PolicyGenius Review: Affordable Term-Life Insurance

Insurance is often not fun to talk about – especially life insurance. Still, that doesn’t mean the topic should be avoided altogether. This is why I was very interested in writing this PolicyGenius review to help anyone who’s been on the fence about getting insured. It’s hard to think about what would happen to your loved ones and your financial affairs if you happened to pass away early. But doing so is one of the best ways to ensure your family’s stability if you were ever out of the picture especially if you have kids.

If God is willing, I want to have a long life and watch my son grow up. However, I have to face reality that if that doesn’t happen, he deserves to have financial stability in his life. This includes having the opportunity to go to college and pursue other aspirations. Term life insurance can help secure that.

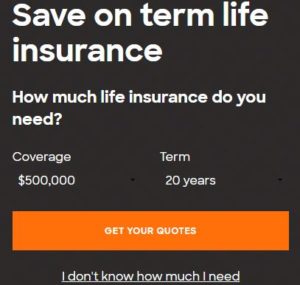

A few years ago, I met with a representative of PolicyGenius who first introduced me to the ground-breaking platform. PolicyGenius is a one-stop-shop allowing consumers to shop for the best term life insurance policy to meet their needs. Before I dive into this PolicyGenius review, I wanted to point out why I believe term life insurance is better than whole life insurance.

Table of Contents

Term vs. Whole Life Insurance

Some of you may know what the noticeable differences are between the two. I know there are a lot of people who don’t (I used to be one of them) so I’ll explain.

Back when I was looking into life insurance policies, I favored whole life over term life for some reason. Since whole life insurance is for life, I figured why not just lock in a good price and never have to worry about a new life insurance policy again? While permanent life insurance may provide protection for your entire life, it accumulates a cash value over time. The policy owner can borrow against tax-free, or use for educational and retirement funding.

Whole life insurance is best for estate planning. Part of your premium goes toward building cash value and the policy also pays dividends that make that cash grow as the years go by. In order to buy a suitable amount of actual insurance protection if you died, you’d have to pay a much higher premium than with term life – about 5-15 times higher.

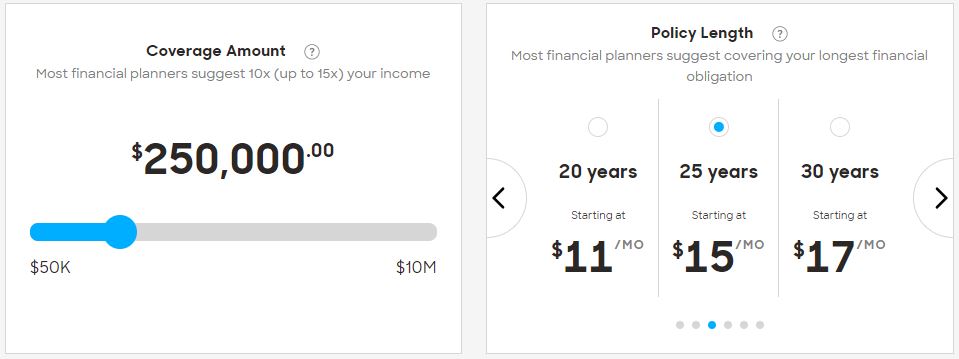

With term life insurance, you choose a term between 10 and 30 years. You’ll pay a monthly premium based on how much you need to be able to provide income and assets for loved ones. These plans don’t build cash value and are just in place if anything unfortunate happened. Therefore premiums are much lower and can start at $10 per month. However the average monthly cost ranges from $25-$35/month for term insurance.

In my opinion, if you:

- Are relatively healthy and expect you will live long

- Are not interested in tax-advantages and waiting around for the cash value that whole life insurance plans offer

- Or, already have a solid saving and investment strategy in place

Stick with term life, pay a much lower monthly premium and invest the difference on your own instead.

A Life Insurance Mistake

I finally finished a pre-marital counseling course with my not husband that we took with members of our church. When we got to the financial planning part of the course, I thought we had each other all figured out since we already talk openly about our finances regularly. One of our counselors just happened to have previously worked in the insurance industry and when my husband started telling him about his whole life insurance policy, the doubts I had about it were solidified.

Back in 2009, my fiance’s parents persuaded him to get whole life insurance. Not knowing any better, he chose a policy that required him to pay a monthly premium for $25.00 that would only pay out $23,000. That is practically nothing if he kicked the can seeing as it wouldn’t even cover burial/funeral expenses and his debt.

Meanwhile, I was paying less than his monthly premium for a $250,000 term-life insurance policy. Needless to say, the counselor advised him to switch and I wholeheartedly supported the idea because that was not going to fly. He took the $300 cash value the policy built up over all those years and started looking at term life options.

We used PolicyGenius to weigh our term life insurance options and here’s why I love them.

What PolicyGenius Does

Buying the right life insurance for you is a serious process that shouldn’t be taken lightly. PolicyGenius smooths all that out and breaks down the technical terminology so you can find an ideal life insurance policy quickly and without all the hassle.

Their process is so simple to find the right life insurance provider for you. To begin, you go through a quick form that covers three categories: basics, health and coverage.

In the basics section you will provide answers to questions such as:

- If you’re opening a term life insurance policy for the first time, supplementing or replacing another policy you already have

- When you need your coverage to start

- Gender

- Date of birth

- Zip code (PolicyGenius is offered to U.S. residents at the moment)

- If you’re a U.S. citizen or permanent resident

- If you have a spouse or significant other

The health section will focus on:

- Your height and weight

- If you have used tobacco products in the last 5 years

- Whether you’ve been treated for or taken medication for specific health concerns

- Family history of specific health concerns

- If you’ve had your driving license suspended or revoked, more than one ticket or accident in 5 years

Once you reach the coverage section you will be able to see costs for different insurance amounts and terms (length of years covered by the policy).

Once you make your coverage and term choice you will be shown several quotes from the top contenders and you can compare them side-by-side.

While it may seem like a lot, once you’ve answered these handful of questions (which are mostly yes or no or multiple choice) you’ll complete this online application through PolicyGenius in 5 minutes or less!

- Pet Insurance

- Renter’s Insurance

- Long-Term Disability – Read more about disability insurance here

- Health Insurance

Oh and did I mention all of this is free? PolicyGenius acts as the unbiased middle-man so you can obtain your quote, shop around, ask questions, and apply all for no charge. If you don’t currently have a life insurance policy through an employer or on your own it wouldn’t hurt to apply and see what your options are.

The Platform Educates You So You Can Make The Final Decision

When it comes to choosing the right type of insurance, the final decision will always be yours. After dealing with my fiance’s life insurance mishap, I now understand how important it is be aware of what you’re getting yourself into so you can make a conscious final decision that you are happy with.

PolicyGenius is not just in the business to help match you with the best insurance provider, they are also keen on educating you on the industry and the process. They have a helpful FAQ section on their site with answers to insurance questions you didn’t even know to ask, 101 guides, and free personalized insurance advice through their Insurance Checkup Portal that provides you with a customized to-do list after analyzing your financial safety net and your needs.

Also they offer helpful resources such as a life insurance and disability insurance calculator. Plus, they have their own blog sharing many insightful tips to help you save money and protect yourself properly.

PolicyGenius Review: The Pros and Cons

Here are some pros and cons when it comes to using PolicyGenius to help you see if this policy aggregator is right for you:

Pros

- You don’t have to create a PolicyGenius account to get a quote

- They work with many reputable insurance companies that are noted for their financial stability

- They have a large amount of resources to help you on your insurance journey

- PolicyGenus offers amazing customer service and are impartial when offering advice

- The quote and application process is very simple and quick

Cons

- They don’t work with every single insurance company so you may not be getting the absolute rock bottom price available

- PolicyGenius doesn’t offer all types of insurances (i.e. health insurance, life insurance etc.) in each state

- They may require additional information to complete your application

Whether you are 25 or 55, life insurance is a must if you have assets and loved ones to protect. My hope is that this PolicyGenius review conveyed that important message. If you choose term life, it’s a small price to pay for your peace-of-mind. Knowing that your loved ones will be stable and have the financial support they need is priceless. PolicyGenius will help you find just what you need.

Do you have life insurance? Do you favor term life or whole life?

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.