September Budget Review

Happy fall everyone! I haven’t even had a pumpkin spice latte yet this year and already loving the weather, decorating around the house and preparing our favorite fall meals.

If you’re new here, at the end of each month I share my budget and spending in order to be accountable for my financial goals along with tracking my spending overall. I also think it’s fun to look at the way people budget their money so in these types of posts, I try to be an open book. I start off by going over my highs for the month (good things that happened) and then my lows (the bad stuff) as a way to highlight my successes and see what works well for me while still being able to acknowledge my failures or the things that didn’t turn out so well.

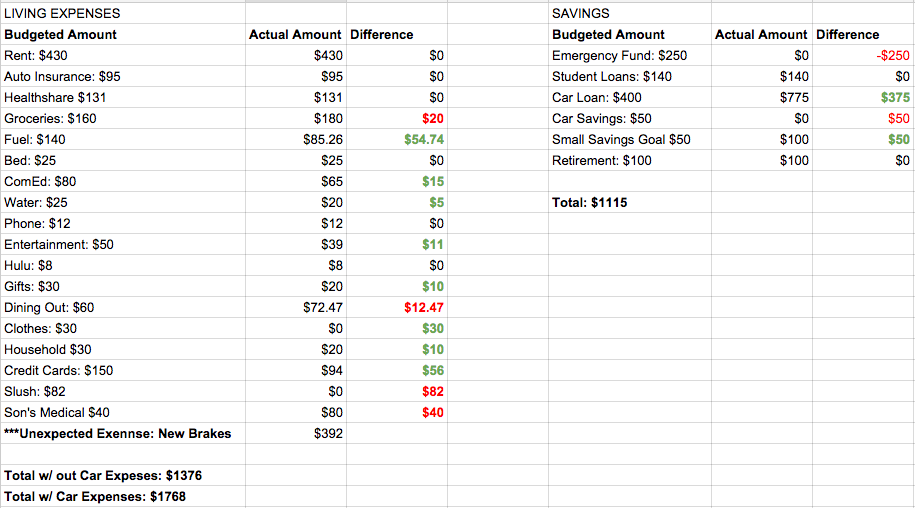

September was a low spend month for me overall thanks in large part to the fact that I didn’t have much money to spend to begin with. Last month I shared with my newsletter subscribers how I felt like I was experiencing a budget deficit and feeling very uncomfortable financially since my income at my full-time job temporarily decreased as a result of not receiving my bonus. That’s just one of the many crappy parts of living paycheck to paycheck but thank God for multiple streams of income.

Needless to say, I’m happy the month is over and FinCon also helped the time fly by. Below my official budget spreadsheet, I also included how my FinCon budget panned out for those of you who might be interested or want to attend FinCon next year and get insight on some common expenses associated with traveling and the conference.

My Highs

My Lows

Onto the Budget

Extra Bonus: My FinCon Budget

So obviously my biggest advice for FinCon is to try to budget and prepare for the conference and your trip early because it’s totally worth the investment. I started setting side hustle income aside a few months before the conference and tried to set a realistic budget of how much I expected to spend and what things would cost.

To my surprise, I ended up being under budget at the end of the week and I got to pocket some of the extra money I saved/put it toward bills etc.

Luckily:

-I scored a free flight to Charlotte with my credit card reward points and didn’t have to pay $25 each way to check my bag since I somehow shrunk all my items to fit safely so I traveled for FREEEE!

-Breakfast was covered most of the days and even some lunches were covered as well. Thank you FinCon sponsors!

-The events were included in the price of the conference. So I didn’t have to pay to visit the Mint Museum in Charlotte for Ignite FinCon or the awesome bowling event sponsored by SoFi.

-I’m not a big alcohol drinker and I’m not crazy about beer, but it does help give you liquid courage when at social events as long as you’re being responsible 🙂 I received drink tickets at many of the events so I didn’t have to pay for alcohol and got to try a few new drinks as well.

Here’s how all the expenses broke down:

My half of the hotel room: $345

Transportation from the airport (The Sprinter bus): $2

Emergency internet at the airport: $5

Cash for meals and drinks that weren’t covered along with extra outings and any other expenses: $100

Transportation back to the airport: (Uber w/ Kayla): $0 (thanks to a $20 credit I received)

NC Souvenirs for family: $40

Amount Budgeted for: $670

Total Spent: $492

Leftover: $178

How did your month go?