How to Stop Living Paycheck to Paycheck Once and For All

Are you living paycheck to paycheck? You’re not alone. According to a Highland Solutions survey, more than 63% of Americans live paycheck to paycheck. According to this particular survey, the pandemic has increased the number of people who feel they are on a much tighter budget with even less room to spare.

Unfortunately, this is not surprising. Money can become such a strain when you’re wondering how you’re going to pay your bills and basic expenses.

However, in this guide, I’m going to give you a full step-by-step plan to help you break the paycheck to paycheck cycle once and for all. You’ve probably heard this term before, but you may be wondering what does living paycheck to paycheck mean?

Table of Contents

Paycheck to Paycheck Meaning

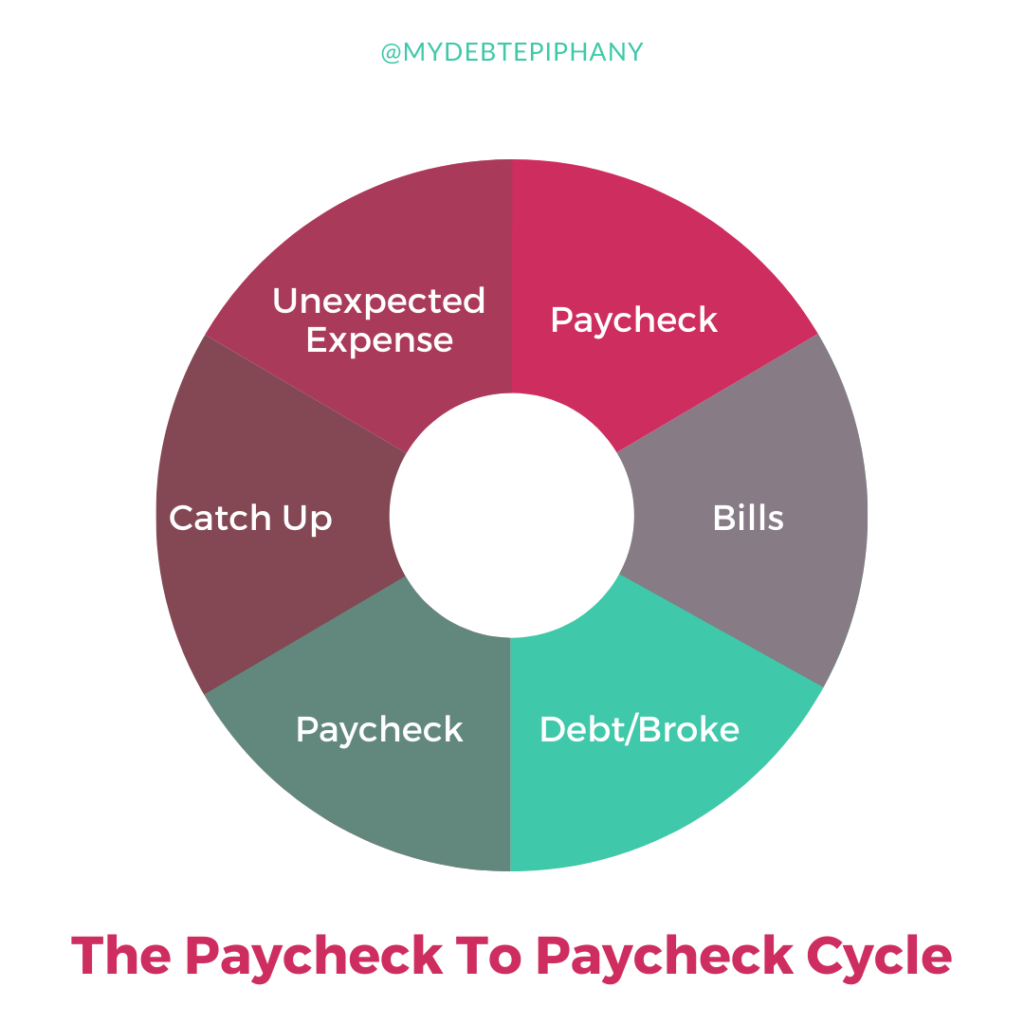

Living paycheck to paycheck means your life is heavily dependent on your next payday. How it usually works is you get paid from work and proceed to pay bills, get things for your home, pay off debt, and cover other wants and needs. Before you know it, your cash flow is severely drained after paying your initial expenses. To make things worse, maybe an unexpected cost or emergency expense pops up.

If you don’t have the cash, you may need to use a credit card or take out a loan. Then, your next payday arrives and you can slightly breathe normally again. You excitedly pay your bills and make payments on your credit cards or loans. Only to find out that soon enough, you’re right back where you started with a very low bank account balance and few options as you await your next payday.

If you’re a visual person, living paycheck to paycheck might look something like this.

Worst of all it’s a cycle and it can be hard to break that wheel. Some people live paycheck to paycheck for years or their entire life. This often means:

- Having little cash flow each month leads to lots of financial stress and anxiety

- There is hardly any money left over to save

- Debt can easily pile up and compound when you’re forced to borrow and spend more than you have

In short, living this way is not fun. Breaking the cycle can be challenging, but it’s not impossible.

How to Stop Living Paycheck to Paycheck (The Key Ingredient)

It requires a lot of work and strategy, but in my opinion, it’s worth it in the end because I used to live paycheck to paycheck. About 7 years ago, I hated money and my relationship with my finances. I felt like no matter what I did or how hard I worked, I could never get ahead.

My lasting memories of struggling financially include everything from:

- Wondering how I was going to stretch food to the end of the week for myself and my son – Often times I’d go to food pantries and a local soup kitchen that provided free hot meals to the community weekly

- Looking on the ground in the parking lot of my apartment to see if anyone dropped some change so I could wash my clothes

- And the worst – laying awake at night and wondering how I was going to pay for certain bills and expenses during the month

It’s rough and discouraging at times, but I’m glad I was finally able to equip myself with the knowledge and tools to get ahead financially. I want to show you exactly what I did and help you on your journey. These steps below are things I actually did and hard lessons it took me a long time to learn.

But first, let me share the key ingredient that you need to know or have in order to make this work: cash flow. If you don’t get anything else from this post, just understand that you need extra cash flow to stop living paycheck to paycheck.

In other words, your expenses need to be lower than your income. You need to cut yourself a break. When you’re always having to spend more than you earn or close to that amount, there is nothing left over to help you save or get ahead financially so you can stop living paycheck to paycheck.

If finances are already super tight in your household, please stay with me. I’m going to show you some key ways to free up money and create more cash flow but first, you need to set this goal. Realize that you may need to get one month ahead financially in order to truly improve your finances and break out of this cycle.

How Do I Stop Living Paycheck to Paycheck?

Be sure to follow this step-by-step process if you want to stop living paycheck to paycheck.

Step 1: Track Your Income AND Expenses

Maybe you’ve heard this before and thought you could skip this step. Please don’t skip it. Tracking your expenses and income is crucial. So many people (self-included) don’t know how much they’re spending or bringing home each month. Why should you know this information automatically? You’re not a computer or robot. You’re a hardworking person with a lot of stuff going on.

Do yourself a favor and track your income and expenses weekly. Sign up for a budgeting expense tracking app like Simplifi by Quicken or any of these, download my budgeting templates, or just use pen and paper. It doesn’t matter how you do it. Just track your numbers so you have a clear view of what’s coming in and what’s going out.

Soon enough, you’ll have enough information to draft a solid, realistic budget for yourself to follow each month. If you need help creating a budget or improving your existing budget, check out my free budgeting guide here.

Related: The 50-30-20 Budget Plan: What Is It and How Does It Work?

My Monthly Single Mom Budget: Living and Paying Off Debt on $32,000/year

Step 2: Cut, Cut, Cut

Yes, you knew this was coming. Next, you’ll need to go through your expenses with a fine-tooth comb and make cuts to free up more money. Maybe you’re not spending a lot as it is, but remember, your primary focus is creating cash flow right now. Even if you are already being somewhat frugal, challenge yourself to make some temporary sacrifices now so you can change your life forever in the future.

For example, one expense that I really don’t need is my $55/month gym membership. I like going to the gym 2-3 times a week and feel the membership really pays for itself. However, if I really needed to make a cut, I would get rid of my gym membership in a heartbeat. I can always work out at home for free and watch YouTube videos. An amount like $55 per month doesn’t seem like much, but that’s $660 per year.

See if you can keep going with your expenses and ask yourself some of these questions:

Can I cut my grocery and dining out budget by anything? Even if it’s just $20 to $30?

Do I really need to buy coffee before work? Can I take a break and make coffee at home for a season?

Won’t my family be okay if we skip a vacation this year and opt for a staycation in our hometown instead?

Do I need to buy this new? Can I buy it used or borrow it?

Do I really need this car? Could I downgrade to a cheaper vehicle that requires less maintenance?

Can my partner and I share a vehicle for a while?

How can I get _____ for free?

Continue the exercise by generating real and hard questions to answer as you go through your budget line by line.

Related: 50 Everyday Expenses You Need to Stop Spending Money On

70 Ways to Save More Money While Living Paycheck to Paycheck

Step 3: Don’t Be Afraid to Utilize the Resources and Relief Available to You

Waiting on the edge of your seat for the next paycheck can be tough and tiring – especially when you know that it’s never enough to cover everything. If you haven’t already, commit to spending an afternoon researching different programs and relief options that could be available for you. As someone who used to use welfare, I can say that it’s extremely helpful when you’re truly in need.

I knew lots of people who were too proud to go and get food stamps but I didn’t have time for pride. Instead, I went to my local aid office and got food stamps, and applied for childcare assistance. That way, I could finish school, take internships, and truly invest in my future. It wasn’t long before I had to get off public assistance because I no longer qualified. However, by that time, I had a clear plan in place to help me survive and thrive on my own.

If you are in a situation where you don’t qualify for any government assistance, check to see if there are private resources to help you. Local food pantries can lower your grocery bill. Utility assistance programs can help you cover your electric and gas bill for a few months.

Non-profit organizations often operate ‘clothes closets’ where people can go and pick up clothing for their family for free. Or, perhaps you have debt and one of your lenders offers deferment. Taking a break from paying your student loan or another loan could help you get back on your feet and find more money to save.

Step 4: Commit to Pay Yourself First (Hint: You’ll Want to Save One Months’ Income)

Paying yourself first is such a good habit. When you get paid, what do you immediately do with your money? Do you pay your rent or mortgage? Catch up on bills or debt payments? Treat yourself to something nice?

How about paying yourself first? This involves taking a fixed sum of money and transferring it directly from your checking account to savings. While most people put saving low on the priority list and save it for last, paying yourself first sets you on the path to no longer living paycheck to paycheck.

The truth is, when you have the mindset that you will save money eventually whenever there is something left over at the end of the month, you’re almost always setting yourself up for failure. If you don’t give your money a purpose, it will find its way out of your checking account one way or another (likely through unplanned, extra spending).

Paying yourself first gives you peace of mind knowing that you prioritized your needs and future first and are stashing something away. Even if it’s just $10, it will feel good to know that not all of your money is going to other people.

Jumpstarting the Process of Living on Last Month’s Income

Another benefit of doing this is that it will help you save up at least one month’s worth of income.

Why do this? This is actually the KEY element to breaking that P2P cycle. If you want to stop depending so heavily on your next paycheck for survival, you’ll need to have some savings lined up so you can rely on the cash you have on hand instead.

Here’s what that might look like. Let’s say you usually spend around $3,500 per month. To stop living paycheck to paycheck, you’ll want to save up $3,500 so you can cover a full month of spending WITHOUT a paycheck. When you have these savings, what you’ll do is stash the paychecks you earn instead of spending them right away.

***Remember, you’ll have your one month’s worth of savings to spend and use as you see fit.

Then, when the next month rolls around, you can use money from last month’s paychecks to cover your expenses. Thus, repeating the cycle

and setting aside the current month’s income to be used for the next month. So now you’ll have a brand new cycle that involves living on the last month’s income. You can budget completely differently knowing exactly what you have to work with each month. Most important, you’ll no longer have to build your life and spending around your next paycheck.

Related: Saving and Paying Off Debt With an Irregular Income

Step 5: Increase Your Primary Source of Income

If you want to get better at saving money and paying yourself first, you may need to consider an income increase. I know firsthand that you can only do so much with a limited income.

Once you’ve cut all the costs you could afford to do without, the next step is often to start making more money. There are two main ways to do this:

- Ask for a raise at your current employer or get a higher paying job

- Earn extra money with a side hustle or part-time position

I’ll talk about option #2 in a little bit, but first I want to focus on your primary income source (ie. your full-time job) because this is where you likely spend most of your time and energy.

The best times to negotiate a raise is mid-way through the year or toward the end of the year right before January.

Research salary stats for your specific position and really assess how you can offer value to the company or even increase that value. Can you take some extra training or get a certification that can justify the company paying you more?

Related: How to Successfully Negotiate a Raise

Step 6: Stop Using Credit Cards and Loans

If you’re living paycheck to paycheck, there’s a good chance you shouldn’t be using credit cards or taking out loans. While on the surface, you might think that you’re doing a good thing by providing certain items for yourself and your family and setting up payments. It builds credit, right?

Here’s the thing. Being in debt can cut off your cash flow and keep you stuck in the P2P cycle. The money you meant to save will go toward your car loan, personal loan, and credit card debt. You don’t have to live like this forever.

The solution is to create a debt payoff plan. Personally, I like to prioritize high-interest debt over low-interest debt like mortgages and student loan debt. I believe it’s possible to stop living paycheck to paycheck and still have a mortgage or a moderate student loan balance, but that’s just me.

What really eats up your money though, are those pesky interest rates and credit card fees. Check out some of my links and resources below to help you pay down your consumer debt quickly so you can put more money toward savings and getting ahead financially.

Related: Staying Motivated During Your Debt Payoff Journey

4 Books To Start Reading If You Want to Get Out Of Debt

What Debt Should You Take Care of First?

How Bad Are Debt Settlement Companies?

Debt Mindset Series: Escaping the Debt Trap

Debt Mindset Series: The Power of a Side Hustle

Step 7: Increase Income With Quick-Pay Side Jobs

Another great way to come up with that one month’s worth of expenses sooner than later is to try out a quick-pay side job or flexible side hustle. When I was living paycheck to paycheck, at first it was difficult for me to make extra money because I was in school and taking care of my son.

I couldn’t work a night job and sometimes babysitters were unreliable. So I turned to online work and was able to earn a few hundred dollars per month writing articles as a freelance writer. Other gigs I picked up included brand ambassador work on weekends for $20 to $25 per hour, along with blogging and selling things online.

A quick-pay job is usually something that pays you either that day or the following week. With this, the idea is to earn good money quickly so you can reach your financial goals. Some of my favorite quick-pay side jobs include:

- Selling items online (eBay, Facebook Marketplace, Amazon, and OfferUp are all great places to consider)

- Delivering food via DoorDash or GrubHub

- Babysitting

- Walking dogs

- House sitting

- Freelance writing

- Virtual assistant work

- Delivering pizzas

- Helping people move

- Cleaning houses

- Mowing lawns

I encourage you to see what your interest are and your current level of expertise. Whether you like walking dogs, helping an entrepreneur out as a virtual assistant, or shooting family portraits as a freelance photographer on the side, choose an opportunity that can provide you with consistent extra income so you can throw that toward savings.

Related: Finding the Right Side Hustle For You

Side Hustles Explored: How to Become a Freelance Writer

How to Become a Virtual Assistant From Scratch (Interview With a Real VA)

5 Legitimate Ways to Make an Extra $1,000 Per Month

20 Ways to Make Extra Money Today

Simple, Low Effort Ways to Make Money

Step 8: Use Bonuses and Windfalls to Your Advantage

Finally, I want you to keep an eye out for bonuses and windfalls during this process so you can use that to your advantage. The universe works in mysterious ways. As you start working hard on your budget, paying yourself first, and maximizing your income, you may come across bonus cash which I often refer to as a windfall.

Whether it’s a work bonus, tax refund, or credit from a utility company, try to toss all your windfall money into savings so you can get ahead on your bills and stop living P2P.

Related: 7 Smart Moves to Make With Your Tax Refund

Living Paycheck to Paycheck is Hard. Breaking the Cycle is Hard. Choose Your Hard

I hope you found this guide helpful. I don’t want to discredit the fact that living paycheck to paycheck is hard and all your hard work trying to make ends meet doesn’t go unnoticed. To stop living P2P, beginning the process will also be a bit of a challenge, but it does get easier over time. Start by creating a budget or adjusting your existing budget. Use the resources available to you and take it day by day, step by step.

Feel free to come back here and share your progress and success stories with me in the comments. I’m always rooting for your financial success!

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.