Putting My Health First: Liberty HealthShare Review

As obsessed as I am with achieving financial stability and financial freedom, I cannot put those goals above my health. It’s important to put my health first. And I think all of us could benefit from regular checkups and putting our mental and physical well-being at the top of our list. And that’s what insurance and HSAs are supposed to help out with right? Here’s my Liberty HealthShare review, and if it will work for your health goals.

Table of Contents

What is Liberty HealthShare?

Liberty HealthShare is one of several health-sharing ministries that are ACA-approved alternatives to health insurance. It is not actual health insurance, but as a member, you’re not considered ‘uninsured’ either. It’s kind of in that gray space that I never knew existed with health insurance.

Liberty HealthShare members don’t pay a ‘premium’ each month. But they pay a mandatory fee which will be shared among members who have medical expenses for that month. So in a way, it’s very much like a group of individuals who share each other’s medical expenses vs. having a private company pay for it. If you were a member and had medical bills, other members’ monthly contributions would fund your medical expenses and vice versa.

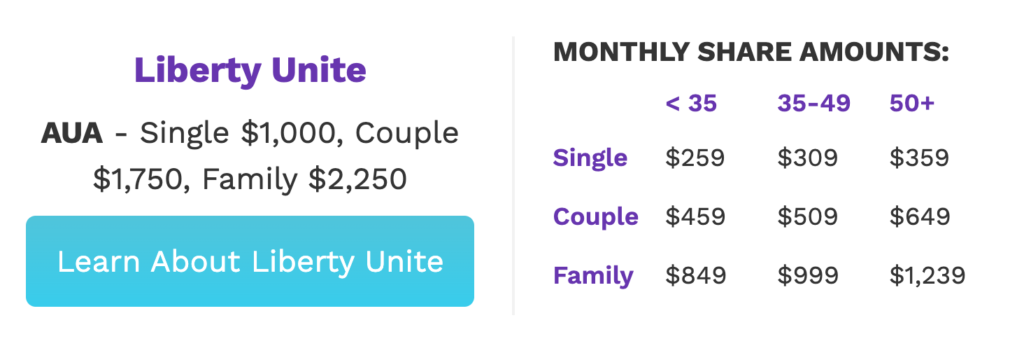

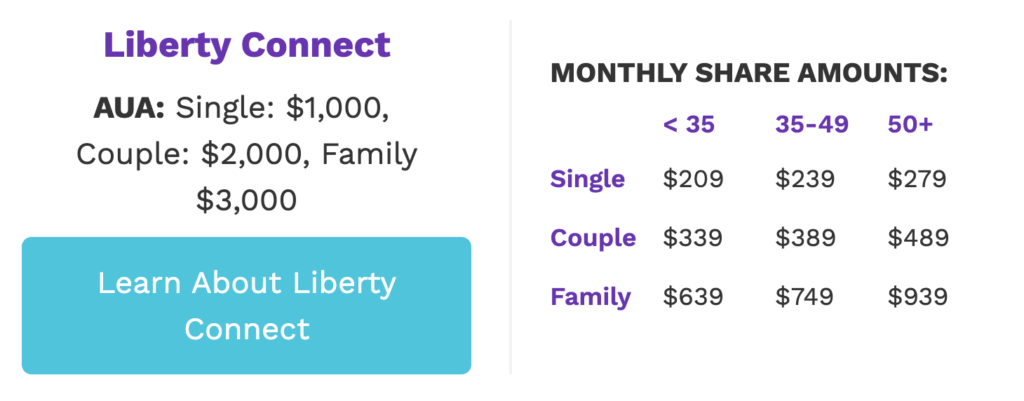

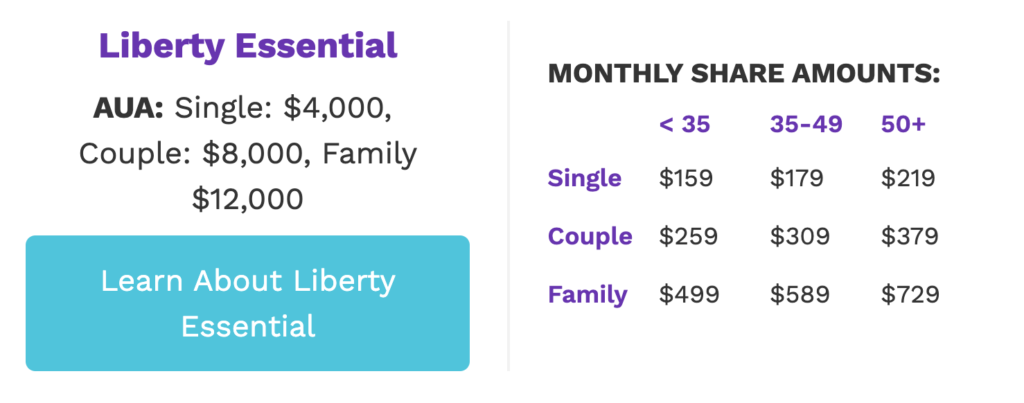

There’s an annual unshared amount (AUA) for each member. This is similar to a deductible, which is an amount that can not be shared. Once you pay your AUA, which is $500 per individual, Liberty Health Share will cover all of your doctor appointments, medical tests, and any other medical expenses depending on which plan you choose.

Different Plans Include:

- Liberty Essential: Up to $600,000 (per incident) of fair & reasonable eligible medical expenses are shareable after AUA has been met. Members pay a 25% co-share. Medical costs are shared on a per person, per incident basis, for illnesses or injuries incurring medical expenses when treated by physicians, urgent care facilities, clinics, emergency rooms, or hospitals (inpatient and outpatient)

- Liberty Connect: Up to $1,000,000 (per incident) of eligible medical expenses are shareable after AUA has been met. Members pay a 15% co-share.

- Liberty Unite: Up to $1,000,000 (per incident) of eligible medical expenses are shareable after AUA has been met.

- Liberty Rise: A program ideal for young adults and married couples (18-29 years old) who don’t have children. Up to $50,000 (per year) of medical expenses are eligible for sharing.

What I Like About Liberty Healthshare

As you can probably already assume, I decided to opt out of the ACA. Instead, I enrolled in Liberty HealthShare this year. A few months back, a reader asked me to provide a review about this particular healthcare option. So I thought it was I’d give my honest opinion about the program in this review.

While the monthly fee or ‘premium’ is low and manageable for me, I love the flexibility of the coverage. I can’t name every little medical expense in this post. But when I signed up I received a detailed list of the services and incidents that were covered under Liberty Health Share and it’s very similar to a private insurance company if not better. Members receive a free wellness check-up. Hospital stays, medical tests, and x-rays are all covered.

As I member, I can also choose which doctor or facility I want to go to. With an HMO or PPO, I’d be subjected to finding a doctor within that specific network. Now I have the option to choose a quality care provider as long as the practice accepts my health share card. I was happy to receive a discount card for prescriptions. I’m sure you know this frugal woman loves a discount.

Updates

It seems like I signed up at the right time. Before this year, it was a requirement that you maintain a membership for at least 60 days before you could utilize your sharing benefits. This meant no wellness checkups or any medical expenses for that manner would be covered during the first 60 days). Now that they got rid of that stipulation in 2015, I was able to utilize my sharing benefits as soon as I signed up.

I also like how the annual unshared amount or ‘deductible’ is so low. I signed up thinking All I have to do is cover my medical expenses up to $500 then they will cover the rest no matter what is is, as long as it doesn’t exceed $125,000. I’m aware that some serious medical expenses do exceed $125,000. So the best option would be to go with Liberty Complete just to be safe. If I continue my membership, I will certainly consider upgrading next year but I just wanted to try it out for now.

Recently, I had to go to the doctor and was required to take a few more tests. I also ended up in the emergency room last week due to really bad back pains that I just wanted to get checked out early on. I realized that I needed to hurry up with my AUA if I wanted to avoid medical bills.

My health and well-being will always be more of a priority than my debt payments and financial goals. At the end of the day, money is just money and what you truly need in order to enjoy your life and your loved ones is your health.

What I Don’t Like So Much

I don’t like how Liberty HealthShare is still so foreign to many healthcare providers. When I went to the emergency room I just showed the records department my card. They made a copy of it and there was no problem.

But when I tried to call different practices to set an appointment for my medical follow-up tests, the receptionist wouldn’t even give me availability without confirming whether or not they could accept my ‘insurance’ or not. I was almost confusing myself when I kept explaining, ‘it’s not private insurance, but it’s not Medicaid either. I really dislike how this country is so obsessed with money and insurance. When it comes to healthcare, providers should be a little flexible.

It would save a lot of time if Liberty would break things down into regions. This would help members find providers who are aware of Liberty HealthShare and will willingly accept it. With that being said, if you were using private insurance before and had an HSA (health savings account) you won’t qualify for one. Liberty HealthShare isn’t considered health insurance and instead of a deductible, they use an annual unshared amount.

It’s also important to remember that Liberty HealthShare is a health-sharing ministry based on religious values and standards. This isn’t necessarily something I dislike since I have the same religious values. But it’s definitely something to consider and it may not be for everyone. In order to qualify for a membership, you need to agree with or accept their shared beliefs. It seems pretty reasonable to me.

Liberty Healthcare Pros and Cons

Pros

- Inexpensive for families with different budgets

- Offers RX cards for many members, thus discounting prescriptions

- Cost sharing is fast — usually within just a few weeks

Cons

- May not cover pre-existing conditions

- May not cover “Non-Christian” items, including birth control

- Does not offer additional coverage for items like dental or vision work

Wrapping It Up

I’ll give periodic updates about my experience with this unique type of health coverage. If you have any questions about Liberty HealthShare feel free to email me or give them a call: (855) 585-4237

Update: December 2015

A lot of readers have been contacting me regularly and asking for an update on my honest opinion and experience with Liberty HealthShare. A few months after using Liberty Healthshare, I did a podcast interview. I shared some of my feedback on the program. That interview is now live and you can view it here. I took a peek at the plans and premiums in the marketplace a few weeks ago. I decided to stay with Liberty for another year.

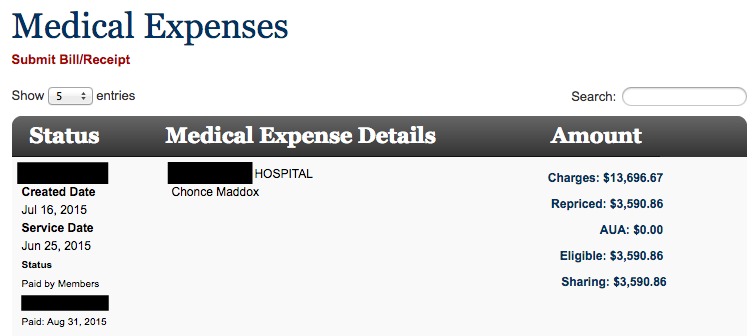

In my interview, I talked about how Liberty helped cover a surgery I had earlier in the year. You can see a screenshot of how they repriced the medical bills and shared the remaining amount among other members. That way I didn’t have to pay for it out of pocket myself.

Liberty HealthShare Review

Health-sharing ministries may not be the perfect solution for everyone, but nothing is perfect when you think about it. It works for me right now in my life. I’m sure it would work for others depending on their situation. I truly and sincerely hope everyone finds affordable and reliable medical coverage for themselves and their families in 2016. If this review or my interview helped give you insight in any way and if you choose to sign up with Liberty HealthShare, I ask that you would mention my name, Chonce Maddox, as a referral. I would receive referral credit and be extremely grateful for your support of me and my blog!

/>

/>Have you ever used an alternative to private health insurance before? Why or why not?

Learn How to Start a Money-Making Blog in 10 Days

My free blogging course will teach you everything you need to know about starting a blog, increasing your traffic, and how to monetize it quickly so you can earn money doing something you love.