January Budget Review

Time for my first budget review of the year. I hope everyone who lives on the east coast is recovering from that harsh snow last month! Remarkably, I can count on one hand how often it’s noticeably snowed this winter in Chicago and we even had two 50-degree days yesterday and Sunday but it’s supposed to snow later today I guess 🙁

Some people are ‘iffy’ about creating and implementing a budget. I’m all for it seeing as how budgeting has changed my life and allowed me to afford more and meet my financial goals quicker. I like to start the review off by listing out my high and lows to acknowledge what went well, and confront what didn’t go so well and what I might like to change for the future.

My Highs

- I was able to put an extra $600 toward my loans in January. Seeing the balance get under $19k is very motivating. You can check out my debt updates here. The sad part, is that my debt number will actually increase in the spring when I get married since we will be combining everything, but at least I will have less student loans. I’m not sure what I’ll do with my budget reports after May since I may need to get used to having a combined budget, but I’ll still post updates on my debt. If my new hubby is okay with it, I’ll post our total debt number for clarification and accountability purposes. If not, I’ll still share how I’m kicking butt with my student loans.

- I’m happy to be contributing more to my emergency fund this year. It was looking pretty weak toward the end of the year when I started putting more toward my debt. This year, I want to set aside at least 2-3 months’ worth of expenses and separate savings for car repairs, then I’ll feel more comfortable putting more toward my debt. With an emergency fund, I’d take what the experts say to do with a grain of salt. It’s all about what amount feels best for you and your family because there’s no one size fits all solution.

- Celebrating by birthday and my son’s birthday last month was super cheap. I organized a party for him or some type of outing ever since he’s been born so I’ve been running out of ideas. We decided to do something small at the house with just family and it was super fun. We also went to see Disney on Ice but I paid for tickets in December with holiday gift money so that spending isn’t reflected below. For gifts, I purchased this huge ninja turtle play set for him with leftover money saved up from Christmas (since it was supposed to be a Christmas gift but it sold out of stores quickly) and a generous Amazon gift card my boss gave me at our annual holiday party at work. What’s awesome about having a child with a January birthday is that all the leftover holiday toys go on clearance so I was able to scoop him up a nice extra gift for about $6. For my birthday, it was a free day for many museums in Chicago so we went downtown and checked out aquarium and planetarium then went to dinner later. I spent about $10 on myself that day.

My Lows

- Dining out is the only slight issue I saw with my budget last month. Most of what I purchased was takeout food, which is the worst in my opinion because I’d rather go out to an affordable restaurant twice a month and get out of the house instead of order small takeout meals 10 times a month. My weakness is weekends. I try to spend as little as possible during the week and commit to bringing my lunch most days. Then when the weekend rolls around, I cave in, get lazy and think about ordering food so I don’t have to cook. Buying frozen pizzas to prepare on Fridays or Saturdays helped in the past, but then we got tired of them. I’ll have to work on another solution.

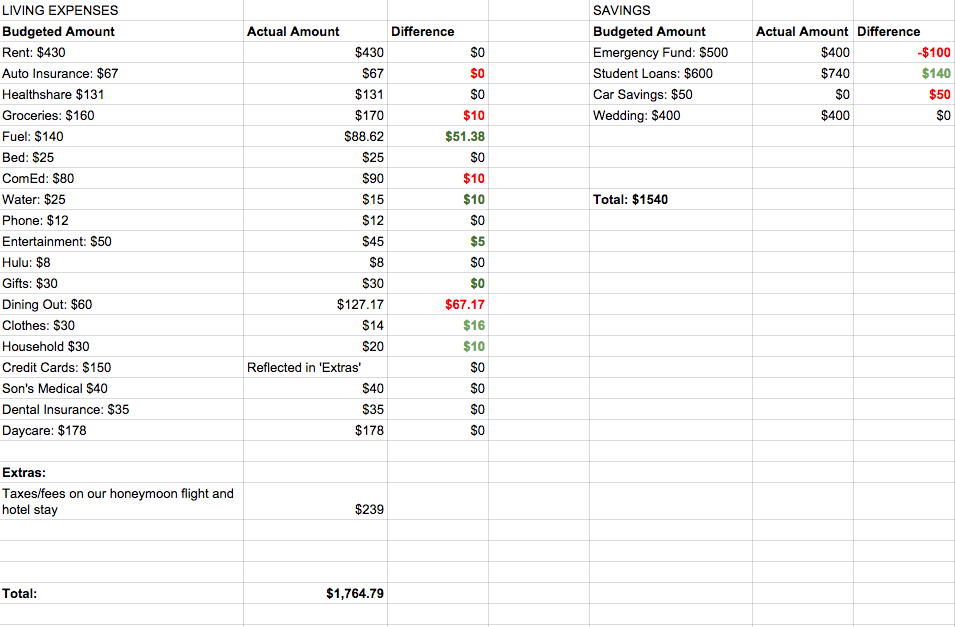

All in all, it was a pretty standard month. Here are the numbers:

How did your budget go in January? Any pleasant or unpleasant surprises?