No, I Won’t Spend $1,000+ on Christmas This Year (And You Shouldn’t Either)

This is a sponsored conversation written by me on behalf of SunTrust. The opinions and text are all mine.

The holiday season is such an exciting time in my household. We love decorating and putting up our Christmas tree the day after Thanksgiving, and I always look forward to a nice break from work and spending time with my family while my son is on Christmas break from school.

With that being said, the holidays have usually been an expensive time in my household due to the cost of Christmas gifts, big family meals, parties, events, etc.

It feels nice to indulge a little bit around this time of year but I’m not going to lie, I used to feel really guilty since I’m trying to put most of my extra money toward debt.

Christmas gifts are nice, but my big goal is to become debt free and live life on my own terms.

Plus, the holiday season isn’t just about gifts and money. It’s about so much more.

Table of Contents

According to a Recent Gallup Poll…

A Gallup poll taken last November indicated that 30% of American adults expected to spend $1,000 or more on Christmas. The average amount of money Americans said they’d expect to spend was around $908.

That’s a lot of money to spend just for one holiday and it might not even include extra holiday expenses that will arise over the next few months. The problem with spending that much money that fast is that it can lead to debt.

Since I refuse to spend $1,000 on Christmas this year, I’ve made a commitment to keep the holiday season affordable while still taking advantage of the special time to give and receive and enjoy loved ones.

Here are a few ways you can do the same.

Plan Out Holiday Spending

It’s important to plan out your expenses for the holiday season by creating a budget you can refer back to.

Earlier this year, Sun Trust founded the OnUp Movement to inspire millions of Americans to take a step forward toward financial confidence to spend more time focusing on the moments that matter and not on financial stress.

More than 700,000 people have signed up to participate in the OnUp movement and I love how SunTrust is encouraging a holiday season without financial stress by sharing lots of free information and tools like their holiday budget spreadsheet.

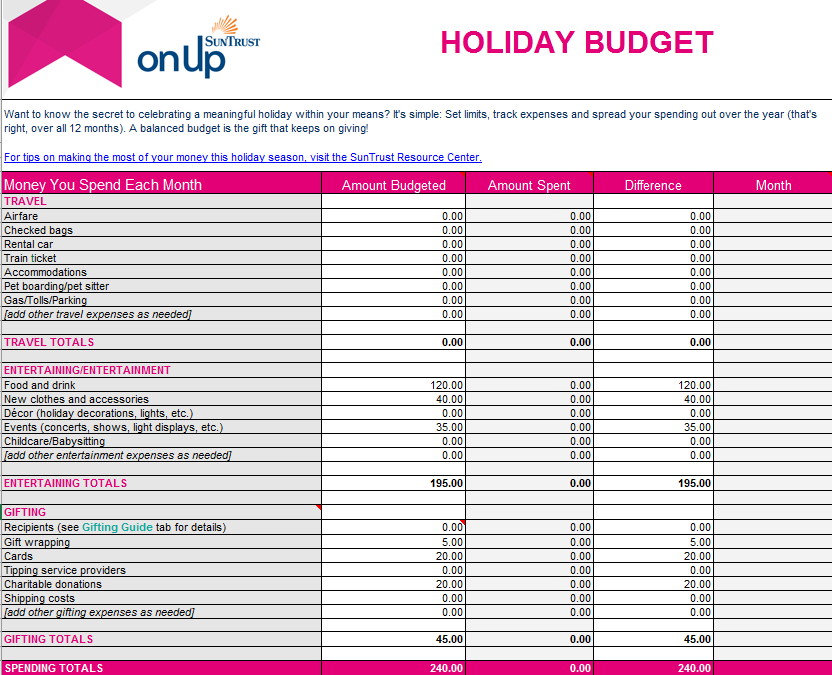

I downloaded the spreadsheet and filled it out to get organized this year so I know how much I have to spend and exactly where my money is going.

We don’t really travel for the holidays but if you do, you’ll need to adjust your budget accordingly and may spend lighter in some other areas. The holiday budget worksheet does all the categorizing for you so you don’t have to feel like you’re forgetting an expense.

Even holiday cards, gift wrapping, and tips have their own categories.

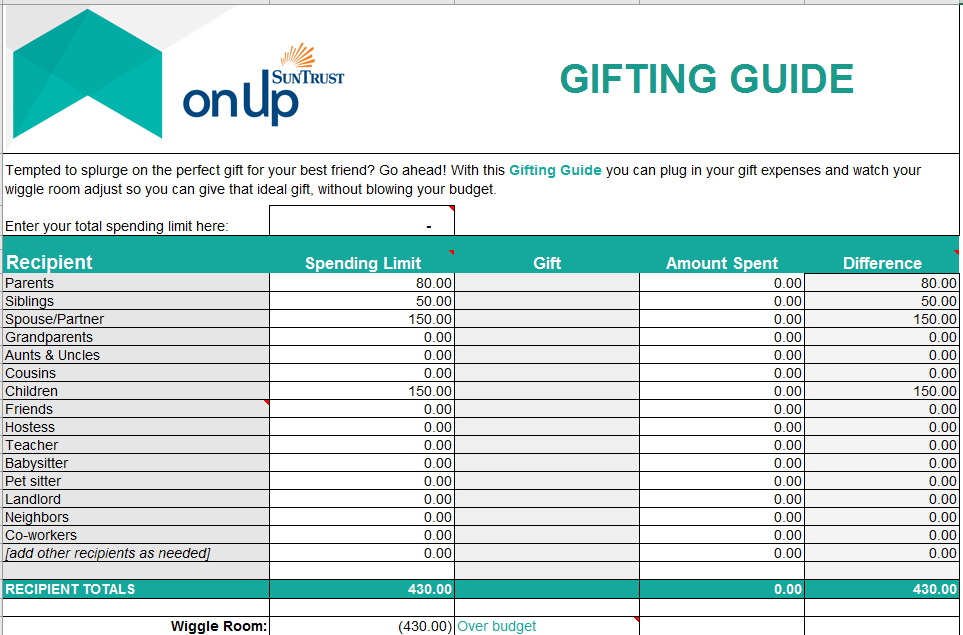

When it comes to holiday gifts, I always jot out a brief outline of what my spending will look like and what items I’ll get for each person.

I do a secret Santa gift exchange with my siblings each year so that just leaves my son, my husband and both of our parents.

We normally don’t buy gifts for aunts, uncles, and cousins and we may just send them Christmas cards or bake something special for them. If we’re trying to stretch with some other people on our list, my son loves art and homemade gifts are always an option as well.

Join the OnUp movement and start filling out your budget spreadsheet for the holiday season.

Related Articles: How to Prepare Your Finances for the Holidays

How to Stay on Track with Your Debt Payoff Goals this Holiday Season

Utilize Holiday Sales

I think the holiday sales get people excited and geared up to shop for Christmas but they don’t understand that retailers are using the sales to reel them in to spend even more money. Most times, retailers will require you to spend more money in order to get a bigger discount. You think you’re saving money, but you’re actually spending more than you planned to spend.

This is why it’s important to utilize holiday sales strategically so you can get more bang for your buck. You don’t have to take advantage of every sale, but if an offer appeals to you and you had to spend the money anyway, go for it.

I recently got my son some gifts from Target and decided to get the bulk of his items there since they gave shoppers a discount for spending a certain amount on toys and games. You can also use coupons loyalty rewards and rewards from sites like Swagbucks, and even take advantage of deals for Black Friday or Cyber Monday if that’s your thing.

Say No When You Can’t Do It

Saying no is not always easy, but sometimes it’s worth it if it keeps you from overspending. When my 6-year-old son asked for a PlayStation 4 this year, I gave him a big fat ‘no’.

Not only is that game system pretty expensive right now, I’m not positive he’s mature enough to take care of it and understand some of the games since he’s still working on his reading.

Sometimes my husband and I have to take a rain check on certain holiday events or gift exchanges with friends because it doesn’t fit in our holiday budget.

Don’t worry, we still make time to see family and friends around the holiday and spend quality time with them, it just doesn’t involve spending money.

Adopt Frugal Traditions

I’ve talked about adopting frugal holiday traditions before a while back on the blog, but just to reiterate, I basically took some of our most expensive holiday traditions and replaced them with free and frugal activities instead.

We used to go to the Winter WonderFest in Chicago all the time, but it’s super expensive so if we can’t afford it, we do other things like go to the annual tree lighting festival which is free, decorate our home, go on the holidays lights train for free to check out Christmas decorations, go sledding when it snows, watch movies at home on Netflix on Christmas Day, etc.

If your holiday traditions involve spending a ton of money, you may need to rethink them in order to save more.

Accept Used Items

I have nothing against used items as long as I can put them to good use. I sometimes buy used and refurbished gifts for my son for Christmas and all of the decorations for our tree were are used and we received everything for free.

Accepting donations or even purchasing gently used items for cheap is a great way to cut back on holiday expenses.

Shift Your Focus Away From Spending Money and Buying Gifts

If you’re busy trying to spend $1,000+ on various different things these next few weeks, you probably won’t have time to shift your focus to doing something to help those in need and volunteer in your community.

There are so many volunteer opportunities each holiday season and if you find a cause you like, you can involve the whole family. You can also volunteer your talents and services to help other people.

If you focus on giving things other than gifts, you’ll naturally spend less and have a more rewarding holiday season.

At SunTrust Bank their purpose is lighting the way to financial well-being. When you feel confident about your money, you can save for your goals and spend knowingly on what matters most to you.

The onUp movement was created to guide millions of people one step at a time towards a more financially confident life without ever losing sight of the moments that matter along the way.

Join the growing number of people transforming their stress into positive motivation to move onUp.