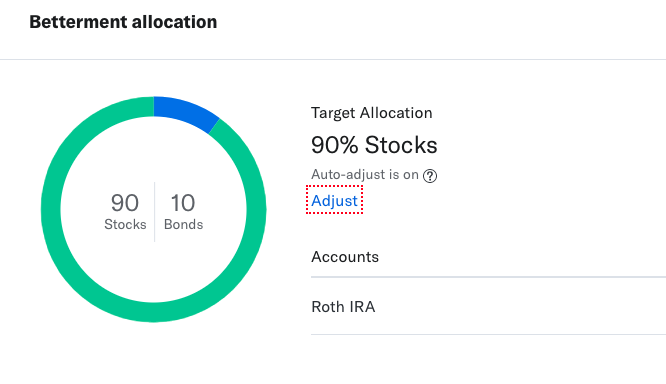

I also invest with a robo-advisor called Betterment which is where I keep my IRA (Individual Retirement Account). Since I’m young, willing to take on more risk, and really want my money to grow in the market over time, my portfolio is 90% stocks and 10% bonds right now.

Betterment asks you a few questions about your savings goals, investment preferences, and timeline to reach those goals in order to customize a plan for you.

Betterment asks you a few questions about your savings goals, investment preferences, and timeline to reach those goals in order to customize a plan for you.

Then, all you have to do is set up monthly automatic transfers and watch your portfolio grow. Betterment does charge a small management fee, but it’s worth it because you don’t have to do anything other than deposit money each month.

The system invests it on your behalf and shows you growth and exactly what you own.

Just this past year alone, I’ve seen so much growth with my investment account through Betterment, even after the market dropped during the onset of the pandemic.

How Can Investing Help You Build Wealth and Retire?

The stock market’s returns have grown steadily for the past 100 years. Even through dips and economic recessions, the market always bounces back sooner or later.

This is why it’s important to invest for the long term if you want to build wealth and retire. When the market dips, I stay calm and don’t touch my retirement savings. I know it will be several years before I consider retiring, so I want to let that money sit and grow with compound interest.

What’s ‘compound interest’, you might add? I touched on this briefly earlier, but it’s when your money earns interest and grows over time. It’s the opposite of what happens when you have debt.

Picture this:

- You have a $5,000 credit card bill and a 17% interest rate.

- Each month that you don’t pay this debt down, your balance will increase due to interest. Soon, the interest will ‘compound’ and become part of the total debt.

- Then, you’ll be paying interest on your interest.

Well, with investing, the opposite happens, and the money you save grows as the market improves.

- Say you invest $10,000 and don’t touch the money for 25 years.

- On average, your investment earns a 7% return.

- In 25 years, you’ll have over $54,000!

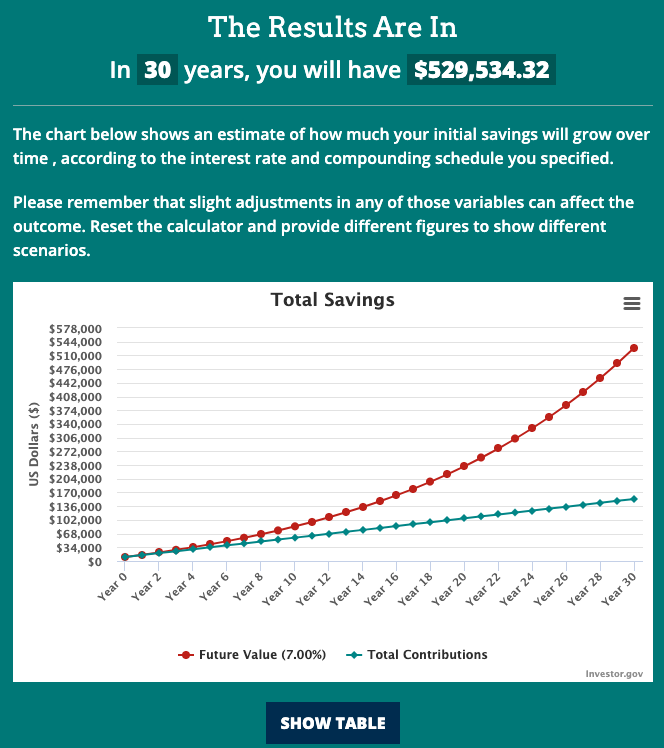

Let’s say you take that same initial $10,000 investment and continue to invest $400 per month over the next 30 years with a 7% average annual return. In 30 years, you’d have over half a million dollars thanks to compound interest!!

This should be enough motivation to invest a few extra hundred dollars each month consistently.

I encourage you to play around with the free compound interest calculator I found on Investor.gov.

How to Start Investing With 3 Programs

Since this awesome financial wealth information was unfortunately not taught to many of us in schools, it’s up to us to learn the ins and outs of how to invest in stocks.

While hiring a financial advisor can be very helpful, it may be out of your budget.

However, amazing digital courses are the next best thing and quite affordable, considering the incredible value you receive.

You can certainly learn how to invest in stocks on your own, but having expert guidance and direction through a digital program is a great way to avoid beginner mistakes.

The three courses below are fantastic for whatever stage you’re in on your stock investing journey: beginner, intermediate, advanced/fully committed. If you want to learn more about investing, I included summaries of each of my favorite online classes below.

1. The Investing for Beginners Master Class

If you feel that you’re an absolute beginner or moving towards the intermediate level, then this course is designed to help you build the foundation you need for the next level.

Noted as “the course about finance and investing that should’ve been taught in school”, The Investing for Beginners Master Class does a great job of starting with basic, foundational financial information to help raise your financial confidence.

The course creators, Andrew Sather and Dave Ahern, focus on equipping you with responsibility and the key skills to grow your wealth and financial wellness.

The Investing for Beginners Masterclass has 23 modules divided into 4 categories. You’ll learn about:

Personal Finance Basics

Over 2 modules, this section highlights the financial points that will help you better understand investing. It also details IRA accounts so you will know which is best for you and why.

Stock Market Basics

From a detailed breakdown of what stock actually is to how to diversify and much more, this section ensures you come away with very extensive knowledge on how the stock market actually works and the key terms that go along with stock market investing.

Stock Market Strategies

This unit is where you’ll dive into details on how to utilize the stock market for your benefit by learning the most commonly used strategies to get the most from the stock market.

Analyzing Stocks with Value Investing

Value investing is a strategy that deserves its own category. You’ll learn ways to examine stocks that can grow your portfolio without breaking the bank.

Additional bonuses are that this program comes in video format, is self-paced, gives you lifetime access, and comes with a 30-day full refund guarantee. At $97 it is a great resource to help you learn how to start investing and confidently start your stock investing journey.

Learn more about the Investing For Beginner’s Masterclass

2. Perfect Portfolio Course

This is a great mid-level investor’s course, and it’s great for those who want a refresher on the basics but are ready to shift into higher-level investing content.

With easy-to-digest information, the Perfect Portfolio Course, by Kevin Matthews (a number one best selling author and former financial advisor), teaches you how to create an investing for success roadmap that is designed to take your investing confidence to a whole new level.

The course curriculum is divided into 7 sections that focus on everything portfolio related from top to bottom.

While it highlights the stock market fundamentals and different types of investments, a central theme of this course is learning how to avoid major stock investing losses. Kevin shares amazing techniques on how to test your investment ideas before you spend your own money.

You also receive tools such as the Investment Workbook, links to testing sites, and an all-important statement walkthrough so you understand the key information in your investment statements.

Other tools you’ll receive with this course include:

- Investing Test Toolkit – Gives you tutorials on two investing tools to test out your investment ideas

- Portfolio Cheat Sheet – If you’re looking to invest ASAP, the Portfolio Cheat Sheet can help you to invest in less than 10 minutes

- Fee Analyzer Tool – This tool will help you save money with your investment choices and improve your overall performance

- Investment Savings Guide – The ISG is designed to help you save your first $1,000 to start investing

Hearing what former students have said shows why this course is a great option to help you learn how to start investing confidently in the stock market:

“I benefited from this course and the info provided. Now I can determine how much is needed for retirement and balancing paying off student loans back. This session is leading myself (and others) in the right direction” – B. Johnson, Rochester, NY

“Oh. My. Gosh…That class was amazing and the information was easy to digest! I’ve been so afraid of diving into investing because it seems so convoluted…Now I feel pumped and ready to go! Thank you Kevin!” – A. Harrison, Charleston, SC

Learn more about the Perfect Portfolio Course

3. Trade and Travel

Raise your hand if you like to travel! If you’re ready to actively trade stocks or potentially replace your income with investment returns, this course is designed for you. Created by Teri Ijeoma, Trade and Travel gives you the full range of knowledge and will help you become an advanced/fully committed stock investor.

Trade and Travel teaches you how to start investing and supplement your income by becoming a day trader. Yes, it’s all legit, and I know people who are excellent stock traders and earn good money doing it, but it’s NOT a get-rich-quick scheme. You’ll need to take the time to learn how to invest the right way.

I personally love Teri’s story because, like most of us, she working at a job where she was overworked and underpaid. After a friend passed away, she realized life was too short not to be able to enjoy it.

This epiphany led her to enroll in an investing class to earn extra money through the stock market so she could retire early and travel.

Trade and Travel will teach you how to:

- Pick good companies to invest in and make your first trade

- Protect your portfolio from losses

- Price your trades correctly and read stock charts

- Regulate your stock trading efforts so you’re not just having one-time surprises but frequent regular income through stock trading

Trade and Travel includes online classes, coaching calls, and more support to help you learn exactly what you’re doing as an investor.

With all the information and ongoing support you’ll receive, this course will help you to finally learn master concepts that will help you make your trading income regular.

Time To Invest!

These courses all have something in common: they teach you that investing doesn’t have to be complicated. You can learn how to start investing and build up with your level of risk tolerance and desire to learn more.

Starting your investing journey is within your reach, and these courses will help you gain the knowledge and experience you need to invest with confidence.

You’ve worked hard all these years, but your paychecks won’t last forever. You owe it to yourself to get your money to work for you.

Have you started investing yet? Why or why not?