My New Save Half Budget

I’ve been budgeting for a while now and what I find interesting is how we all create budgets to stay organized and on track, but life is never so clear and predicable. Things happen, circumstances change, and mistakes are made. It’s all a part of life. The key to effective budgeting is being realistic, keeping it somewhat flexible and being open to change when it occurs.

I’m so glad I was finally able to redo my budget because while I continued to do budget reviews after each month, the original budget that I shared last year has changed drastically.

For starters, we moved so my living expenses have changed, I’m no longer paying for child care and a few other factors have contributed to my expenses changing.

This year I decided to save half of my income in order to help me get closer to paying off all my debt and reaching financial stability. Each month I share a portion of my journey toward saving half on Frugal Portland. I recently discussed how I not only wanted to survive on half of my income, but how I also wanted to thrive and continue to do the things that make me happy. The road hasn’t been easy, but it’s well worth it.

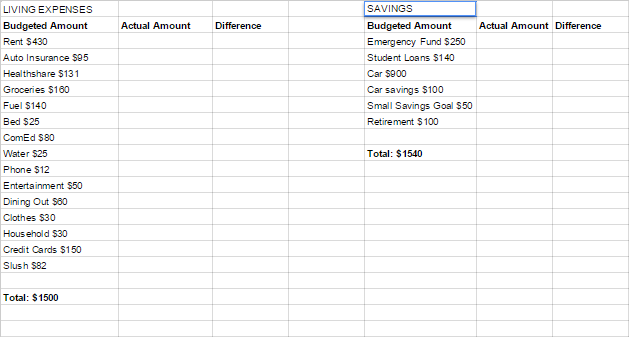

I played around with some numbers and came up with this budget for my living expenses and saving goals each month. I’m all fancy with my spreadsheet now 🙂 I’ll start using this budget in July so I’ll be able to report on how well it’s going in my budget review at the beginning of August.

Trying to Budget Down to Zero

I’ve never had a budget quite as clear and specific as this one and my main goal was to try to budget down to zero each month. I’ve never budgeted every dollar I earned each month with the intention that the leftover money at the end of the month will be saved or put aside as a cash buffer for the future.

Well let me tell you, I can only speak for myself but when I used to budget like that, there was no money left over at the end because it was all spent or tied up into something else. When I sat down to do my budget reviews, I’d compare my spending to my income and find out there was $100-200 in what I call ‘missing money’.

I used to have to search through my bank statement and dig up receipts to find out what I did with the money and that was super annoying. With this new budget, I can’t say I’m budgeting exactly every dollar I earn – because my freelance income is steadily increasing and it’s very irregular – but this budget does allow my ‘extra funds’ to get extremely low and I’m hoping that whatever extra freelance income I do have will be going toward debt and savings.

Related: The Ultimate Guide to Budgeting

Why Save Half?

Ever since I read about Kathleen (from Frugal Portland) and LaTisha (from Young Finances) talk about saving half of their take home income. I was floored. I knew it was something I wanted to do and while I don’t make a ton of money, I finally have the mindset and dedication to do it.

What motivates me? Debt. Getting rid of my debt and becoming financially stable so I don’t have to live paycheck to paycheck anymore is my bottom line. You just don’t know how sick and tired I am of having to pay lump sums of money to lenders each month. But maybe you do.

I can only imagine what my life will be like when I get paid and don’t have to send a chunk of the money away for a debt payment. I’m so over being in debt and having it hold me back. Even when I become debt free, I will continue to save half because it will give me more opportunity. Even though I plan on increasing my income as much as I can, right now I’m at the point in life where I need to keep my expenses low in order to make this work.

By saving half of my income, I can invest more, build up my emergency fund quicker and save for a down payment on a house. All these goals would be more difficult and take longer if I committed to only saving 10% of my income.

I’m one of those weird frugal people who absolutely loves the idea of living well on less so I’m going to embrace this period of my life.

Have you ever tried to save half of your income? Do you budget down to zero each month or do you prefer to have a little extra breathing room with a financial cushion?