Wow what a month! March was a month of changes and a pretty standard month in terms of finances. Every month I share how well my spending went according to my budget and acknowledge my highs and lows for the month. I’ve been thinking that this may be one of the last reviews I’ll post since I’m getting married in May and I imagine it will be a huge adjustment to combine finances and work out a joint budget.

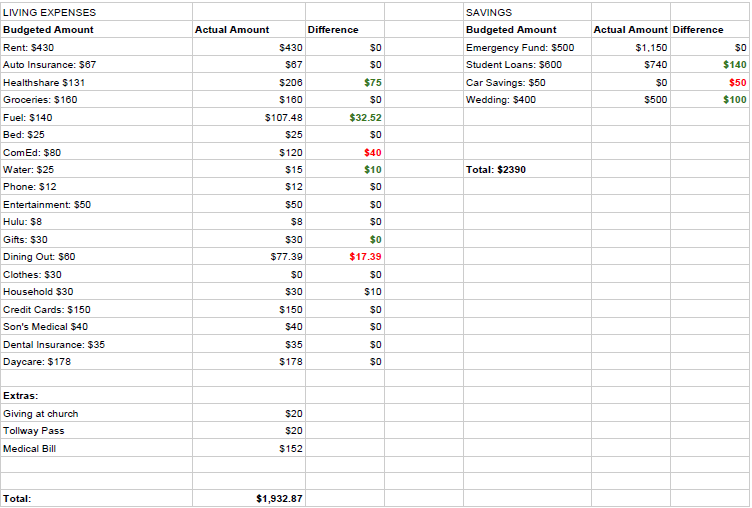

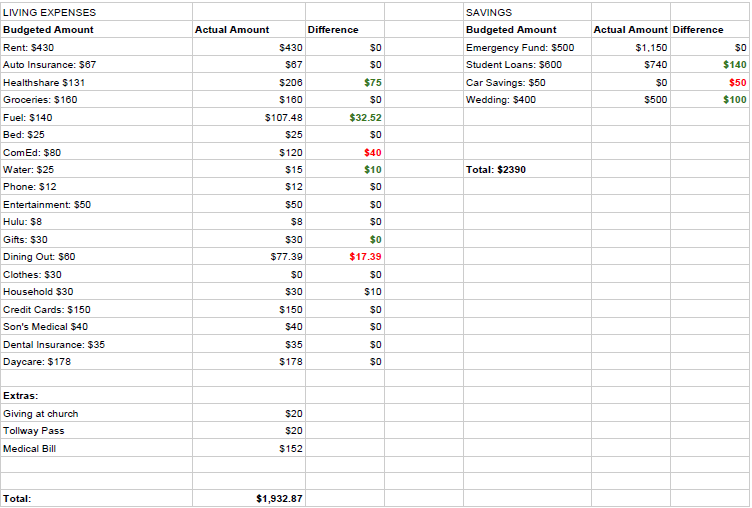

I made some progress on my wedding planning to-do list, had a great Easter at my mom’s house, and spent some quality time with my son for his spring break. This past weekend we went took my son and brother to LegoLand which was super fun. I had almost as much fun as the kids did checking out all the attractions and included some pictures below of the awesome Lego city of Chicago display. Even though it’s technically April, I paid for our tickets in March so the spending is reflected in this month’s review. I am spending a little more than I show on the spreadsheet below for wedding expenses each month, but since I deposit money to a wedding savings account each month and place it on the savings side of my budget, I don’t think I should account for it twice when I spend it. Plus, I plan on sharing a big wedding budget review later to see how we did with keeping our spending under control.

My Highs

I love starting things off by reflecting on my debt repayment progress. I put another $740 toward student loans last month and got my debt down to $17k. I really hope to get it down to around $15k by the time I quit my job to freelance this summer and I plan to get it as close to $10k by the end of this year so I can knock out the remaining balance in 2017. That’s my rough plan but it could change.

We lowered day care expenses by reducing my son’s schedule from 4 days after school to only 2 days. I’m thankful that my son can go to daycare after school some days but I’ll be happy when I start working from home and I can eliminate this expense altogether. Since he’ll be in first grade in the fall, I’ll have plenty of time to work while he’s in school so I won’t need childcare thankfully

I also made my 6-month auto insurance payment last month. Since I set about $67 aside per month to prepare for the lump sum payment, I didn’t see the need to mention it twice on this month’s report. Somehow I actually set aside a little more than the premium amount I was quoted so I transferred the leftover money to my savings account.

My Lows

I didn’t get a tax refund this year. This is not so much of a low but a change of pace for my finances. Since I’ve been working, I’ve always received a tax refund each year but for this year, since I have self employment income and my income has pretty much doubled since last year, I didn’t receive the child tax credit and had to owe. On the bright side, I over saved for taxes and had some money leftover that I also put in my savings account. So shouldn’t this be a high?

A $750 medical bill? Oh no! I received a large medical bill in the mail last month with demands to pay it so I’m looking into this issue to confirm what it was for and it I really owe the money. The medical industry is just so bizarre to me these days I can hardly keep up. Plus I’m with Liberty HealthShare so it makes things a bit different. I know I haven’t paid my annual unshared amount yet, but that should only be $500 so I’ll have to reach out to them to see why I’m being asked to pay it and worst case scenario, it will be added to my total debt and I’ll get on a payment plan and make small payments each month since I’m sure there will be no interest attached and I have other expenses to prioritize right now.

Onto the Budget

How was your month? Any wins or surprise expenses?