What’s Up with These Student Loans?

Last year I shared a lot about my car loan debt and how I was paying it off.

Now that it’s out of the way and paid off, I’m definitely shifting my focus to attack my student loans this year. I put student loans on the back burner last year since my strategy to pay off my debt involves eliminating high interest debt first and working my way down to the lower interest debt in order to save money.

As a result, I put very little toward my student loans last year and interest ate up quite a bit of that money.

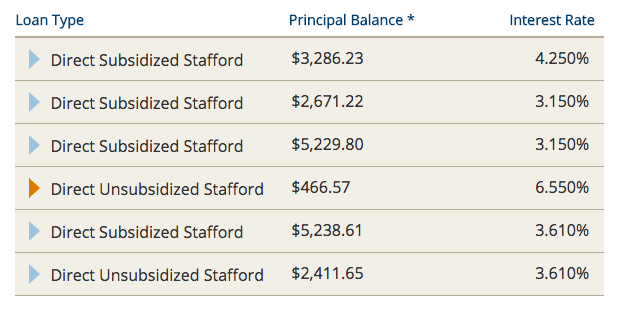

Below is a screen shot of my current student loan balances:

As you all know, I want to get rid of this debt ASAP so I’m trying to find the most efficient way to pay it off in the shortest amount of time. This is when I thought about consolidation and refinancing my loans.

Consolidation and refinancing are not one in the same, but they are very similar. Consolidation and refinancing are best if you have a large balance you need to tackle, or high interest rates on your loans that could be lower. For individuals who are lucky enough to have a small balance, you should know that you must have at least $7,500 to meet the eligibility requirements of most companies. The $18,000 I still have in debt is a lot of money to me.

RELATED: Is It Worth It To Refinance Your Student Loans?

What Consolidation Entails

Consolidation involves combining multiple student loans into just one loan. By rolling all your loans into one amount, consolidation will simplify the debt by allowing fewer bills and payments to keep track of each month.

In addition, consolidation allows borrowers to switch out older, variable rate loans with just one interest rate while possibly lowering your monthly payment as well. Consolidation can be done with a federal or private lender.

How Refinancing is Different

Refinancing is similar to consolidation in that it allows you to combine multiple loans into one amount and lower your interest rate. When you use a refinance student loans program, you take out a separate loan with new terms through a new private lender to pay off your loan balance, then you pay back the private lender at a lower interest rate.

Which Option is Best for Me?

I’ve been thinking a lot about refinancing my loans lately. The conversation has also come up during a recent recording of my new podcast Financial Conversation (that has yet to air), where the ladies and I discuss our take on student loan debt.

The benefits of both consolidation and refinancing sound nice, but there are a few disadvantages. If I chose to refinance my federal loans, I would give up any opportunity to receive federal loan relief options like deferment, forgiveness, income-driven plan and more should I ever need them.

I haven’t really even taken advantage of any of these options and as of now I don’t plan to in the future. If anything ever happened to me where I couldn’t earn an income or make ends meet, it is nice to have those options, but I would also enjoy a lower interest rate and the ability to pay my loans off quicker.

I don’t want to drag the repayment process along and I’m hoping to be student loan debt free in two years at the latest.

On the flip side, my interest rates are not that high even though they could be lower. Right now I pay one monthly payment for my student loans but the amount is split among the five loans I have and I have no control over which loan I want the payment to go toward unless I pay extra each month. I can’t stand that.

With one payment and one lower interest rate, I feel like I can make more progress instead of having one payment being split five different ways.

Consolidation and refinancing are best if you have a large balance you need to tackle, or high interest rates on your loans that could be lower. The $19,000 I still have in debt is a lot of money to me.

After weighing these pros and cons, I feel like refinancing my loans can definitely help me crush my student loan debt, if I’m willing to take the small risk of opting out of Federal student loan relief options. I really wish I would have refinanced my car loan last year, but I ended up paying it off so fast. I’m definitely all about paying less on debt and minimizing the amount of money that gets wasted on interest.