How Your Bank Can Help Improve Your Finances

This post is sponsored by The Huntington National Bank. All thoughts and opinions are my own.

In the past, I never viewed my bank as a crucial resource to help me manage money. I always just thought a bank was a place that would keep your money safe, offer loans, and charge fees whenever you didn’t comply with the terms.

If you didn’t have a ton of money in your account, you were basically treated as just another number. That said, I knew I wanted to change my local bank for the past few years now, but I guess I was just in procrastination mode and kept telling myself that someday I would do it.

Someday finally came and I was actually able to visit the Huntington Bank headquarters in Columbus, Ohio a few weeks ago. My visit definitely changed my perspective on certain players in the banking industry.

I decided to open up a new account with Huntington Bank a few weeks ago and couldn’t be more excited about this. In this Huntington Bank account review post, I wanted to provide an honest review of my experience at Huntington so far and what the initial account opening process was like. Plus, I want to share why choosing the right bank will help you improve your finances along with how I’m making the switch easy and painless.

Table of Contents

Why Huntington Bank?

Huntington Bank is a full-service bank that’s been around since 1866. They have branches and offices in 7 states across the Midwest region and pride themselves on their slogan, ‘Welcome’. The ‘Welcome’ philosophy speaks to the fact that any and everyone is welcome regardless of where you work, and how large or small your money goals are.

Huntington wants to focus on deep relationship building in order to meet each person’s specific needs. Huntington prides itself on 3 core values:

- Can-Do Attitude

- Service Heart

- Forward Thinking

All of which, I can wholeheartedly agree with. Seeing that Huntington provides quality banking products, is motivated to help customers win financially, and prioritizes serving in the community and giving back are all reasons that motivated me to join the family.

Opening an Account

Huntington Bank offers checking, savings, and CD accounts along with credit cards on the personal side. You can open an account online but I decided to visit a branch and open an account in person since it was pretty close.

When my husband and I sat down with a banker, she initially asked us what our goals were. This was pretty refreshing because I could see that she cared about matching us with the right products to fit our needs.

We really didn’t know about all their account offerings so it wouldn’t have been the best idea for us to just pick an account without any research or background info.

We told the banker how we’d purchased our first home last year and already had some savings but wanted to really focus on managing our cash flow day-to-day.

We decided that the Asterisk-Free® joint checking account was the best option for us right now and we may consider upgrading to the Huntington 5 Checking® account in the future.

Going through paperwork, selecting our debit cards, and setting up online banking only took about 45 minutes. We were glad to handle everything right then and there without having to follow up or submit additional info.

With Asterisk-Free Checking, There are:

- No monthly maintenance fees

- No minimum balance requirements

- 24-Hour Grace® (to avoid overdraft fees – find out at more huntington.com/grace)

- Mobile banking and deposits

- Email and text alerts (as always, message and data rates apply)

- Online bill pay

One feature I’m super excited to start using is The Hub. It comes with savings and MMA accounts and can be accessed via mobile banking.

A New Digital Banking Experience

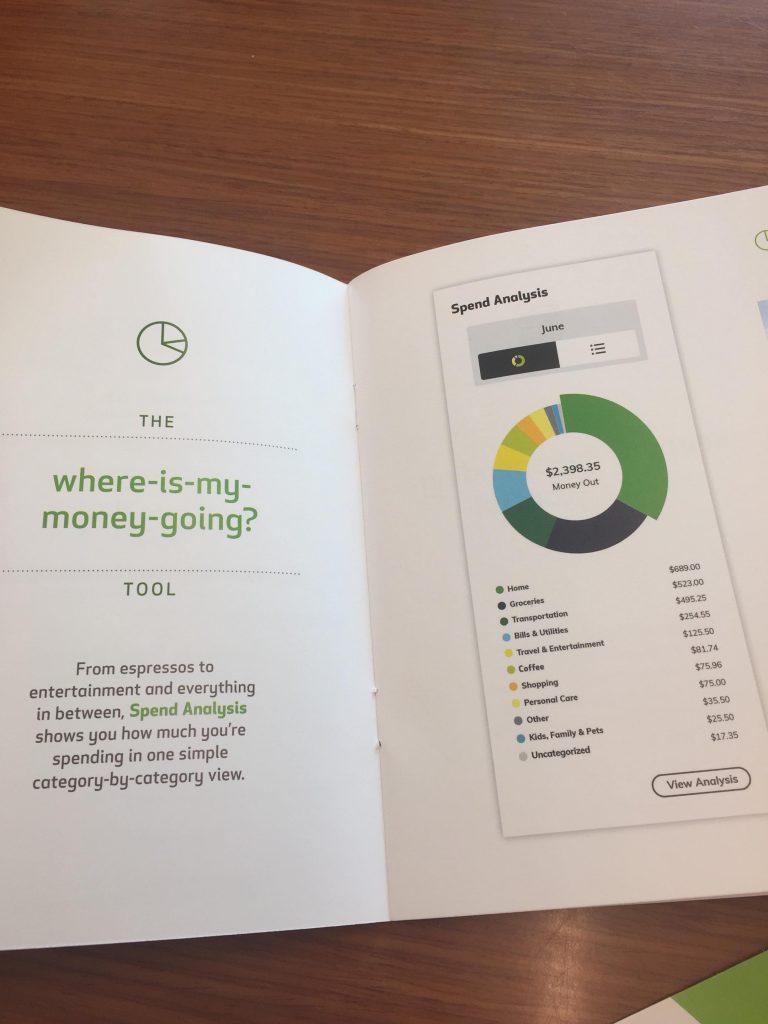

The Hub is Huntington’s digital banking tool that helps look out for your financial future. The Hub tracks your spending and organizes it by category so you know exactly where your money is going.

You can then use the Spend Setter option to set budget categories and set monthly limits to avoid overspending. I love to base my budget on real numbers and not assumptions, so I like that this feature takes your actual transaction history into account.

- Set notifications for transactions and budget updates

- Plan and track your savings over time

- Avoid surprise expenses by adding future bill payments, transfers, and direct deposits to your calendar

How Your Bank Can Help Improve Your Financial Life

Managing my money well is a huge value of mine. If you’re reading this blog, I’m sure it’s high on your priority list too. I’m a firm believer that your bank should support your financial goals and needs whether you want to pay off debt, save for a big purchase, or stop living paycheck to paycheck.

I’m sure it comes as no surprise that my husband and I are going to be using all the insights we get from The Hub to improve our finances and hit our savings and debt payoff goals this year.

Sometimes it’s easy to use your debit or credit card to spend mindlessly. Then when you go overboard or make a mistake, you end up paying for it in banking fees along with credit card bills.

I like how Huntington Bank goes out of their way to help match you with the right banking product, track your spending automatically, and help you stick to your budget and avoid overspending with their mobile banking tools.

In my opinion, everyone should bank with an institution that provides:

- Quality products that meet a variety of financial needs and goals

- Interest-bearing account options

- No or low fees

- Open communication and transparency in regards to overcoming obstacles and providing financial solutions

- Flexible deposit and withdrawal options

- Email and text alerts (great for fraud protection)

- Easy access to your account via mobile banking

- Excellent customer service

All these things are key in being able to manage your money with confidence and use it to do more of what you love in life.

Making the Transition Smooth

So far, switching over was so worth it, but we do have a few crucial moves to make the transition smooth. If you’re planning on switching banks, here are some important areas to focus on.

Redirect Auto-Drafts

My husband and I made a list of all of our auto-draft payments for bills, his student loans, and any other expenses. This wasn’t too hard to do because I already have a written budget system where I write track payments for bills and record their due date.

Ideally, you can choose to switch banks during a week that is slow for auto-payments. Let some companies know that you’re planning to switch and see if you can temporarily move the payment date or update your info online.

Set Up Direct Deposit

Once you open your account at the new bank, request a direct deposit form with your account and routing number on it. Update your banking info with your employer ASAP so the switch doesn’t affect your payment.

My husband started a summer job to help maintain a license he has so he was able to turn in a new direct deposit form the same day we changed banks. I have a few freelance clients who pay me via direct so I will need to change this as well.

Remove Your Old Card Number From All Retail Accounts

Be sure to switch your card number from your accounts with Amazon, eBay, Walmart, and other sites. We have an auto shipment set up for Amazon Subscribe and Save and we don’t want the order to get delayed since it’s for household items and toiletries.

Reconnect External Accounts and Payment Systems

If you have any external checking or savings accounts, be sure to connect them to your new bank account so you can make easy transfers. This is also important to do if you accept and send payments online via sites like PayPal, Stripe, and Venmo.

I receive some client payments via Stripe and PayPal each month so I will be connecting my new account at Huntington very soon. It’s best to do this sooner rather than later because it can take a few business days to verify the account.

Final Thoughts

Switching banks may sound like a lot of work but it’s really not. This is especially true if you’re going to be receiving more benefits that will help you take your finances to the next level.

Transitioning overall comes down to organization and planning. Make a list of what needs to be changed, then choose one afternoon or evening to knock everything out.

What do you look for when it comes to choosing the best bank for your needs? What’s needed to have a pleasant long-term relationship with your bank? Name your must-haves and deal breakers in the comments below!